March Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| EMR | 2.4% | |||

| KLG | 1.3% | |||

| AMZN | 2.6% | |||

| SWK | 2.6% | |||

| CNQ | 2.5% |

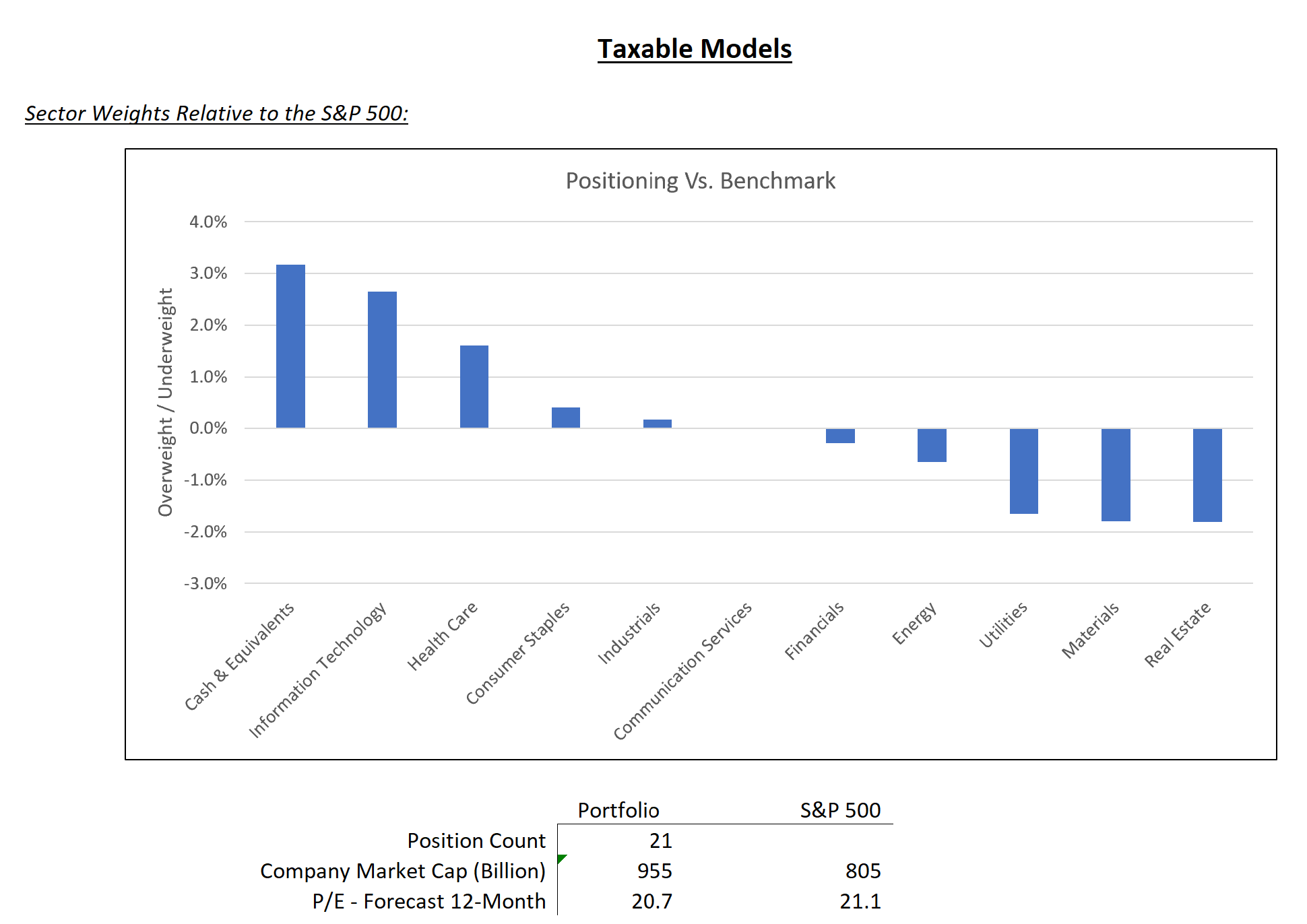

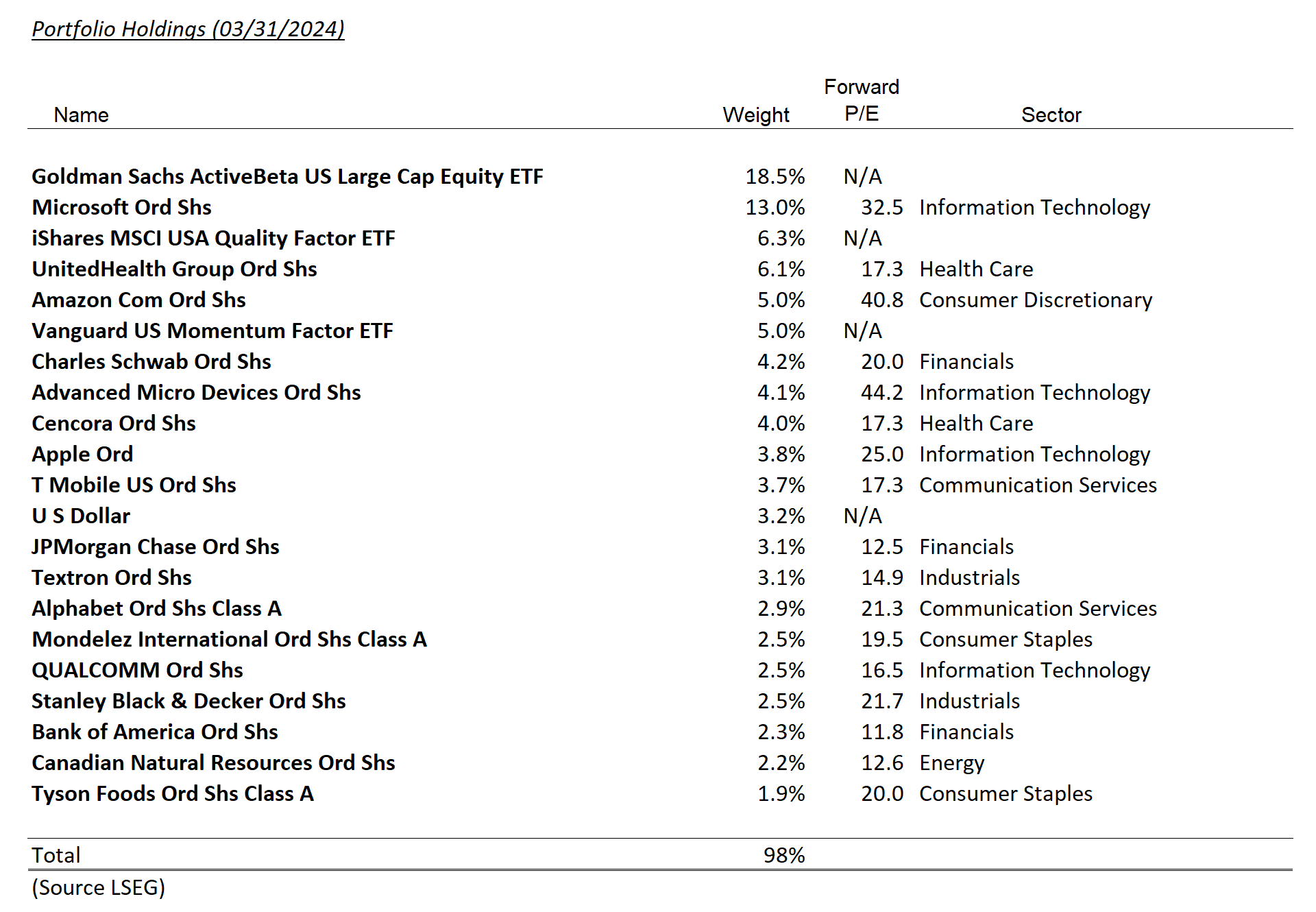

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| EMR | 2.3% | |||

| KLG | 1.2% | |||

| AMZN | 2.3% | |||

| SWK | 2.5% | |||

| CNQ | 2.2% |

Summary of Month’s Action:

Last month equities gained over 3%. Energy was the standout performer, gaining over 10%. No other sector had a notable performance. Given the level of turnover in March, and our upcoming Tally, we will dedicate the balance of this commentary to trading activity. All figures are sourced from Koyfin.

