October Changes

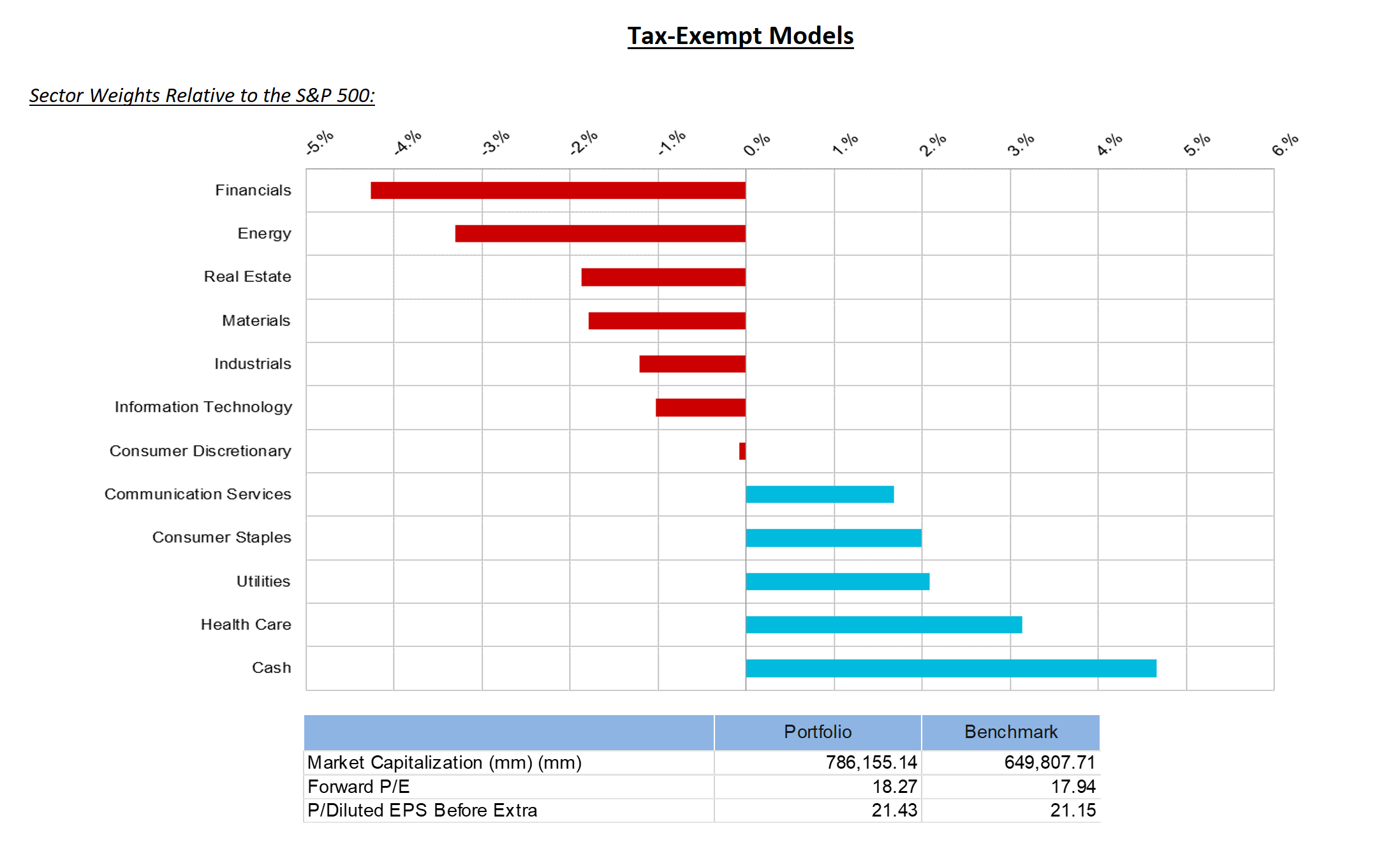

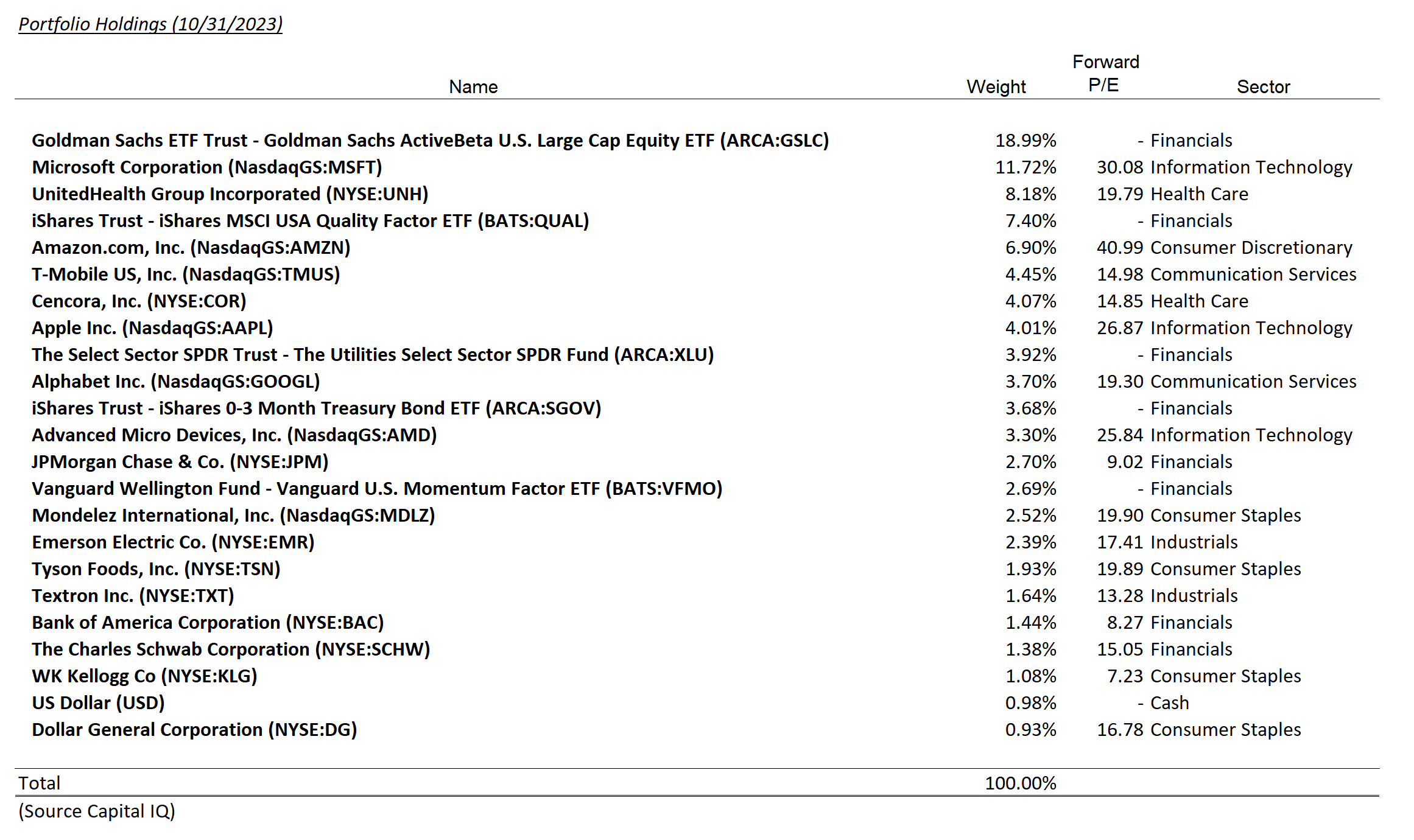

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| KLG | 1.1% | |||

