July Changes

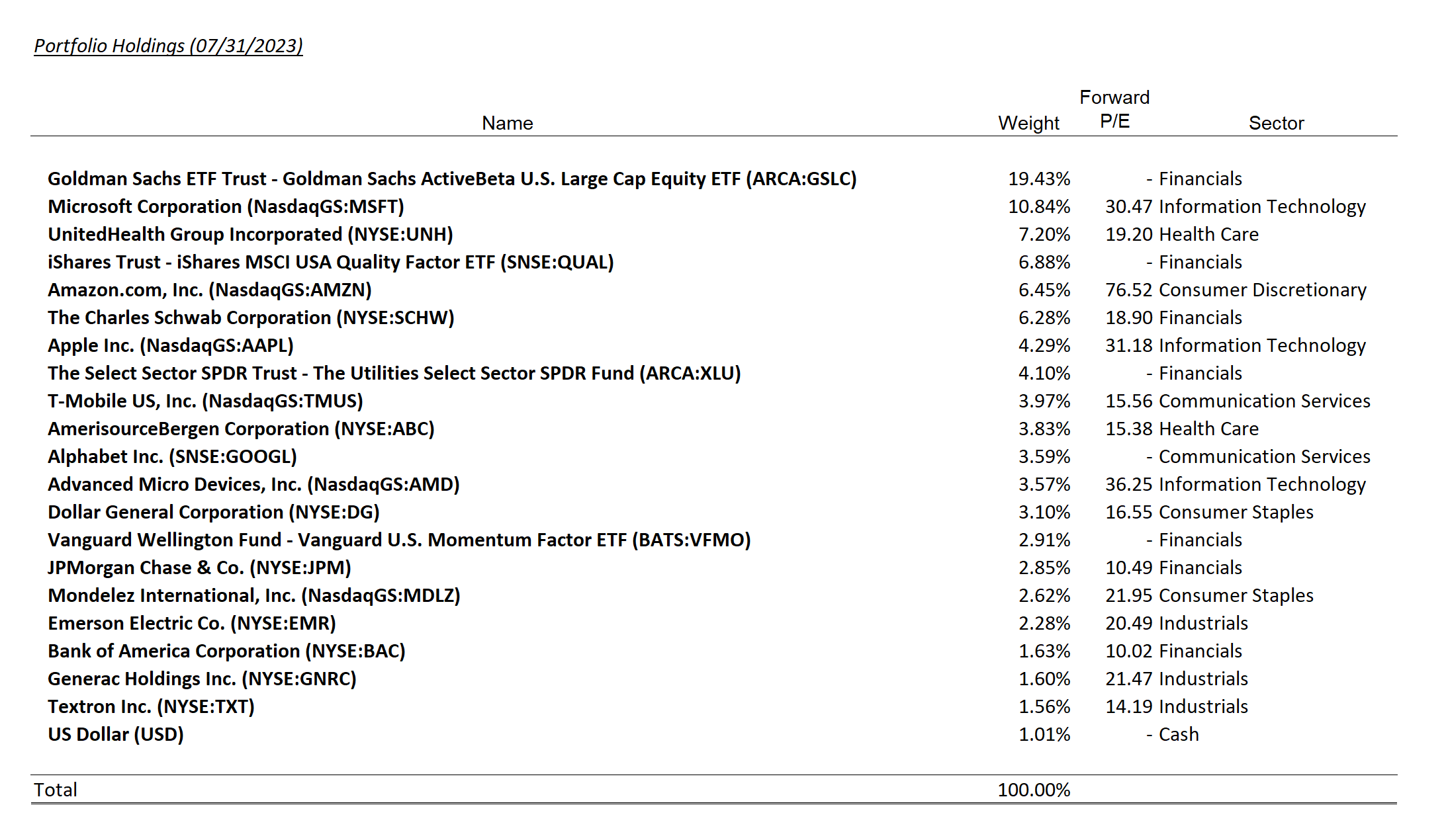

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| GNRC | 1.6% |

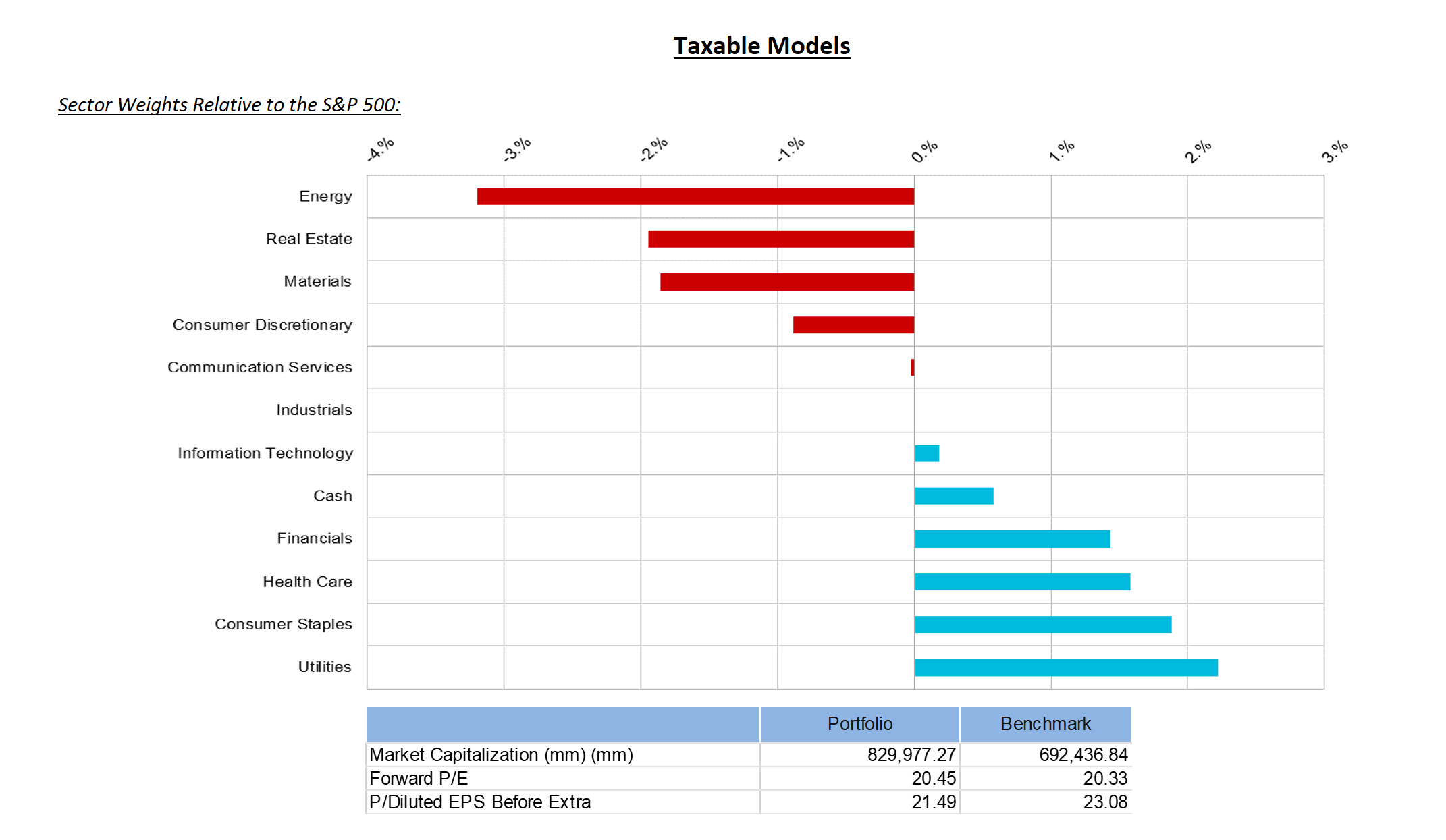

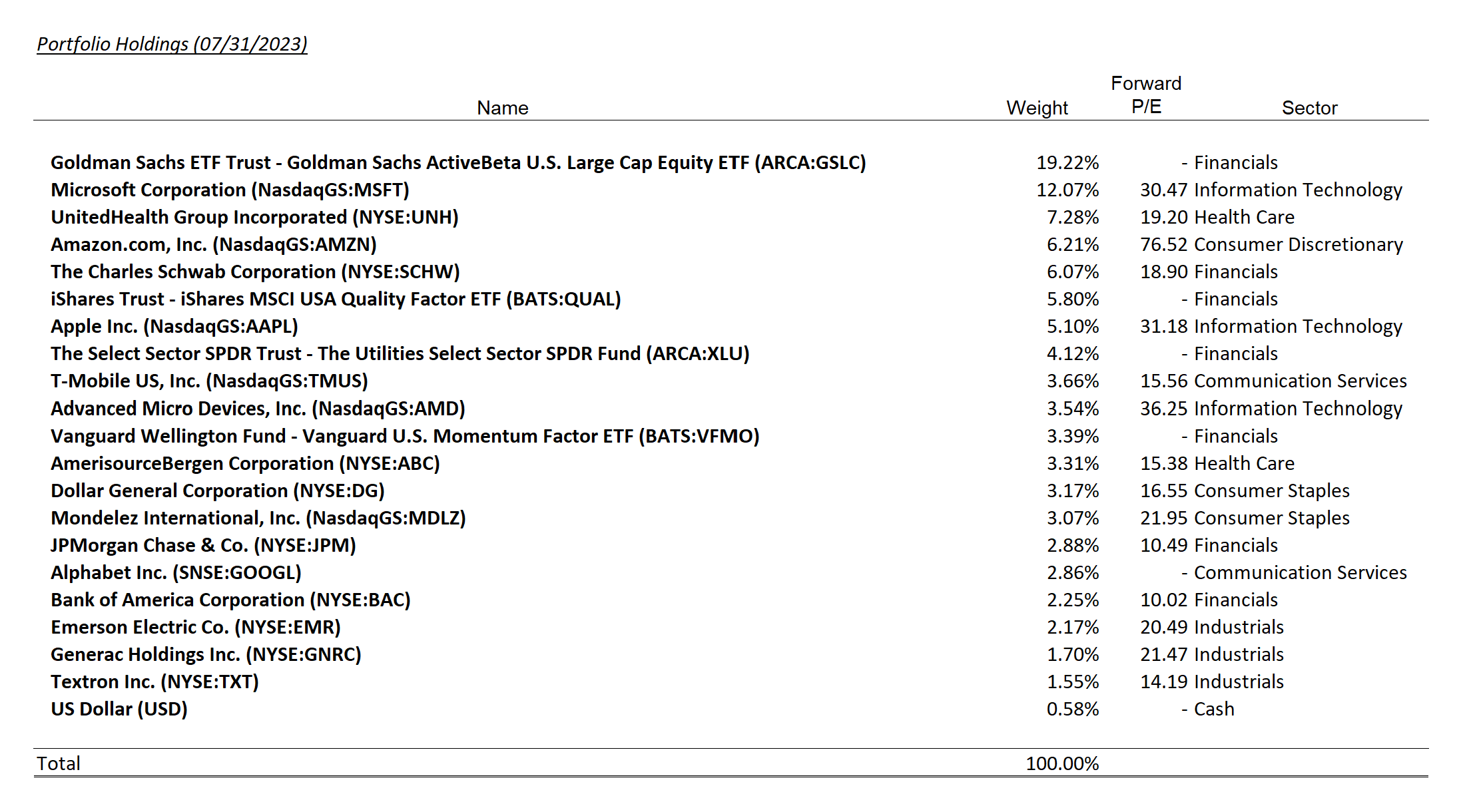

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| GNRC | 1.7% |

Summary of Month’s Action:

The S&P 500 gained 3.2% during the month of July. Energy, Communication Services, and Financials were the standout performers. Healthcare, Real Estate and Consumer Staples lagged the market in July. Top gainers in Lincoln Capital portfolios, on a percentage basis, for the month of July were Schwab, Generac, and Textron, which were up 16.6%, 15.8%, and 15.0%, respectively. Negative holdings for the month were AmerisourceBergen, Microsoft, and T-Mobile, which declined 2.9%, 1.4%, and 0.8%, respectively. Generac will be discussed below.

Schwab Performance

Schwab posted their second quarter results during July and the market approved. While still losing deposits, the pace has dramatically declined as management assumed it would; in fact, peak utilization of expensive short-term funding (brokered CDs and FHLB) occurred in May and has since declined.

Also encouraging was Schwab commentary on their Advisor Services business, which serves RIAs like Lincoln Capital. Advisor Services has swung from deposit outflows to inflows and this segment has typically led the retail business. If a recession is avoided and rates play out as expected, we believe Schwab will provide attractive returns from today’s levels.

