September Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| GNRC | 1.3% |

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| GNRC | 1.4% |

Summary of Month’s Action:

September was a difficult month for equities and bonds, too, for that matter. The S&P 500 fell 4.8% during the month (per S&P CapIQ). From a sector perspective, energy was the only one to finish the month positive. Sector laggards included Real Estate, Information Technology, and Industrials. The key influence for the month was interest rates. The 10-year U.S. treasury closed on August 31st at 4.09% and ended the month at 4.58%, and has surged even more October-to-date (all using Koyfin data).

What has been the driver of long-term yields? The oil market appeared to be somewhat responsible yet, upon closer inspection, it didn’t seem to be a major factor. Five-year breakeven inflation rates – the market’s expectations for inflation over the next 5 years derived from the treasury inflation protected securities market (TIPs) – have not increased meaningfully and sit at 2.18% today (per the Federal Reserve Bank of St Louis).

Rather, it seems the market has removed the amount of federal funds rate cuts next year, implying a higher rate for Fed Funds as we exit 2024. This repricing has been driven by both Fed communications and also due to economic strength.

We will expand on many of these topics in our upcoming quarterly Tally and Perspective.

Generac Sold

We sold our position in Generac. As mentioned in our July commentary, we intended to sell Generac, but were looking for an opportune time to sell it. With hurricane season past its peak, we don’t think there are many upside surprises left this year and decided to liquidate the position.

As stated, demand appears to be ebbing for Generac, as the company cited lower year-over-year installations in its latest quarter despite 2022 installations being artificially depressed due to a lack of installation labor. Ultimately, Generac needs to sell more units to make money and, unlike cars or iPhones, replacement demand can offer no support if new sales slow down.

