November Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| DG | 0.9% | |||

| SCHW | 1.9% |

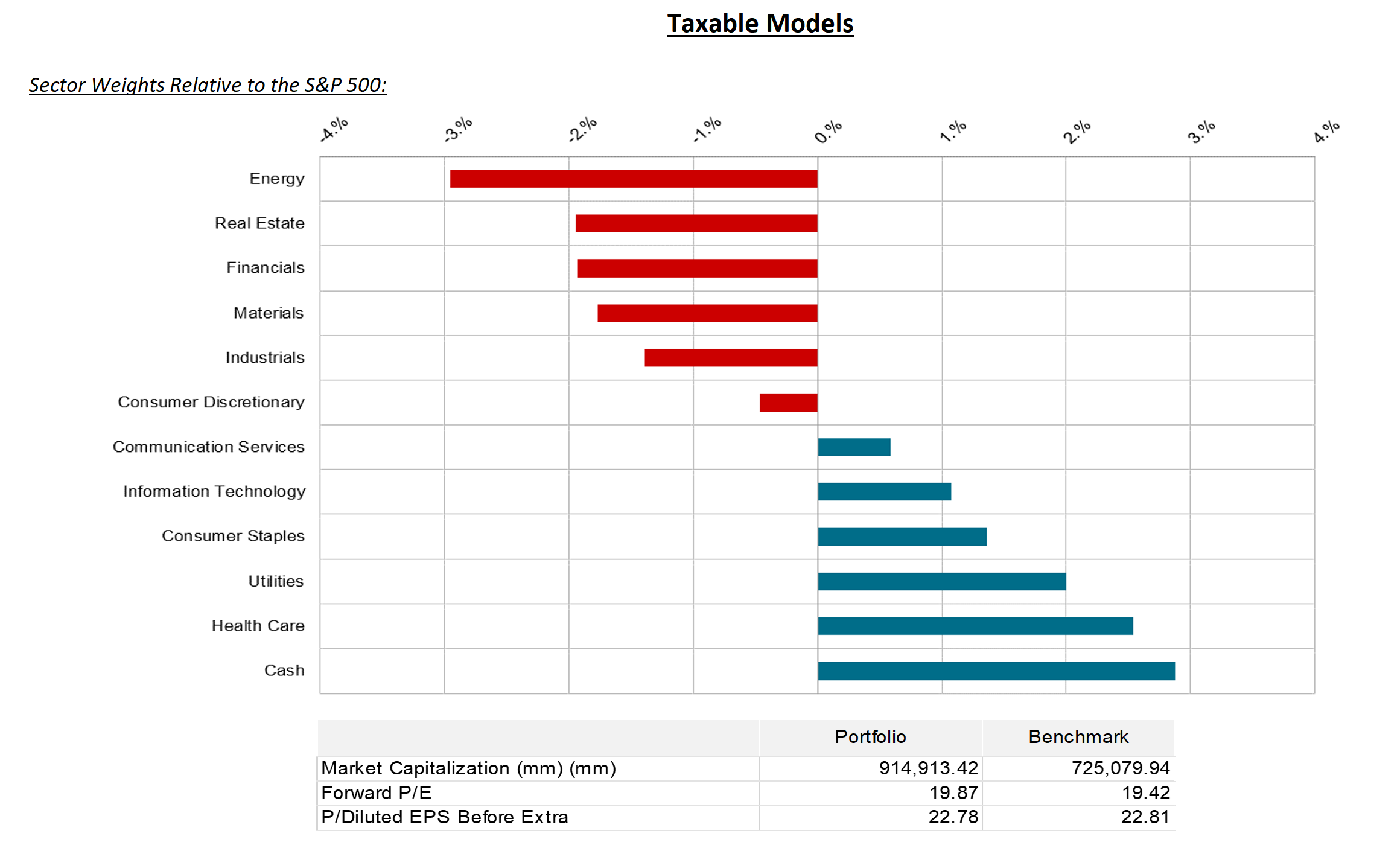

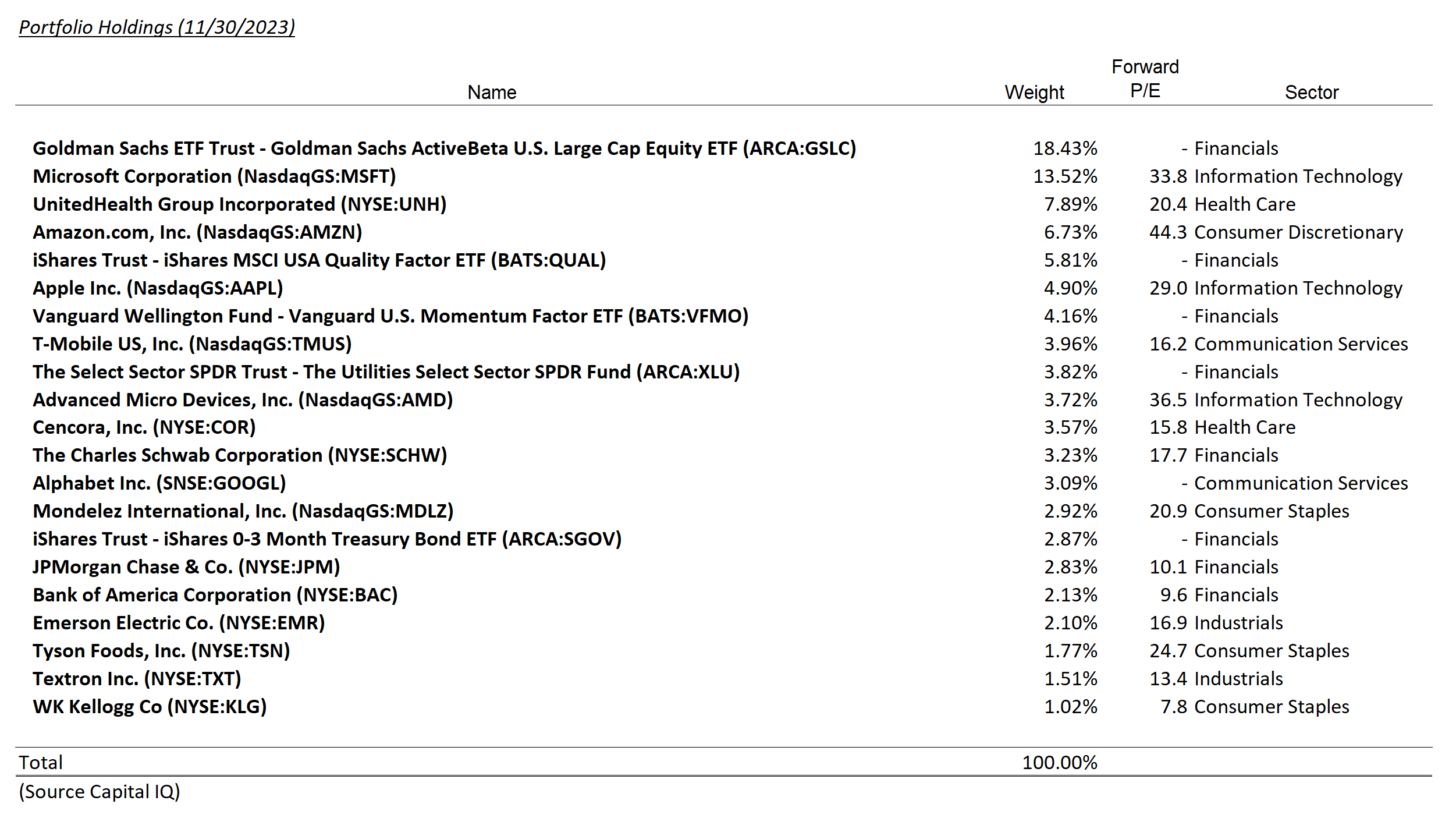

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| DG | 1.0% | |||

| SCHW | 1.9% |

Summary of Month’s Action:

November was a historically strong month for both bonds and stocks. The S&P 500 increased by more than 9%, while the Bloomberg US Aggregate produced total returns of more than 4.5% (source: Koyfin). Information Technology, Real Estate, and Consumer Discretionary gained the most, while Energy was negative in November.

For Lincoln Capital’s model, Advanced Micro Devices, Charles Schwab and Bank of America were the top performers, while Textron, Emerson Electric, and Tyson Foods were the top detractors. Tyson and Emerson both reported their latest quarterly results during November and both missed analyst expectations. While near-term setbacks, the longer-term thesis for both companies remains in-tact.

Equity performance in November benefited from multiple positive developments. First, on inflation, the Consumer Price Index report for October surprised to the downside, despite other data showing strong growth and employment. The market cheered this report as it suggests the economy is getting back to the Fed’s target and clears the path for future rate cuts.