Microsoft Performance

Microsoft also reported a strong Q4 (MSFT has a June fiscal year end). Additionally, the pricing strategy of the Microsoft 365 Co-Pilots was announced. The Co-Pilots utilize generative AI and are added functionality to classic Microsoft productivity tools like Outlook, Excel, Word and PowerPoint. Microsoft will be charging an additional $30 per user per month for this product. With approximately 400 million Office users globally, Co-Pilots have the potential to be a large profit driver for Microsoft going forward. Broader release of these tools is still a few quarters out.

Generac Performance

We added a position in Generac (GNRC), which initially did well, and then did quite poorly. Generac is the leader in home standby (HSB) generators, with a market share position exceeding 75% by some estimates. Since IPO (2010), the stock has trounced the S&P 500 as more and more homeowners add HSB units. Power outages have become more prevalent due to issues with both supply and demand. Extreme weather like hurricanes or the Texas freeze in 2021 have caused supply interruptions, as have preemptive power shut offs in places like California to avoid wildfires.

Additionally, to meet regulatory standards, more power supply is being produced by renewable resources which, lacking an economic storage solution, can produce power intermittently. On the demand side, the consumption of electricity is expected to grow strongly due to electric vehicles. This all coincides to create an unreliable power supply and demand environment, and thus increases the appeal of a second source of power for homeowners.

As mentioned, demand has been strong for GNRC, especially in recent years as homeowners had extra money to spend and spent more on their homes. GNRC initially didn’t have capacity to serve this demand. Once GNRC expanded capacity, the bottleneck moved to its distributors who lacked the labor to actually install the product. Extra production capacity without the ability to install it led inventory to build up at the dealers and at GNRC. Generac under shipped demand to reduce inventory and this is the driver of the low sales in the first half of 2023. Once inventory was right-sized, Generac would be able to ship to similar rates as end market demand, and increased installation capacity at the dealers would be gravy.

Unfortunately, Generac’s Q2 report flagged waning consumer demand and, therefore, a longer timeframe to clear channel inventory. This is a troubling development for us. Overtime Generac’s sales have been volatile and determining the baseline trend is difficult. Our conviction is rattled and will likely be looking for an attractive exit point, barring new information.