August Changes

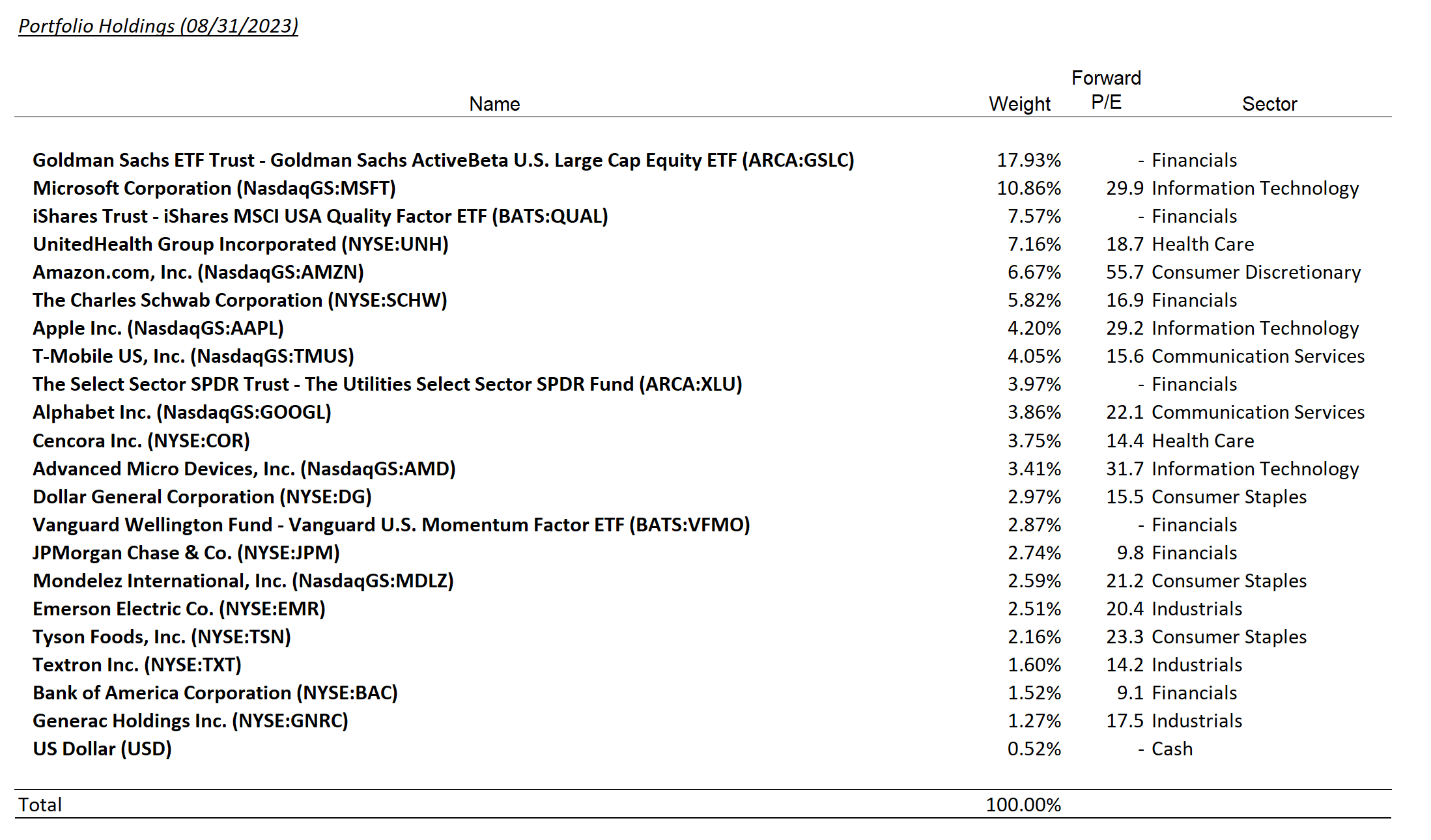

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| TSN | 2.2% | |||

| DG | 1.5% |

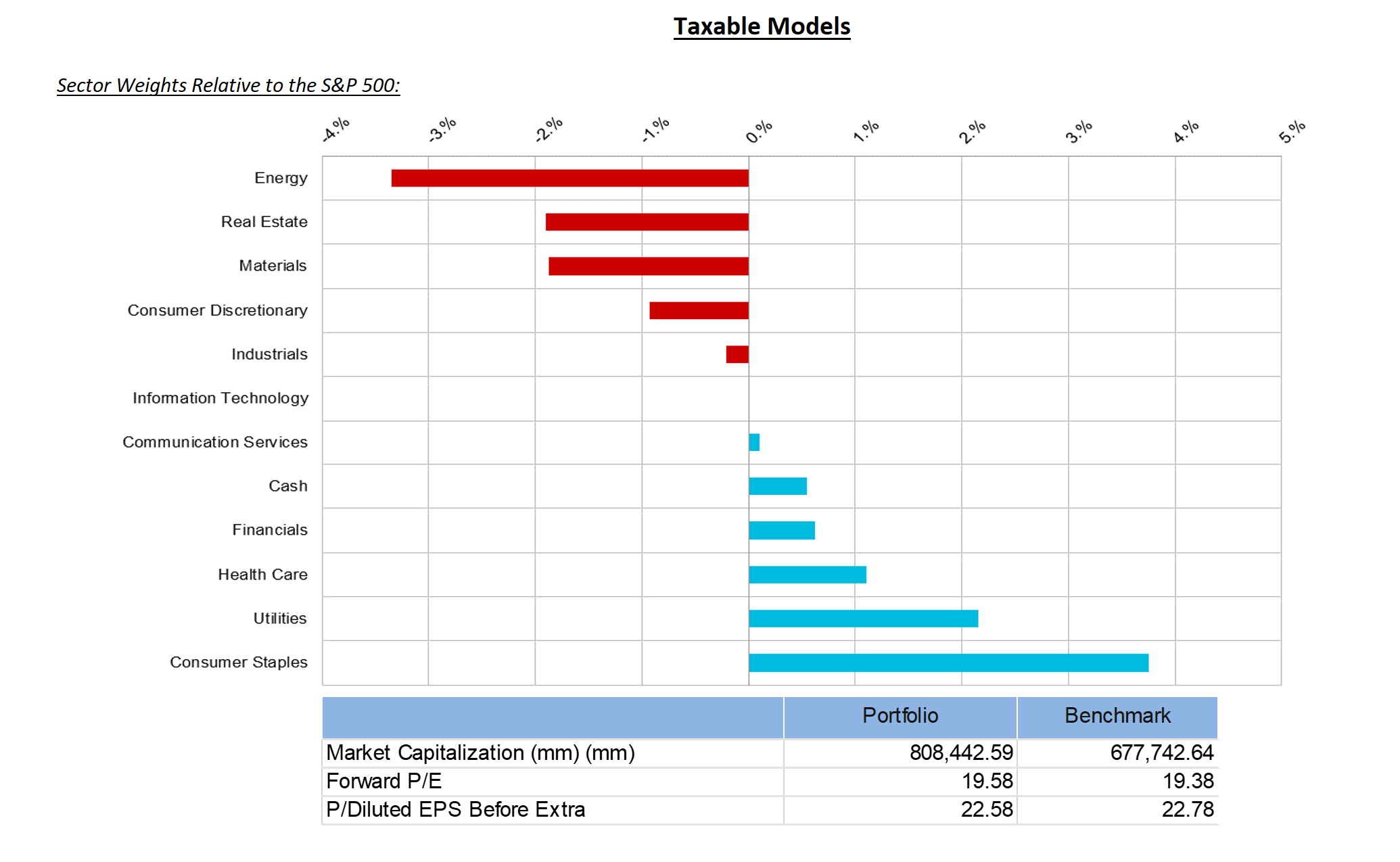

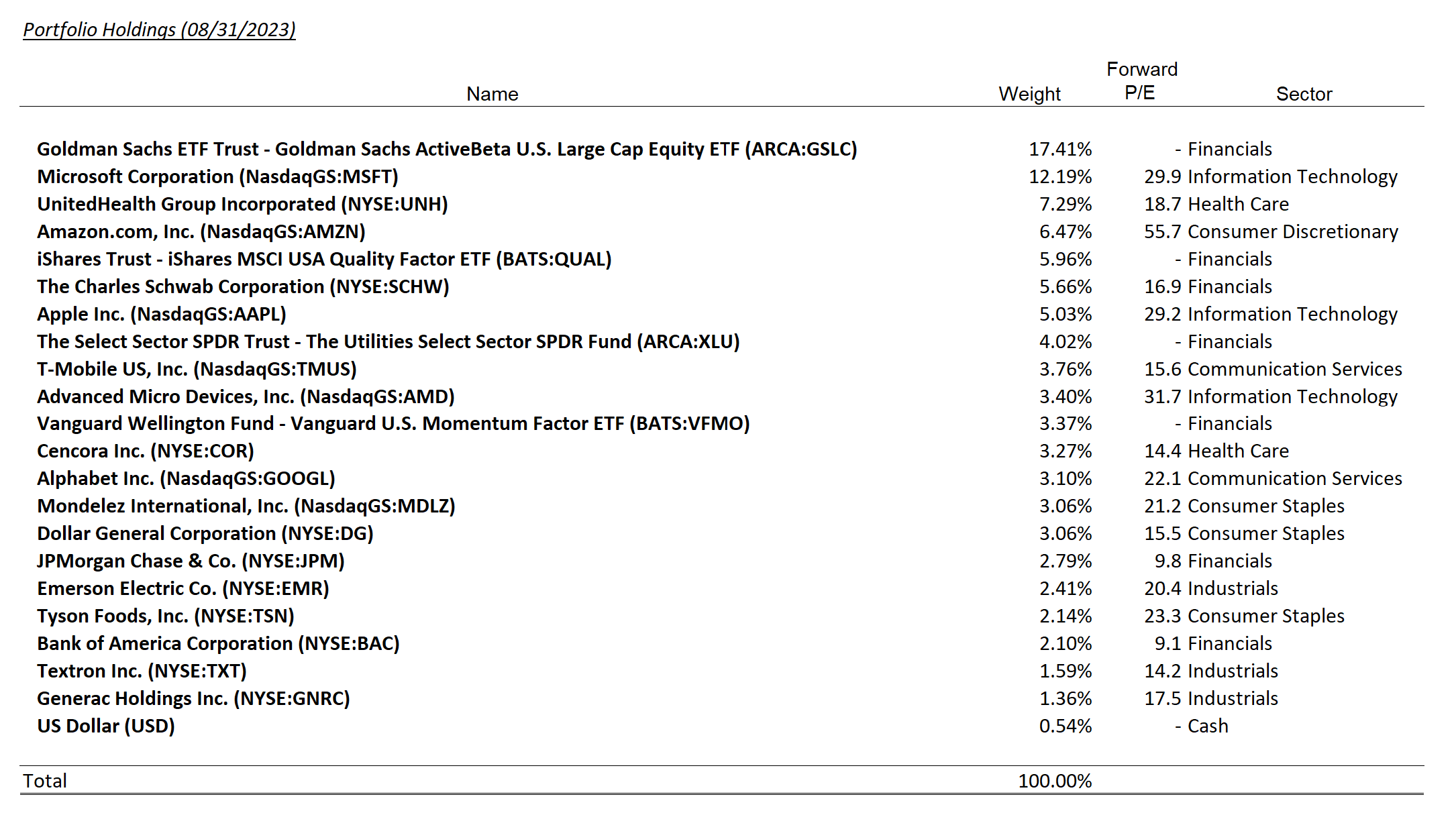

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| TSN | 2.1% | |||

| DG | 1.5% |

Summary of Month’s Action:

The S&P 500 is on track to close August down 1.5%. The top performing sectors for the month were Energy, Health Care and Consumer Discretionary. Laggards were Utilities, Consumer Staples, and Materials. Value lagged during the month of August, while quality and momentum outperformed.

Lincoln Capital portfolios were negatively impacted by the performance of Schwab and Generac. We covered Generac in detail in last month’s commentary. We continue to think Schwab offers one of the best risk/rewards in client portfolios. During the month, SCHW