On the Fed front, through multiple speaking engagements, officials signaled to the market that rate hikes are over. The market took this message and ran with it, not only removing further hikes from their calculus, but also bringing forward the date of the first rate cut from mid-year 2024 to March 2024. This development, plus the Treasury’s recent issuance tweak of fewer longer-dated bonds, coalesced to drive down the 10-year US Treasury rate from 4.88% on Halloween to 4.35% by November 30th (source: Koyfin).

Dollar General Corporation – (DG)

We sold the remaining position in Dollar General. Enthusiasm surrounding the ouster of the new CEO and the return of the old boss has driven shares higher. The stock now trades at 19.3x forward earnings, about even with the market.

In our opinion, at this level, the market is pricing in a bounce to earnings that we feel is still very uncertain. Price cuts and labor investments will be permanent costs rather than one-offs, which leaves the resumption of sales growth to drive margins higher. There have been no indications to date that sales have returned to growth strong enough to expand margins—we will be watching closely for this key indicator.

The Charles Schwab Corporation – (SCHW)

As mentioned in last month’s writing, we intended to build back our position in Schwab. We began the process in November, however, we were not able to do it in all accounts due to the wash sale rule. For reference, taxable accounts that sold shares at a loss in early October would not have been able to use the loss for tax purposes if we purchased the shares within 30 days.

Money fund metrics at SCHW have been turning more favorable, which likely foreshadows a turn in their short-term funding needs and, therefore, impressive net interest income growth. We are watching closely, and will look to build the position advantageously.