| SCHW | 4.1% |

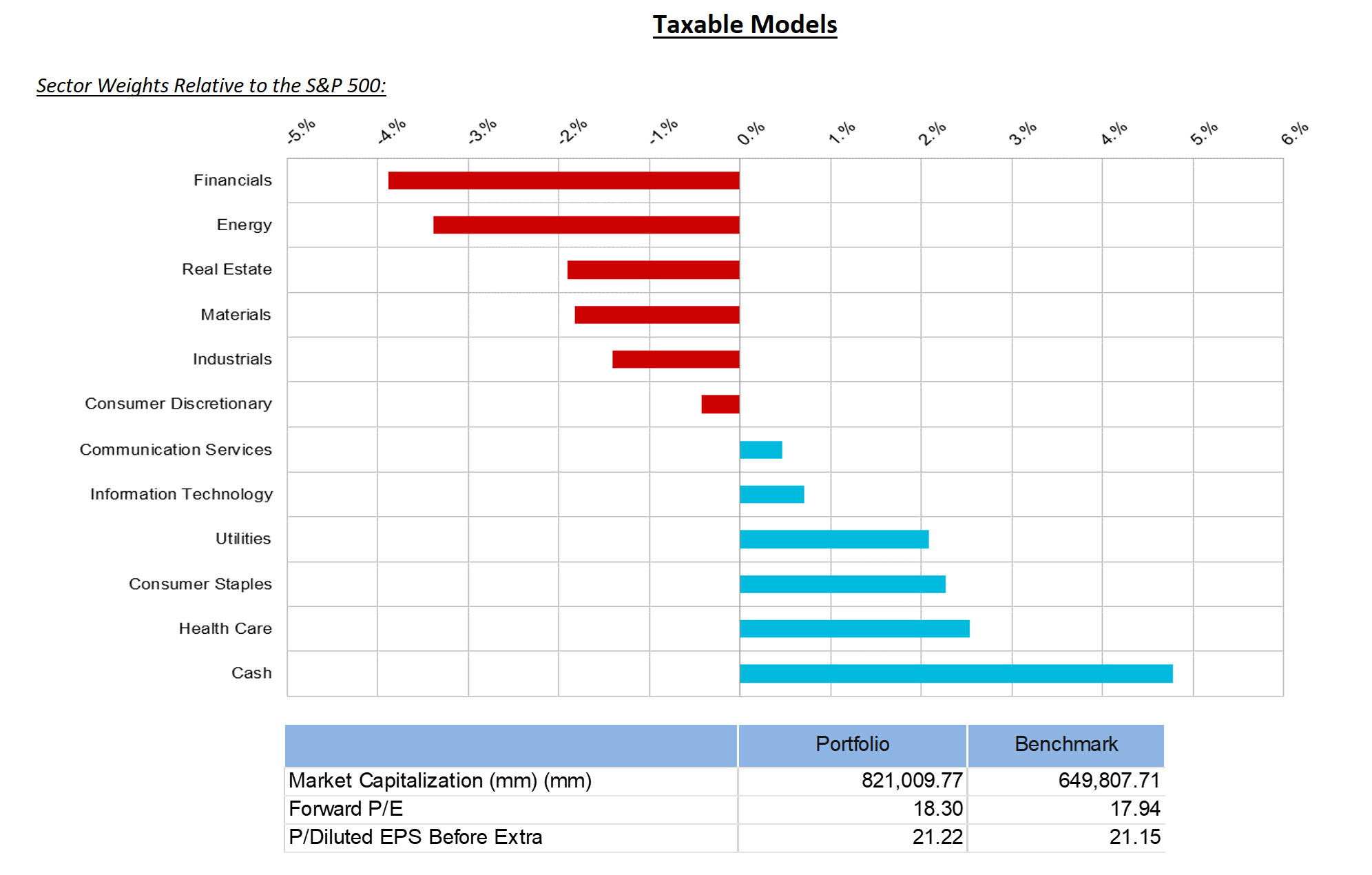

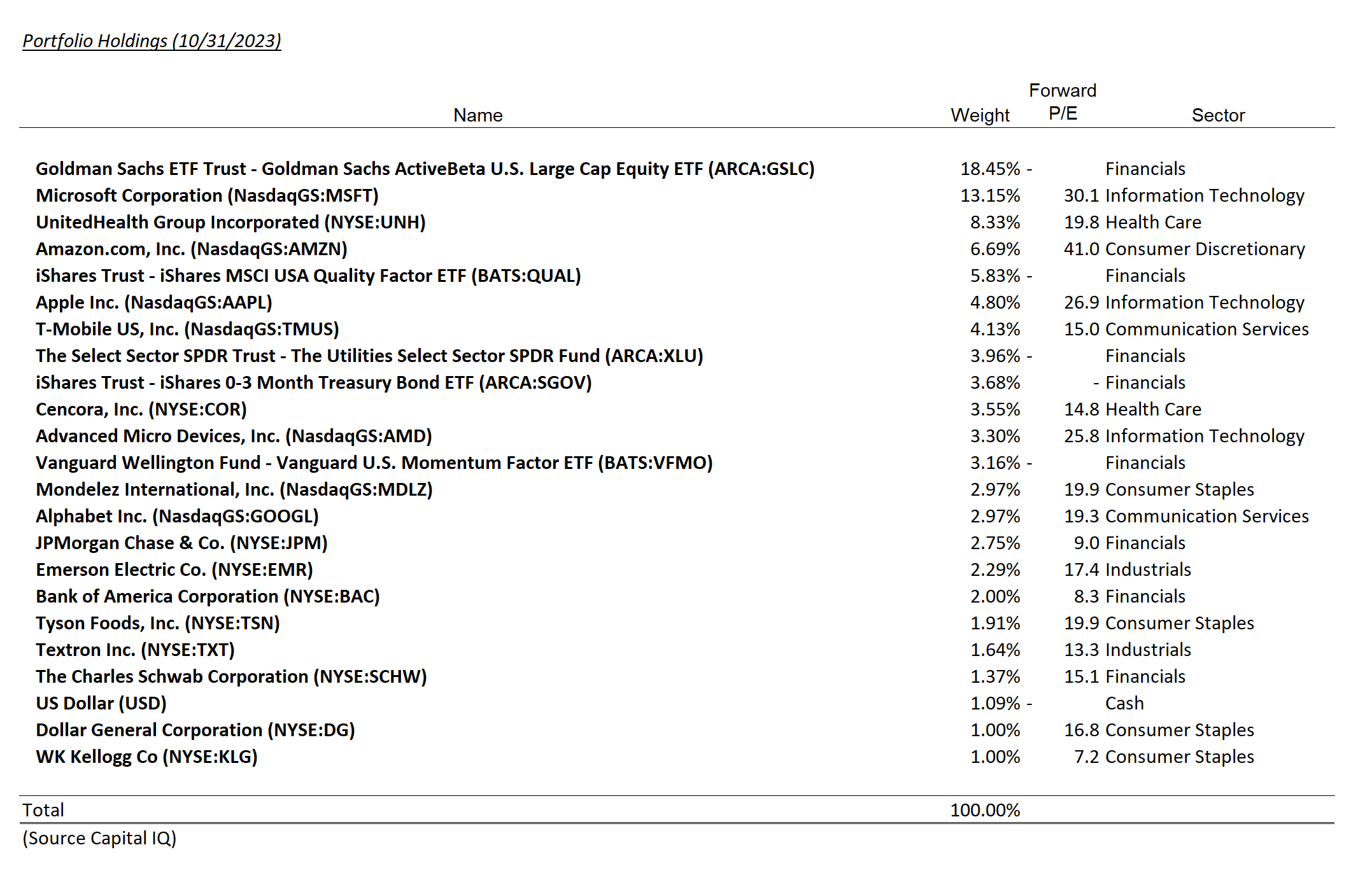

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| KLG | 1.0% | |||

| SCHW | 4.2% |

Summary of Month’s Action:

Stocks posted their third consecutive month of declines in October, with the S&P 500 declining 2.1% (per CapIQ). Utilities, Information Technology, and Communication Services were the sector leaders in October, while Energy, Consumer Discretionary, and Healthcare were the laggards (Source: Koyfin).

