December Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| KMX | 2.2% | |||

| NMIH | 1.6% | |||

| AMD | 1.0% |

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| KMX | 2.0% | |||

| NMIH | 1.1% | |||

| AMD | 0.9% |

Summary of Month’s Action:

The S&P 500 declined 5.8% in December, with momentum and minimum volatility equities outperforming. For the year, the S&P 500 total return was -18.1%—the worst annual performance since the financial crisis (-37% in 2008). Top performing sectors for the month were Utilities, Health Care, and Consumer Staples, while laggards included Consumer Discretionary, Information Technology, and Communication Services. For the year, Energy trounced the S&P 500 and all other sectors, gaining over 55%. Interestingly, this sector has been flat since May and crude prices (front-month WTI futures) were flat for the year. Not owning energy has been a mistake. As discussed in many client conversations we continue to be torn on the sector. On the one hand, many years of underinvestment coupled with surprisingly resolute discipline should keep supply constrained; on the other, a pending demand-sapping recession and a long history of fierce competition. We will continue to watch carefully in 2023. The biggest industry losers for the year were Communication Services (which includes GOOG/META); Consumer Discretionary (AMZN/TSLA); and Technology.

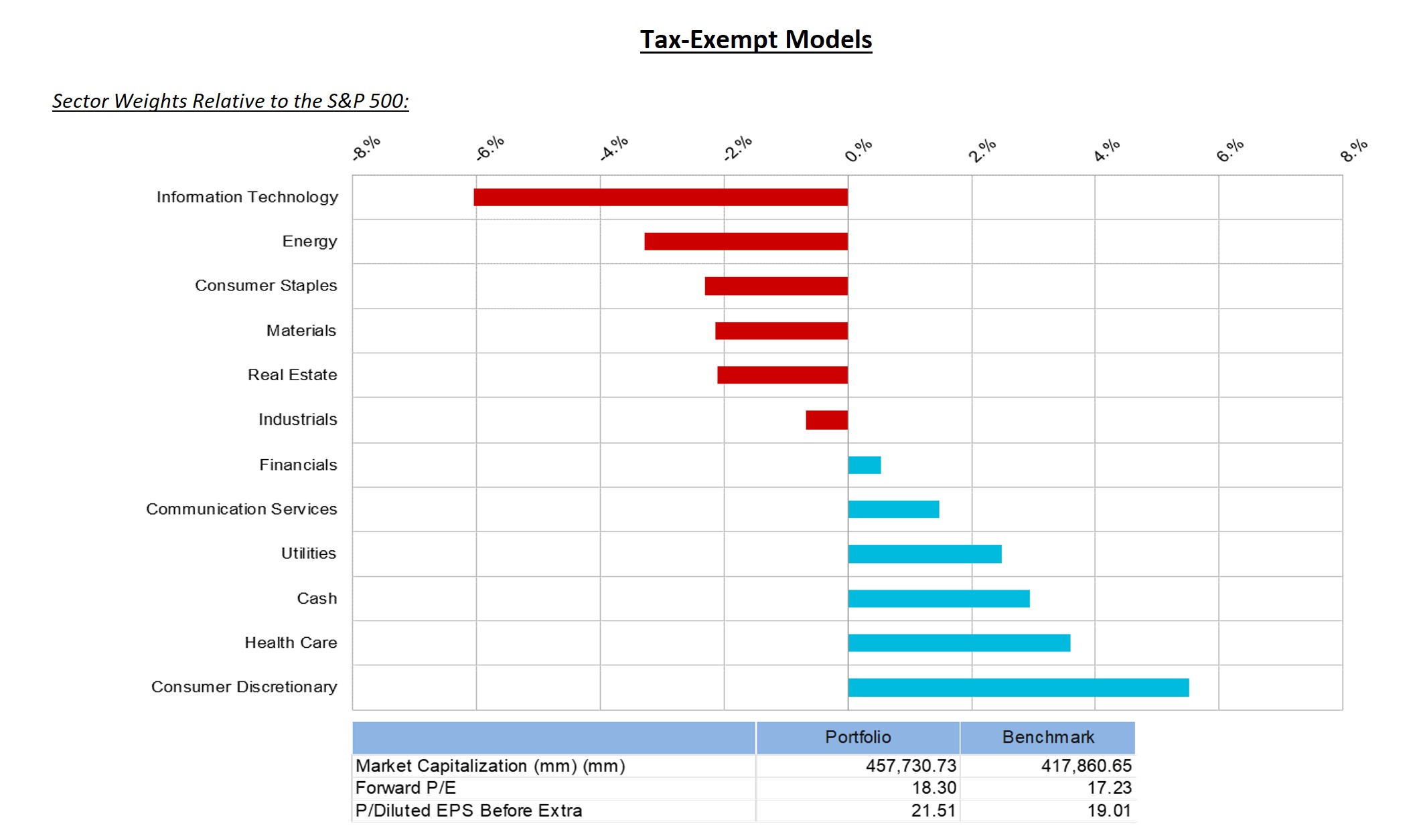

Lincoln Capital’s tax-exempt model outperformed for the month and the year. For 2022, the tax-exempt model returned -15.7% gross of fees. Single stocks, excluding ETFs, returned -14.3%, while XLU returned 2.1% for the partial holding period and broad market ETFs declined 19.7%. Cash and SGOV holdings were additive to performance this year. We will share a more detailed perspective about 2023 in the upcoming Quarterly Tally.

Security Specific Comments:

NMI Holdings, Inc. (NMIH) – We sold our remaining position in NMIH this month. While buying the shares today and holding for five years will likely generate decent returns, we expect the ride will be anything but smooth. Rising unemployment and falling housing prices will put stress on NMIH’s P&L, which will require lower near-term earnings expectations. We will likely add this holding back if/when the risk reward becomes more compelling.

Advanced Micro Devices (AMD) – We added to our position in AMD. We are still in the throes of a large inventory depletion cycle for semiconductors. This is widely known and well factored into today’s share price. The cycle is expected to turn sometime in mid-to-late 2023, at which point, we expect AMD’s business to improve greatly due to the rising market and its continued share gains in the data center.

CarMax, Inc. (KMX) – We added a small position to KMX. We began looking into the company in mid-December and liked what we saw. The company is the used car retail market leader, selling 4% of 0- to 10-year-old used cars. With more than 30% of the used car market sold by independents and another 30% being consumer-to-consumer sales, the industry is still very fragmented. KMX should be able to use its technology, inventory, and sourcing position to gain a competitive edge in this market. Today, however, the used car industry is in tumult. Rising prices, mainly driven by a lack of supply, coupled with higher interest rates is causing consumers to pull back. Lower demand is now driving prices down. Lower unit sales hurts KMX’s used business, while lower units and lower prices are hurting KMX’s wholesale business. The company was expected to earn >$7 coming into 2022, and now it’s likely to earn somewhere around $2.50. The company is trading at a price-to-book commensurate with the financial crisis, further showcasing investors’ disdain for the shares. Our initial research, plus the sharp decline in shares after the company released Q3 2022 earnings, created an attractive place to start a position.