July Changes

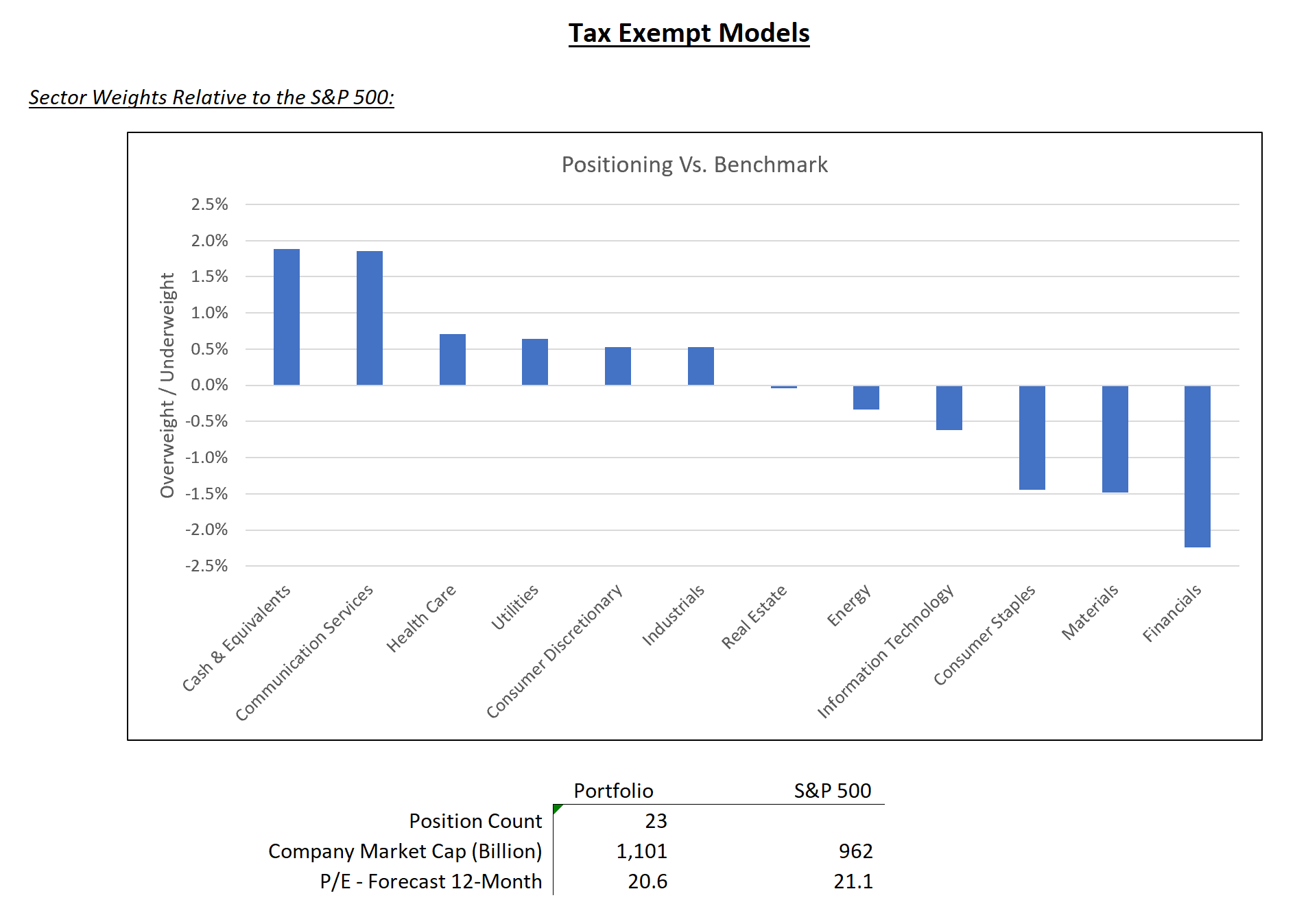

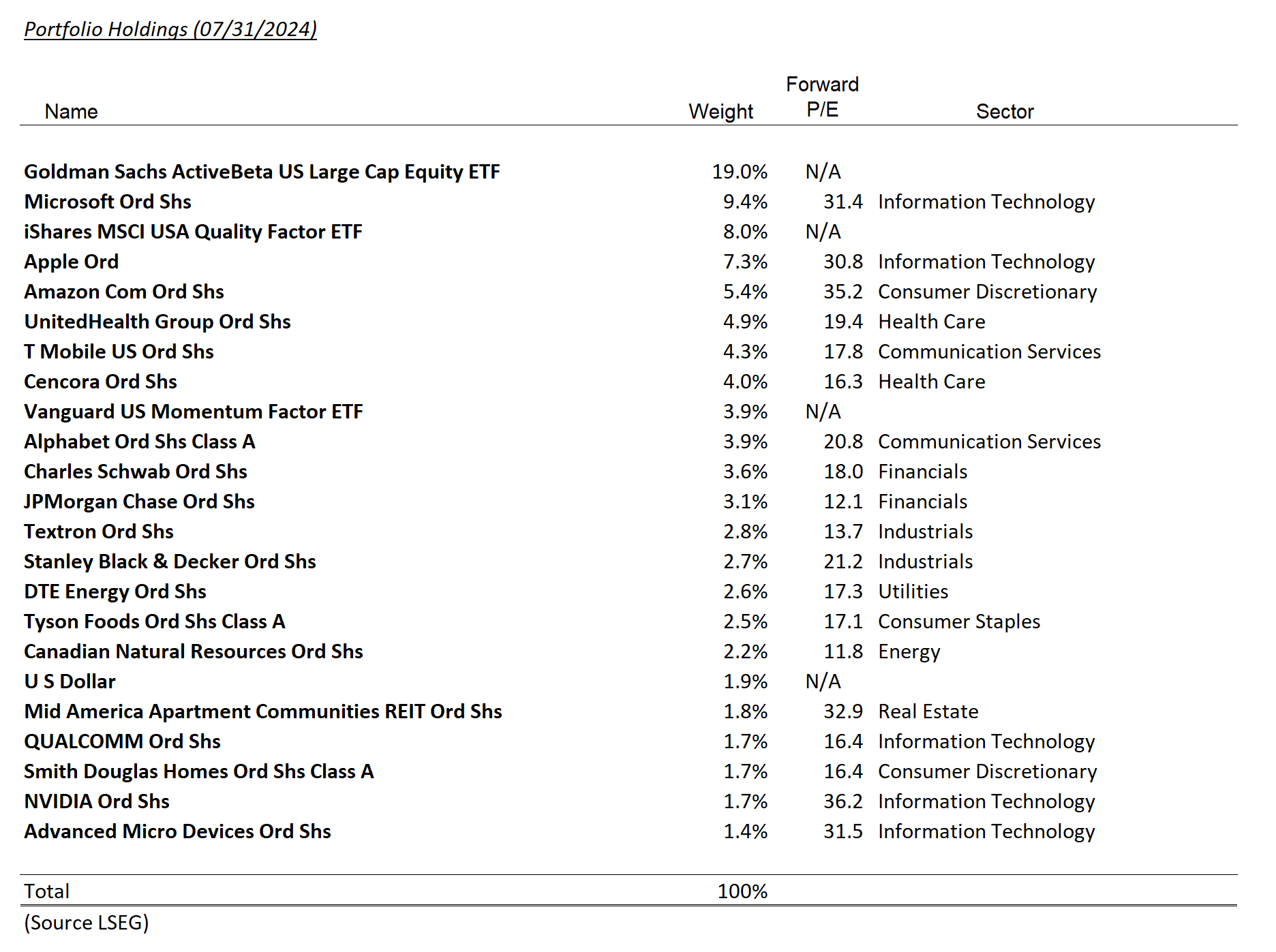

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| DTE | 2.6% | |||

| MAA | 1.8% | |||

| NVDA | 1.7% | |||

| MDLZ | 1.9% | |||

| D | 2.5% | |||

| AMD | 2.2% |

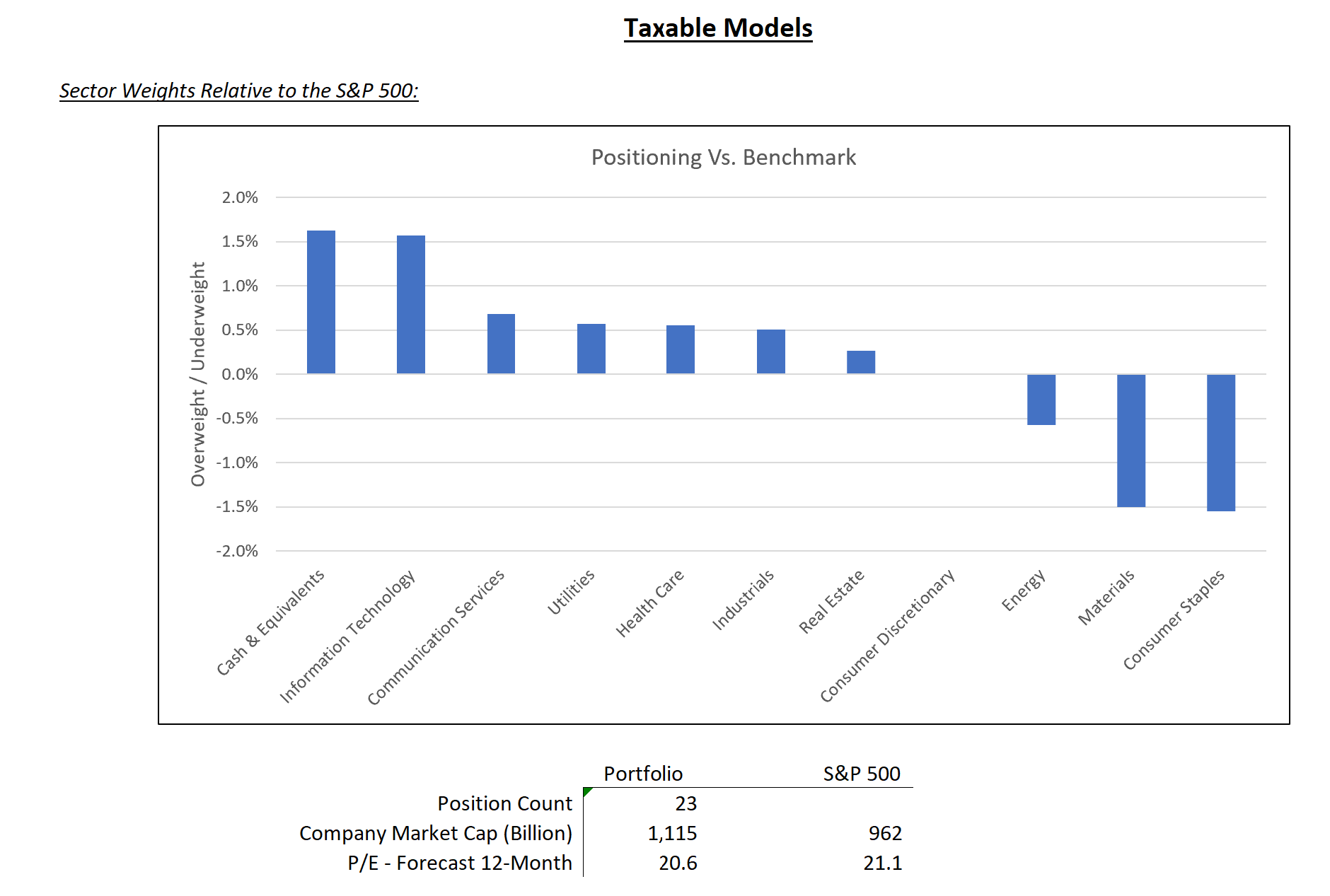

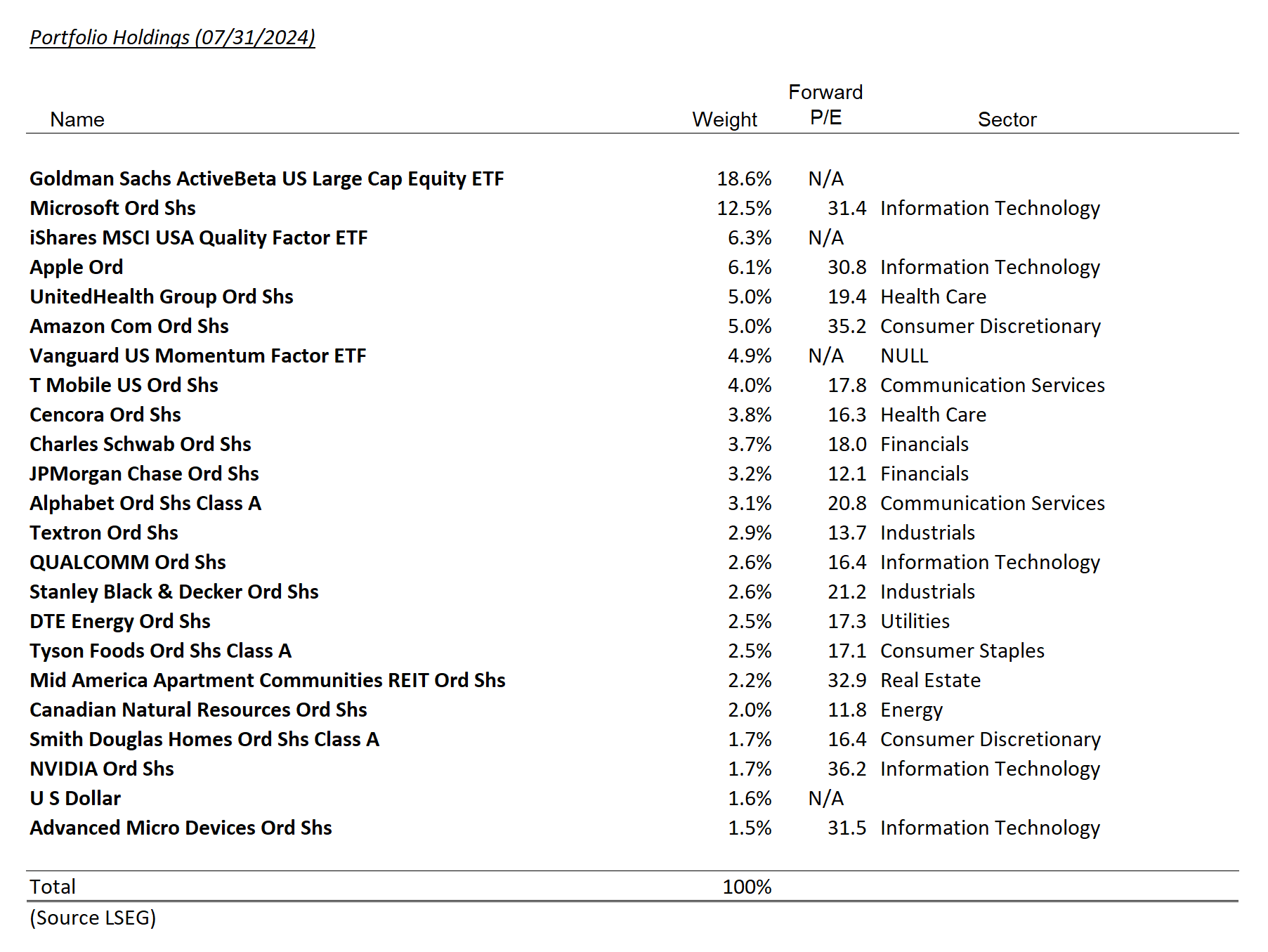

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| DTE | 2.5% | |||

| MAA | 2.2% | |||

| NVDA | 1.7% | |||

| MDLZ | 2.3% | |||

| D | 2.5% | |||

| AMD | 2.2% |

Summary of Month’s Action:

The S&P 500 rose 1.2% during July, but this benign result masked a sharp intra-month pullback of close to 5%. From a sector perspective, information technology, communication services