January Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| QCOM | 0.9% | |||

| AMD | 1.5% | |||

| SCHW | 0.5% |

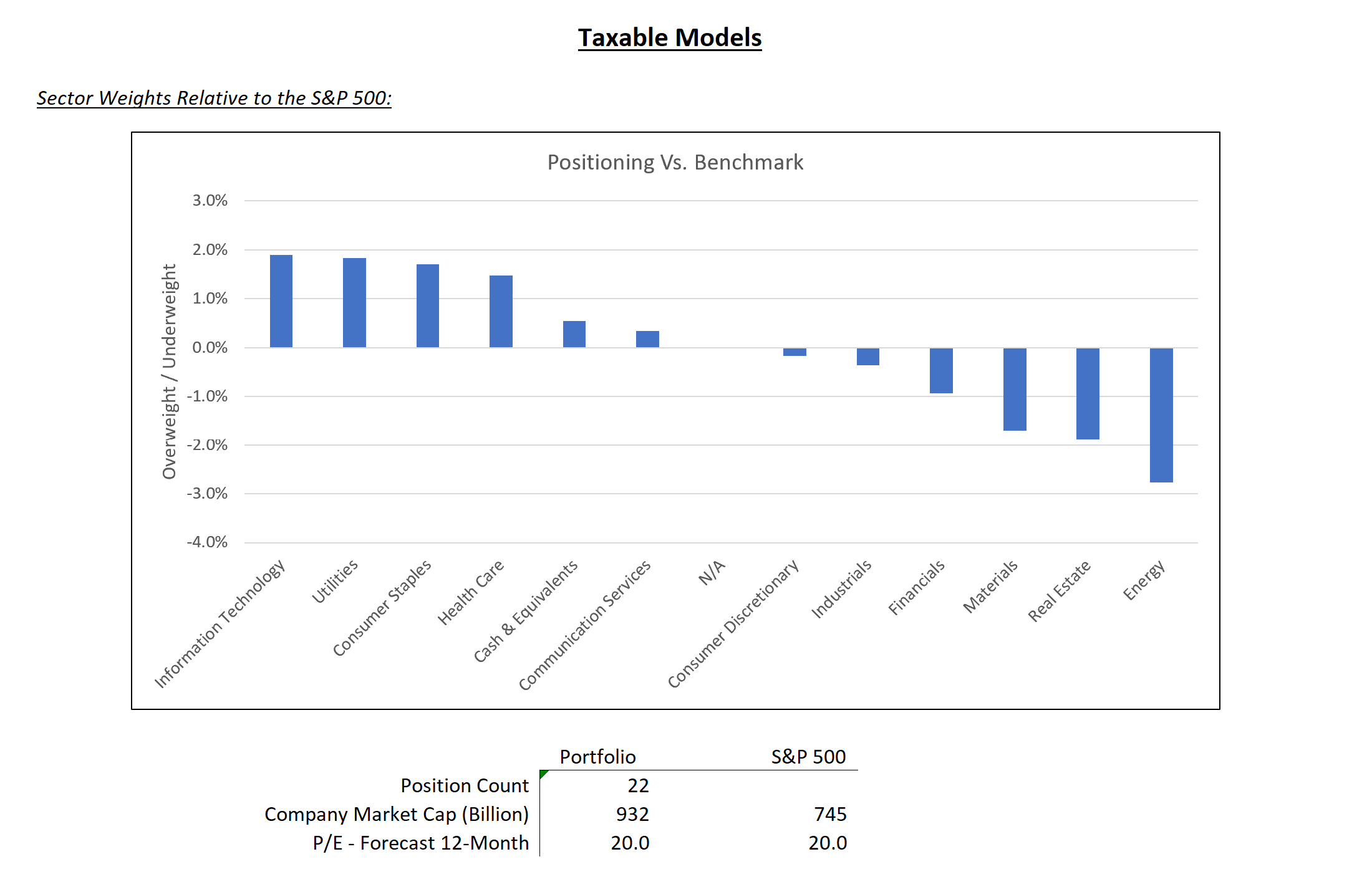