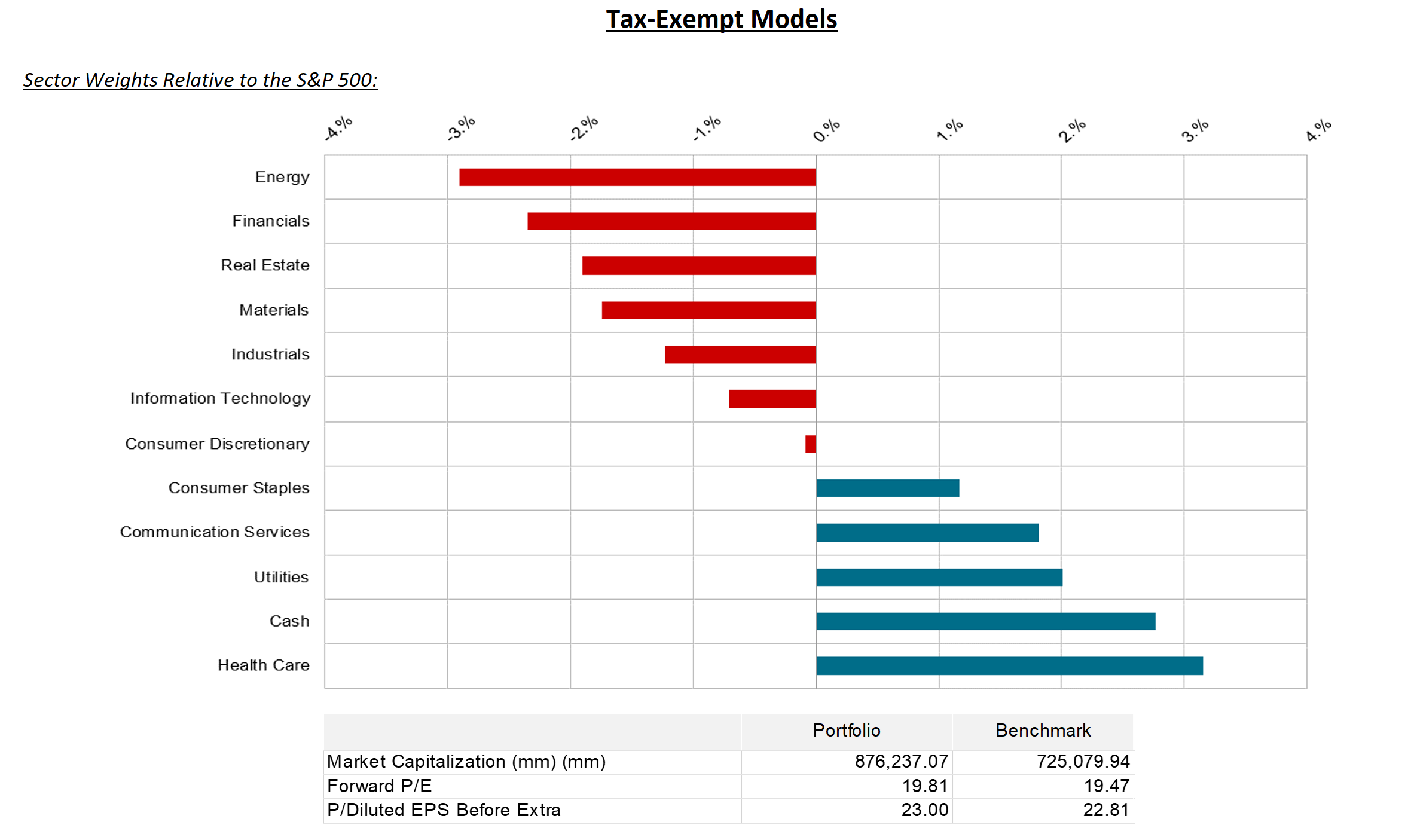

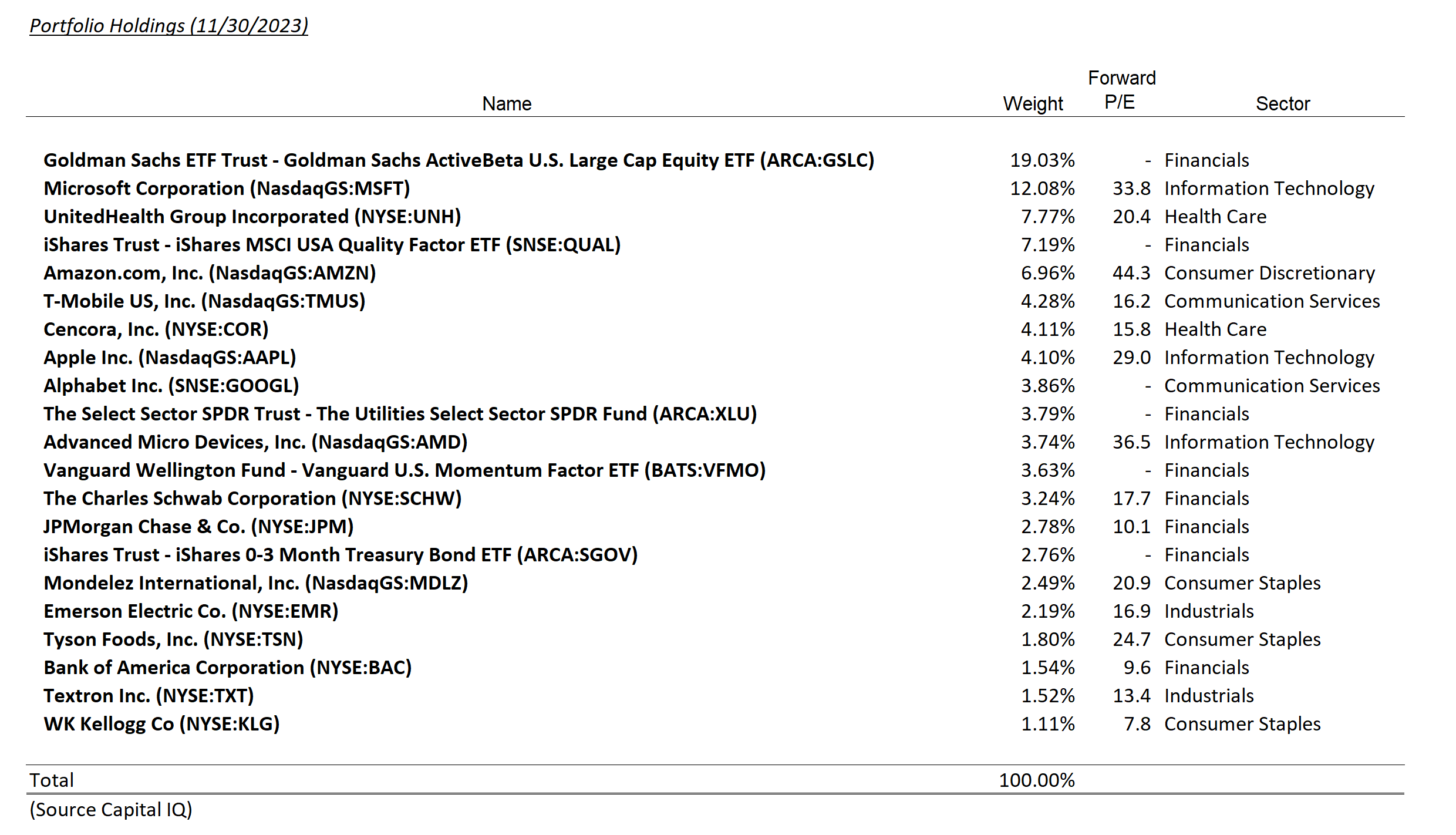

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.