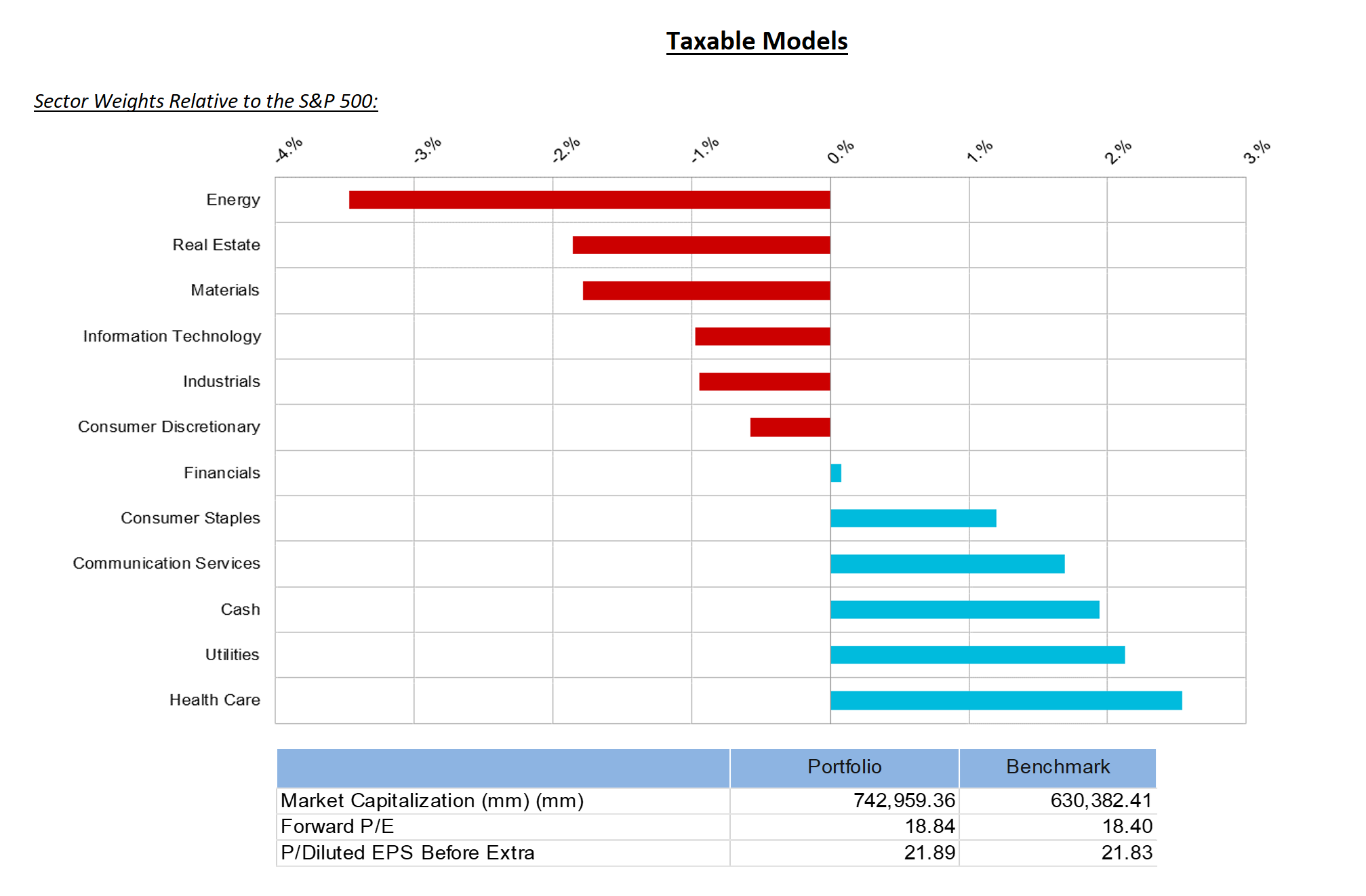

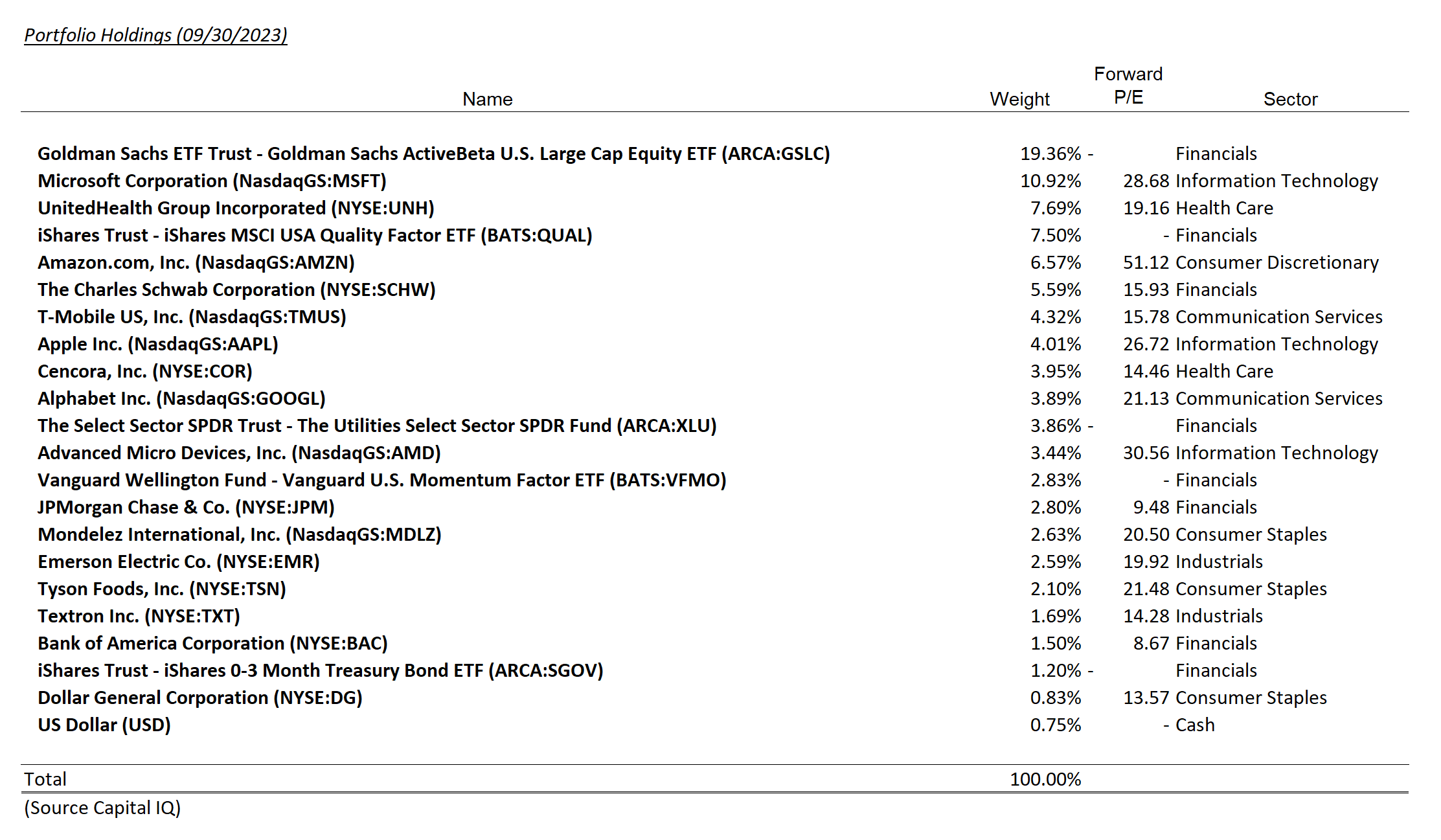

