September Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| CNQ | 2.2% | |||

| AMD | 1.5% | |||

| NVDA | 1.5% |

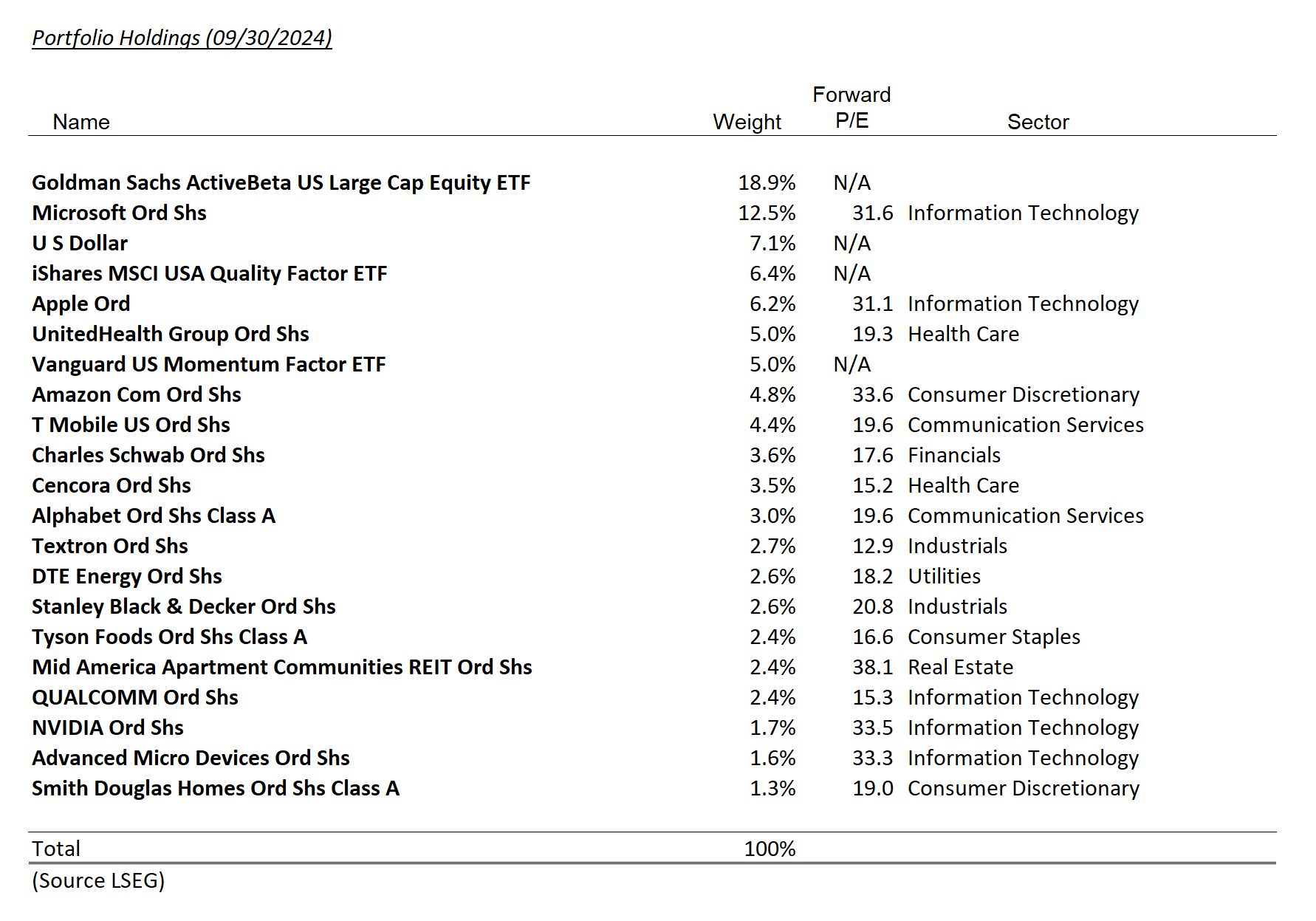

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| CNQ | 2.0% |

Summary of Month’s Action

The S&P 500 rose by 2.1% in September, continuing its strong performance throughout 2024. Leading sectors included Consumer Discretionary, Utilities, and Communication Services, while Energy, Health Care, and Financials trailed behind. (Source: Refinitiv)

On an individual stock level, Stanley Black & Decker was a standout performer, gaining 8.5%, driven by declining rates that spurred enthusiasm in the housing and housing-related sectors. In contrast, Cencora and Tyson Foods underperformed, with no significant developments to report for the month.

Further insights into the equity market outlook and economic trends will be provided in our forthcoming Quarterly Tally. In the meantime, we’ve made key portfolio adjustments to reflect our strategic outlook, including transitioning from AMD to Nvidia in tax-exempt accounts and exiting our position in Canadian Natural Resources (CNQ) as part of our defensive shift.

Transitioning from AMD to Nvidia for Tax-Exempt Accounts

We recently shifted our remaining Advanced Micro Devices, Inc. (AMD) holdings into Nvidia (NVDA) within tax-exempt accounts. Despite some concerns about the return on investment in artificial intelligence (AI) related sectors, we believe these fears have not significantly impacted GPU spending at this time.

A prominent tech investor we follow recently shared a critical insight: leading-edge companies view AI as an existential threat to their business. As a result, they are likely to continue investing heavily in advanced models and high-performing GPUs. This sentiment was echoed during Q2 earnings calls, where many companies reaffirmed or increased their investment plans in AI.

Sundar Pichai, CEO of Alphabet, encapsulated this perspective, stating (paraphrased for clarity and conciseness):

“The risk of under-investing in AI infrastructure far outweighs the risk of over-investing. Even if we over-invest, the infrastructure will have long-term benefits. However, failing to invest now would carry much greater risks in the future.”

Nvidia remains the leader in GPU technology, and its software advantage, particularly through CUDA, shows no signs of diminishing. In our taxable accounts, we’ve opted to hold off on making changes to our AMD holdings until 2025, allowing us to manage gains already realized this year more strategically.

Exiting Canadian Natural Resources (CNQ)

We made the decision to exit our position in Canadian Natural Resources (CNQ) as part of our recently adopted defensive strategy. With the potential for a prolonged global economic slowdown, we expect continued pressure on crude oil demand and pricing, making CNQ less aligned with our current investment posture.

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Past performance is not a guarantee of future results. Please note that due to rounding differences, certain data presented may not sum to 100%.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.