shares underperformed as investors got spooked by a bond sale by the firm, which suggested they needed capital. The resumption of higher long-term bond yields and strong money market flows also likely weighed on the shares. The major positive contributor for the month was Emerson Electric, though there were no material news items for EMR.

A New Addition: Tyson Foods

We added shares of Tyson Foods, Inc., (TSN) to portfolios during August. TSN, founded in 1935, produces 1 out of every 5 pounds of protein (pork, beef, chicken) that Americans consume. In addition to protein production, the company also operates a prepared foods business with brands such as Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, and State Fair. The protein markets are cyclical, but due to the relatively short lives of livestock, and consumers’ ability to substitute for other proteins, the markets often quickly find balance (chicken being the fastest market to adjust).

Today, all three major markets are at cyclical troughs. This has created an opportunity to buy TSN at an attractive valuation less than book value. Since 2001, TSN has traded under book value during 6 episodes and, each time, the shares have gone on to outperform the market the following 12 to 24 months. We expect a similar dynamic to play out today, meanwhile, shareholders will collect a 3.5% dividend yield.

Exiting Dollar General

We trimmed shares of DG after another disappointing earnings call. We intend to exit the position entirely at a more favorable price in the weeks ahead. In short, this investment has not worked out as planned as we failed to appreciate the pricing adjustments and labor investments needed to stabilize the business. We will continue to monitor the stock for future purchase.