and consumer staples were the laggards, while real estate, utilities, and financials were the leaders. All figures sourced from Koyfin.

Looking at Lincoln Capital’s model, Stanley Black and Decker, Smith Douglas Homes, and UnitedHealth were the top contributors. Model detractors for July were Charles Schwab, Advanced Micro Devices, and Microsoft. Most of these securities were influenced by earnings releases—save Smith Douglas, which benefited from a sharp reduction in long-term rates and the expectation that would feed into improving home affordability.

UnitedHealth reported an inline quarter, but this was a relief as investors have had to deal with profitability concerns at Medicare Advantage and new trends suggesting strains moving into Medicaid. However, UNH’s July performance was more impacted by the Presidential election, rallying on improved odds of a Trump victory and slumping as those odds receded. Given the tough environment the Centers for Medicare and Medicaid Services has created for managed care companies, a Trump victory is viewed as a more hospitable landscape for insurers.

Charles Schwab had a particularly bad earnings report, which saw cash sorting (investors moving money out of bank sweep and into other investment products) persist. This trend, coupled with an increase in margin balances, saw the firm’s supplemental funding grow from the first quarter. While it has gone on longer than expected, we continue to believe that cash sorting will not persist forever, as there is some level of transactional cash that will sit in investor accounts no matter the interest rate offered by short-term, fixed-income investments. Once sorting eases, supplemental funding (with interest costs >5%) will be paid down, and the securities book can then expand – securities today earn around 2% versus market rates above 4% – causing revenue to grow rapidly from today’s levels.

Security Specific Comments:

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Past performance is not a guarantee of future results. Please note that due to rounding differences, certain data presented may not sum to 100%.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.