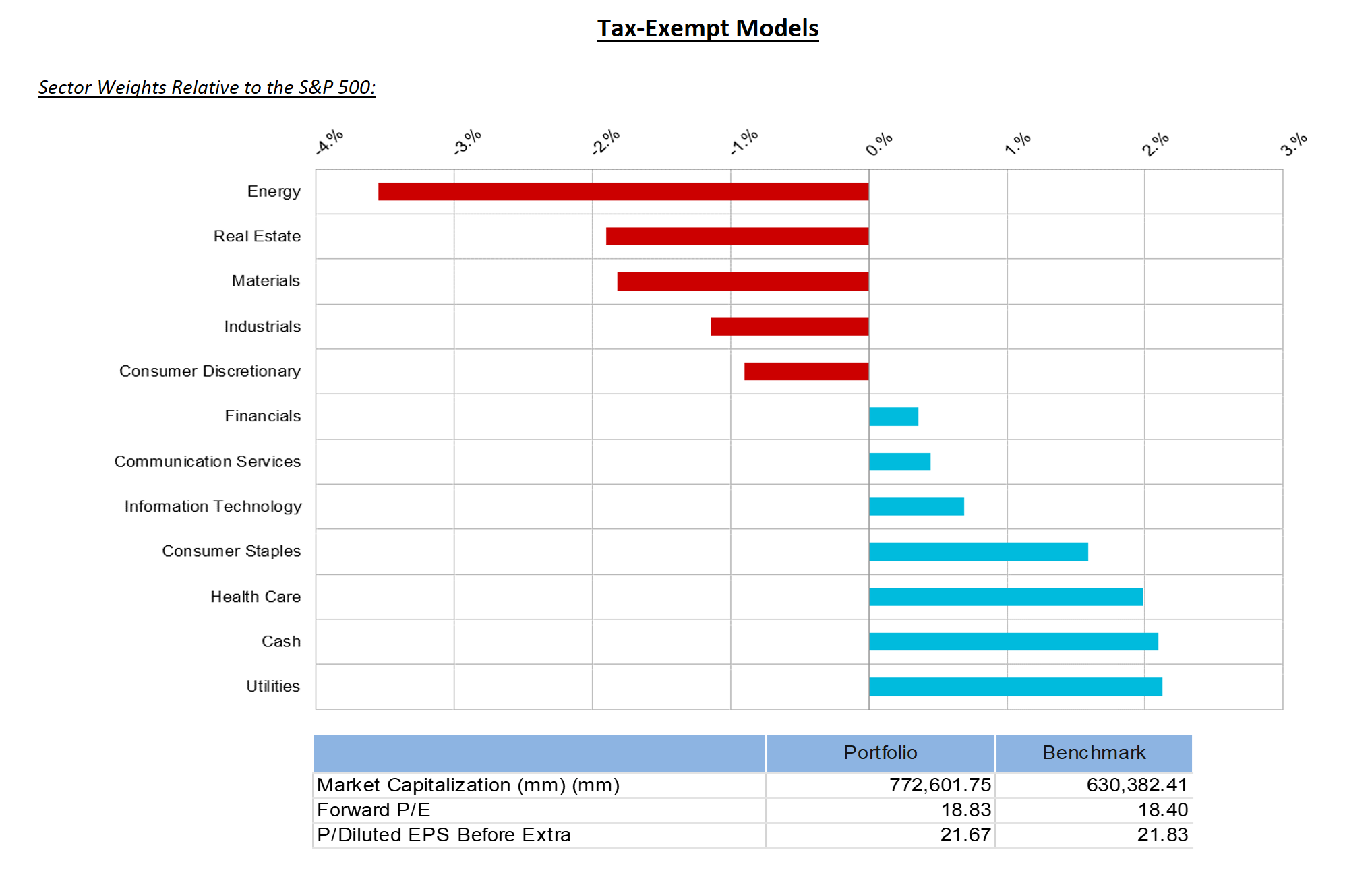

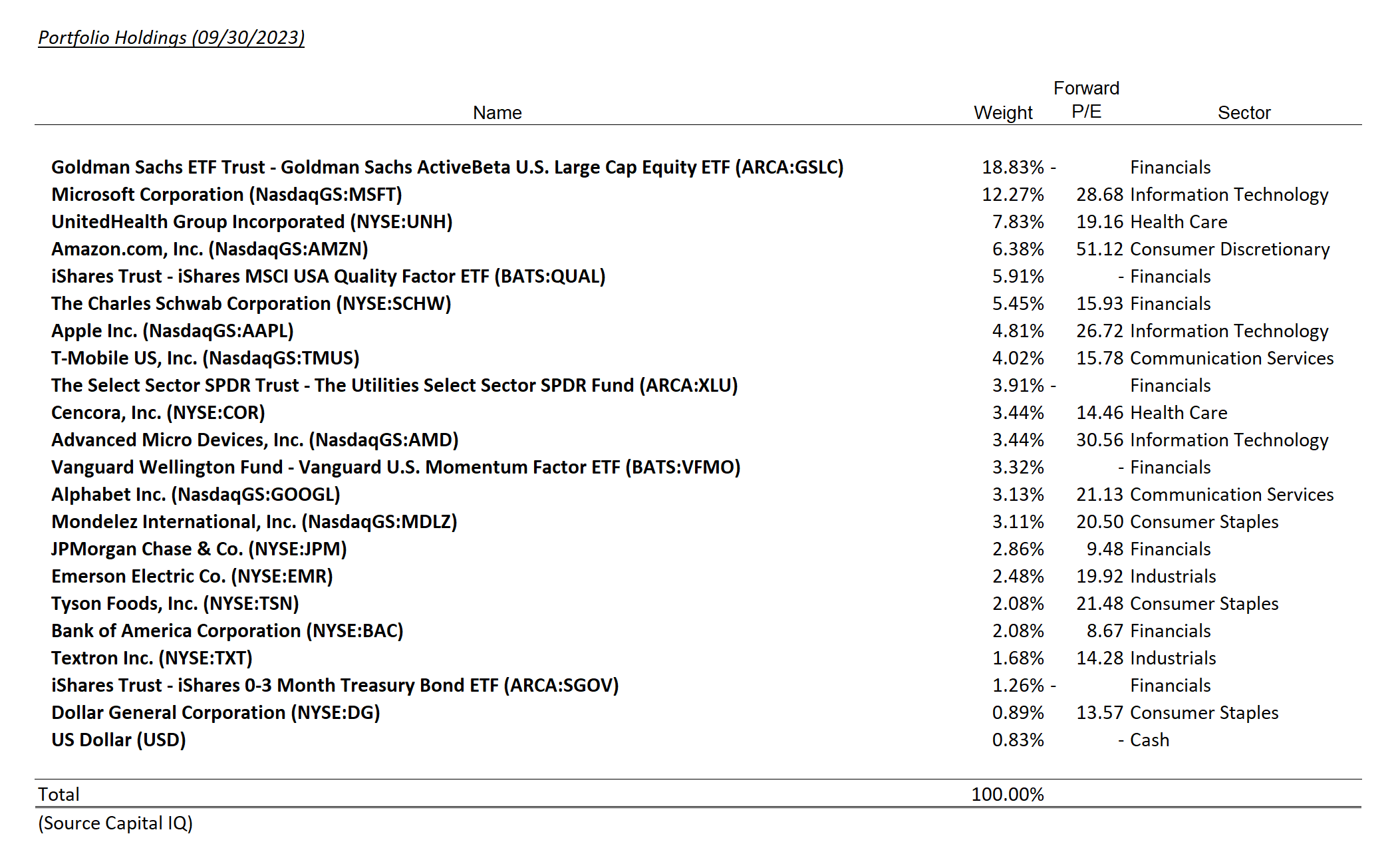

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.