Top contributors to Lincoln Capital’s equity model were Microsoft and United Health. Microsoft reported a strong quarter and excitement continues to build for its Copilot offerings. Copilot for Office 365 will be generally available on November 1st, though it appears to just be for larger enterprises at present. We continue to believe the uptake of these productivity tools is being underappreciated by the market and sets MSFT shares up well for the intermediate term. Portfolio laggards in October included Schwab and Emerson Electric.

For equities, we feel better today than we did at the time of our last writing. Federal Reserve Chairman Jerome Powell just had his November press conference and has essentially guided the market to expect no further rate hikes. Additionally, the Treasury has revised lower its long bond issuance expectations for the near future. These events have allowed the 10-year yield to decline and take some pressure off the economy.

We are making our way through earnings season and, so far, it appears to be an average quarter. Surprises are in line with historical norms. With this backdrop, and a better valuation than earlier in the summer, stocks appear to be okay in the near term if economic data continues to show steady progress. Geopolitics, particularly the conflict in the Middle East, is the largest near-term wildcard for the market.

The Charles Schwab Corporation – (SCHW)

We significantly reduced our position in Schwab over the month as we feared investors did not appreciate the reacceleration of cash sorting that occurred during the summer. Investors took the news in stride, however, and Schwab management pointed out a few pieces of information to alleviate investor concerns:

In September, bank sweep balances grew month over month for the first time since the Fed began hiking, and only 20% of money fund flows have been purchased via bank sweep in recent periods. With the Fed apparently on pause, we are likely close to Schwab growing deposits and beginning to pay down its high cost funding sources.

With this new information and the still positive long-term outlook for the shares, we intend to rebuild our Schwab position over the coming months.

WK Kellogg Co – (KLG)

Kellogg spun off KLG, its North America cereal business, on October 2nd. We initiated a small position in client accounts shortly thereafter. While not foolproof, spinoffs historically perform well. We believe this is due to little information on the new company, which is often a small division of a much larger enterprise, and indiscriminate selling by the new shareholders. The shareholders often sell due to not being interested in the new assets (spun off divisions are often not in attractive industries), or the proceeds received in the spinoff are very small and are therefore sold to tidy up shareholder portfolios.

We believe KLG fits this mold perfectly. Kellogg shareholders received $0.05 in KLG for every $1 held in Kellogg. KLG is also in a mature and declining category—ready-to-eat (RTE) cereal. Also helping depress the price in KLG has been the lousy market for equities in general. If the market was steady or increasing, new shareholders may be more inclined to roll the dice. However, with the weak market, risk aversion is high and Kellogg shareholders are unlikely to give KLG a chance.

As mentioned, RTE cereal is a declining market, however, KLG profits are likely on the cusp of an inflection point. The company is anticipating 9% EBITDA margins this year; however, after reinvestment in their facilities, they expect margins to expand to 13% to 14% by 2026. Achieving close to this target will show material profit growth despite a muted top line. Peers like Post and General Mills have margins above this targeted range, providing proof that KLG’s ambitious targets are indeed possible.

To unlock these margins, management intends to spend aggressively over the next few years, while paying an attractive dividend. This will push debt levels higher and free cash flow negative. This dynamic is the key reason shares trade at today’s levels – 6x EBITDA, 8.2x EPS, and a dividend yield likely north of 6% (haven’t announced it yet). However, higher debt and cash flow dynamics will be temporary.

As the market begins to appreciate the business and investment case, we expect the shares to trade at a more appropriate valuation.

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.