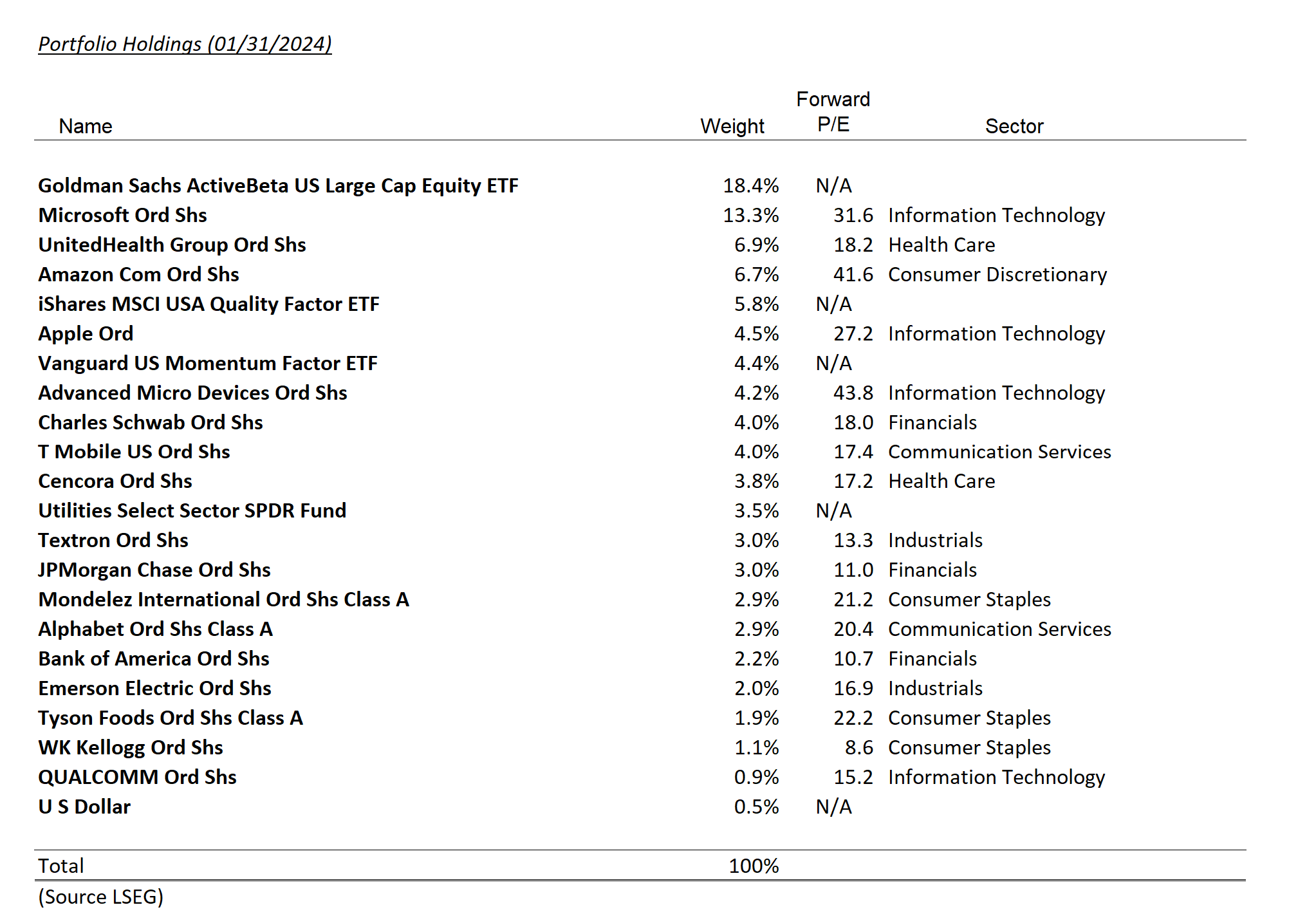

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| QCOM | 0.9% | |||

| AMD | 1.5% | |||

| SCHW | 0.5% |

Summary of Month’s Action:

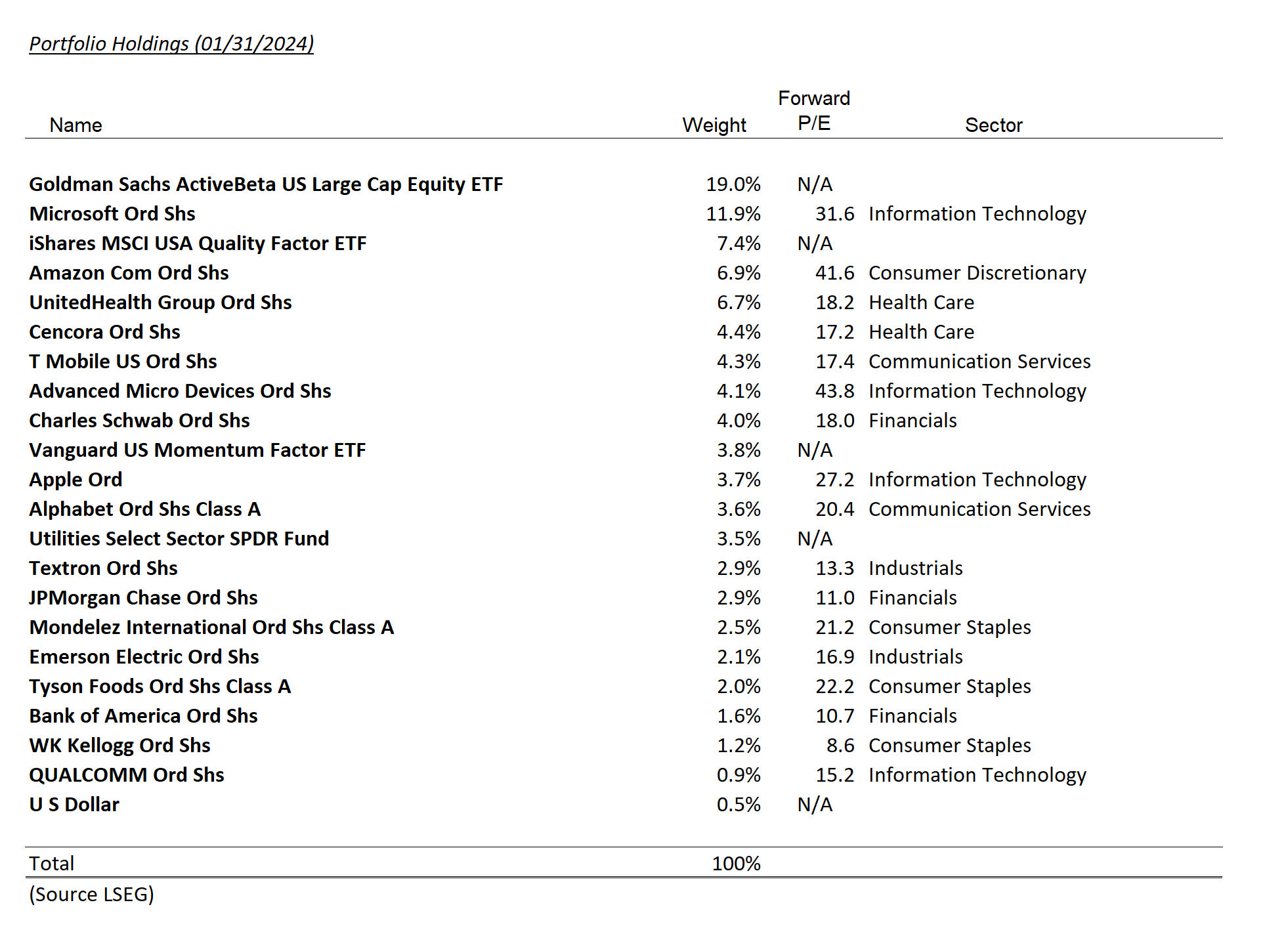

January was a strong month for equity returns. Communication Services, Financials, and Health Care were the top performing sectors while Real Estate, Consumer Discretionary, and Materials were laggards (according to Koyfin).

The biggest contributors to performance in January were holdings of AMD and Cencora, which were up approximately 13% each, in addition to not holding Tesla, which declined 24.6% in January. Negative contributors were Schwab and UnitedHealth, which declined 8.5%, and 2.8%, respectively, in addition to not owning Nvidia, which rose sharply in January (per LSEG).

Qualcomm – (QCOM)

We started a small position in Qualcomm in January, which we subsequently added to in early February. The company has changed a lot in recent years, with intellectual property licensing now representing a much smaller portion of the business. Automotive and internet of things ─ a category that includes wi-fi, 5G, virtual and augmented reality, and industrial applications ─ have grown to be increasingly important at QCOM. However, between the licensing business and Snapdragon chipsets, QCOM is still primarily a smartphone company.

QCOM fundamentals should improve in 2024, as the smartphone industry returns to underlying growth and exits a period of inventory correction. The stock should do well with this fundamental backdrop and an undemanding valuation of 14x 2024 EPS. Snapdragon has a strong position if on-device generative AI takes off (see recent Samsung S24 Ultra), while QCOM will soon ship its first iteration of a central processing unit for Windows PCs, which is a large and lucrative market.

One functional example of Qualcomm’s on-device generative AI.

Advanced Micro Devices – (AMD)

AMD has done extremely well, and we believe the recent valuation is creating some high hurdles with respect to graphics processing unit (GPU) sales. With the launch of generative AI, the world has focused on Nvidia and their dominant GPU franchise. However, AMD has been expanding its GPU portfolio beyond gaming to try and compete in the data center market. The company appears to be having some success with the launch of MI300. During the Q3 2023 conference call, AMD stated they expected $400 million in MI300 sales in Q4 2023 and over $2 billion in sales in 2024. During the Q4 call in January, the company raised 2024 MI300 guidance to $3.5 billion. While impressive, Nvidia’s data center segment sales are forecasted to be $76 billion in 2024.