We Sold WK Kellogg Co – (KLG)

We took advantage of the nearly 30% rise in KLG’s stock during March and sold our entire position. The company continues to make progress against their goal of 5% EBITDA margin improvement over the next few years (a big deal when margins are at 9%). This will require significant spending, funded using debt.

Cereal has been in perpetual decline and there is no obvious reason why that wouldn’t continue. Unionized labor and few specifics provided for further margin expansion add to the risks. If everything plays out favorably there could be more upside to KLG, however, at $19.00 or so, the risks are much more balanced. Clients recognized a 60% gain in less than 6 months.

We Reduced Shares in Amazon.com, Inc. – (AMZN)

We reduced our outsized position in Amazon as today’s price more accurately reflects fair value in our opinion. A year ago, when we added to our position around $100, it seemed as though Amazon was in for years of weak margins due to overcapacity and much slower cloud growth. One year and 80% later, it is clear that these were temporary headwinds for the business.

CEO Andy Jassy has aggressively cut costs, and North American retail margins have swung from flat to 6% as of last quarter. Amazon’s cloud business, while not really benefiting from AI to the same degree as Microsoft, has seen growth stabilize in the low teens. At today’s price, we intend to hold our remaining shares and stand ready to add if another compelling buying opportunity emerges.

We Sold Our Entire Position in Emerson Electric Co. – (EMR)

Emerson has gone through a large portfolio restructuring resulting in a company focused on automation and software—higher margin and faster growth businesses. There still may be some upside left here, but we didn’t want to overexpose the portfolio to industrials as we find Textron and Stanley Black & Decker to be more attractive investments.

We Purchased Stanley Black & Decker, Inc. – (SWK)

Stanley Black & Decker traces its roots to 1843. The company likely needs no introduction with brands such as Dewalt, Craftsman, Black + Decker, and Cub Cadet. The company primarily sells tools and outdoor equipment in addition to an industrial business focused on engineered fasteners. The company saw extremely strong sales growth during COVID, which eventually reversed, a trend that was worsened by inventory destocking at customers.

The outlook for SWK’s markets is not great, but it’s stable. Margins are currently depressed, while management has cost-cutting plans and other initiatives in place to drive them back to historical levels. Any strengthening of SWK’s end markets would hasten the margin recovery. The company is trading at a historical multiple with depressed margins, a setup that should prove profitable to investors as margins regain ground.

We Purchased Canadian Natural Resources Ltd – (CNQ)

Recent events have made us more constructive on energy, particularly oil. We have stayed away from energy mainly due to our skepticism of U.S. shale’s restraint on production growth. Shale companies pumped voraciously in the 2010’s driving down the price of crude and damaging shareholder returns. After this episode, producers began to show restraint, curtailing production and focused on maximizing cash flow. While this has obvious benefits for investors, our expectation was it would not last. This opinion was based on the price of crude being multiples of marginal cost. While our expectation hasn’t played out, something else has—consolidation. There have been large deals in U.S. shale and independent players are being bought by more patient, stable, and disciplined operators. Some deals include Exxon – Pioneer; Chevron – Hess; Occidental – CrownRock; and Diamondback – Endeavor. This likely reduces supply elasticity in the global crude market.

CNQ is an attractive way to play this constructive view. The company is expected to generate 8 to 9% of their market cap this year in free cash flow and return 100% of that back to shareholders through share repurchases and dividends. They are a dominant player in oil sands, which have attractive characteristics, including low marginal cost and low decline rates. Separately, an expansion of the Trans Mountain pipeline should be in service soon, which will tighten up the differential of Western Canadian Select and West Texas Intermediate.

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.