In general, despite attempts to close the gap, Nvidia’s CUDA software is far superior to alternatives. AMD is attempting to fight back with ROCm, an open-sourced software platform. These tools enable engineers to run AI models more efficiently on the underlying hardware. Historically, software advantages have been very difficult to displace. However, whether AMD’s ROCm is inferior or not, not all potential Nvidia customers can buy Nvidia GPUs due to insufficient supply. This sets up AMD’s business to capture sales as the next best option—potentially buying time and providing a toehold for ROCm. Time will tell. We will monitor AMD closely, and potentially trim more in the future if valuation and opportunity costs warrant.

Charles Schwab Corporation – (SCHW)

There is nothing new on the Charles Schwab thesis. Generally speaking, the deceleration of money fund flows is helping the company grow cash balances and pay down expensive short-term funding. Fundamentals will first see net interest income grow as high-cost funding gets paid down, followed by a resumption of balance sheet growth. We continue to believe that Schwab is on a path to much improved fundamentals and represents an attractive investment.

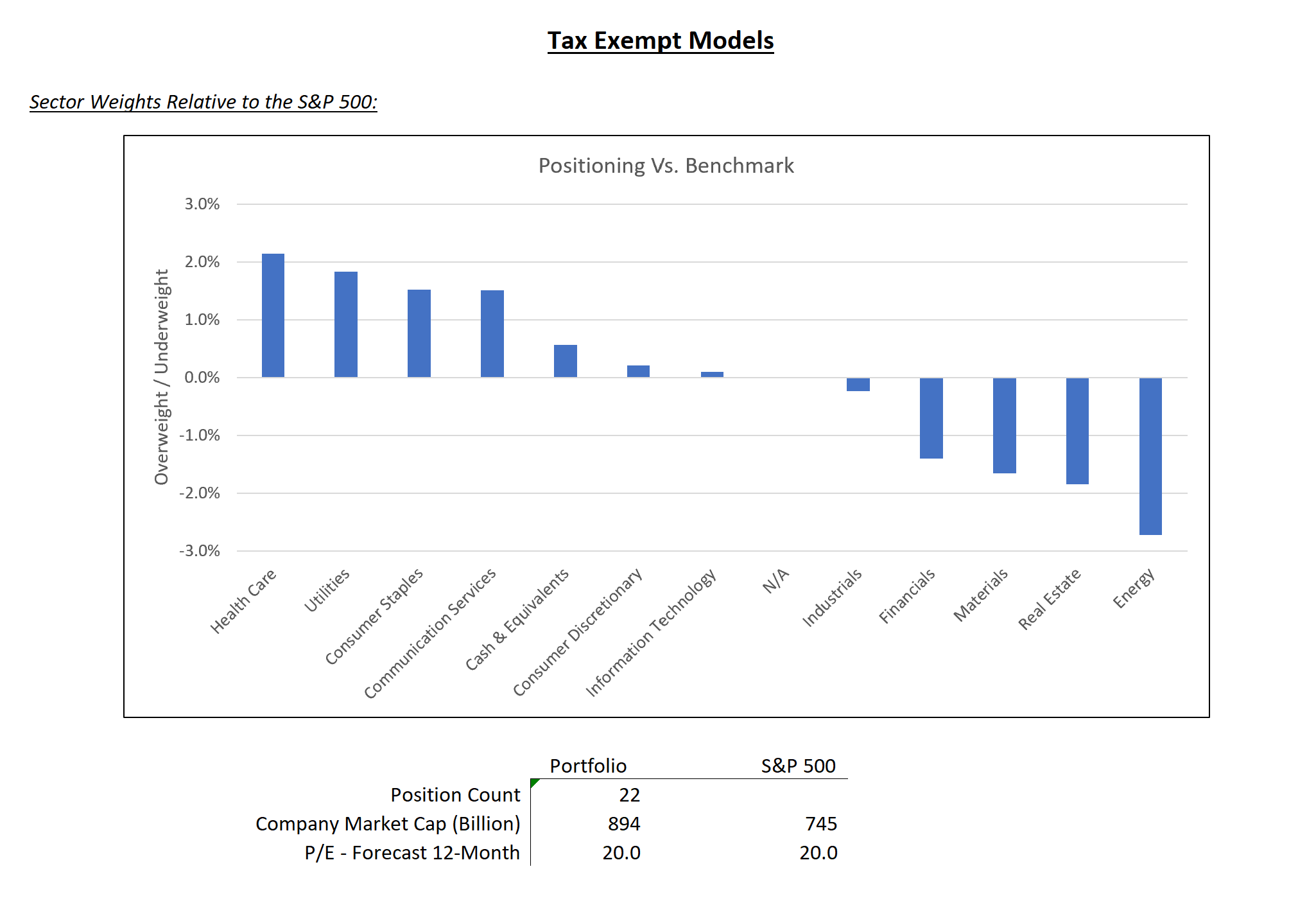

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.