June Changes

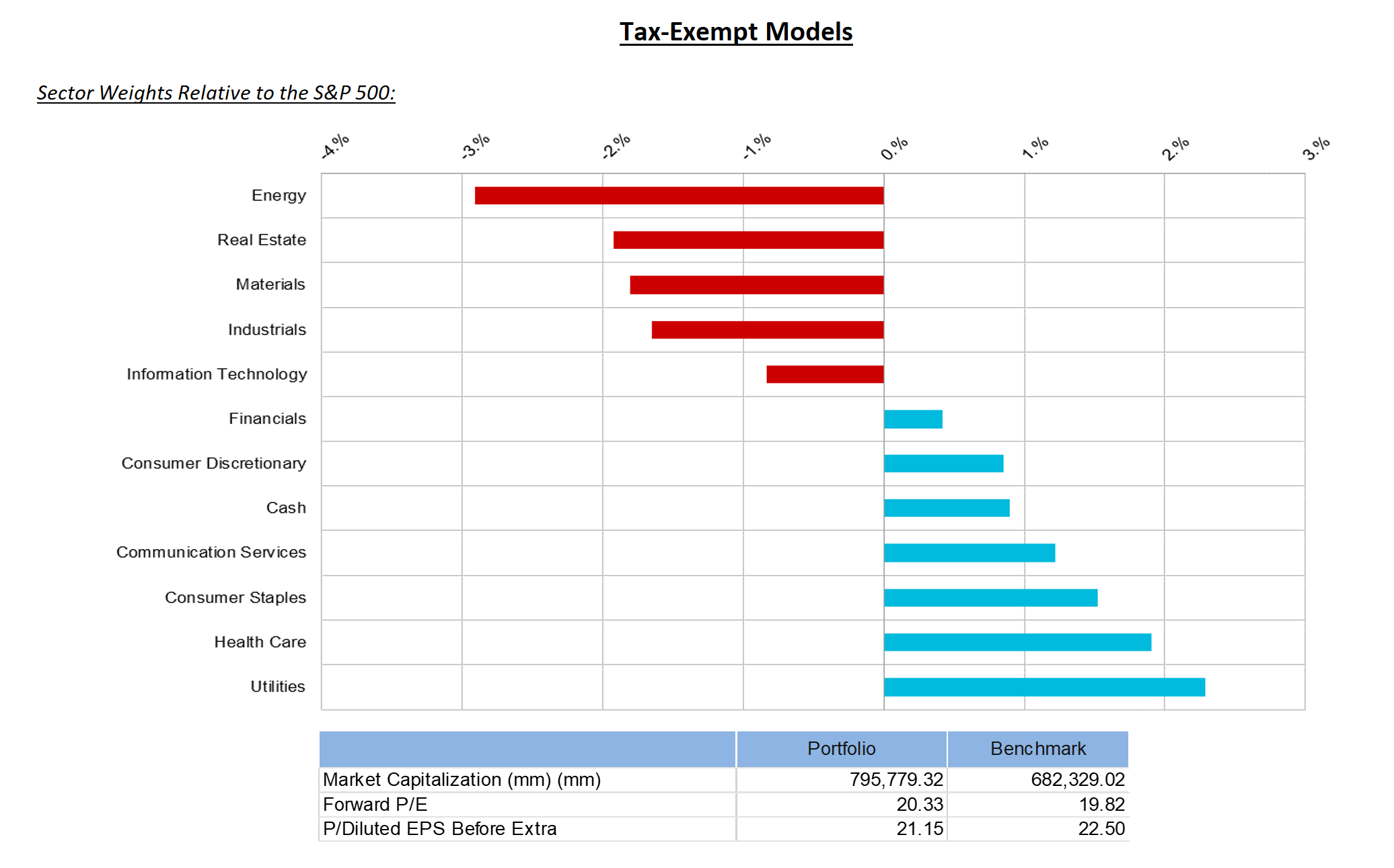

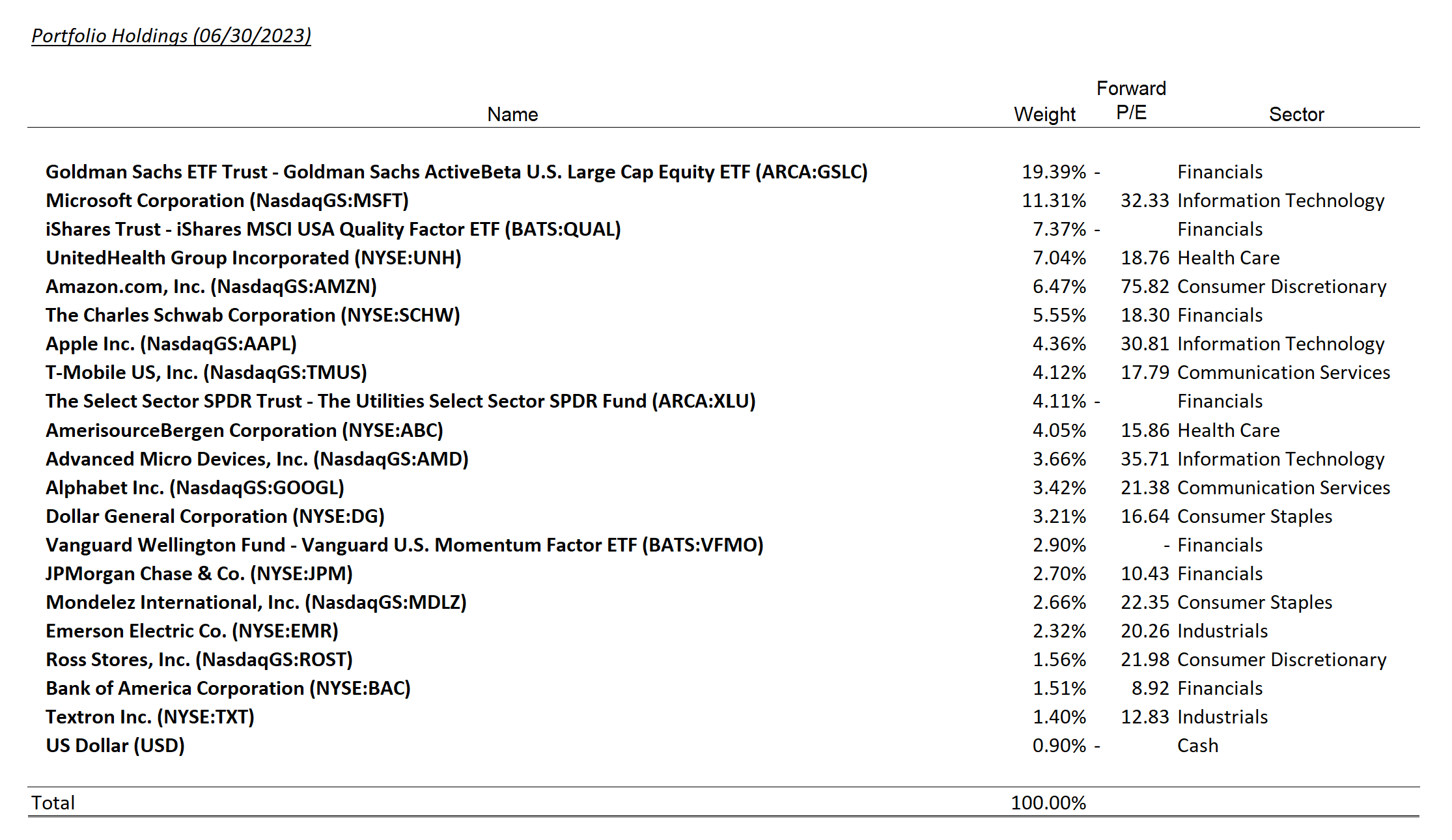

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| None |

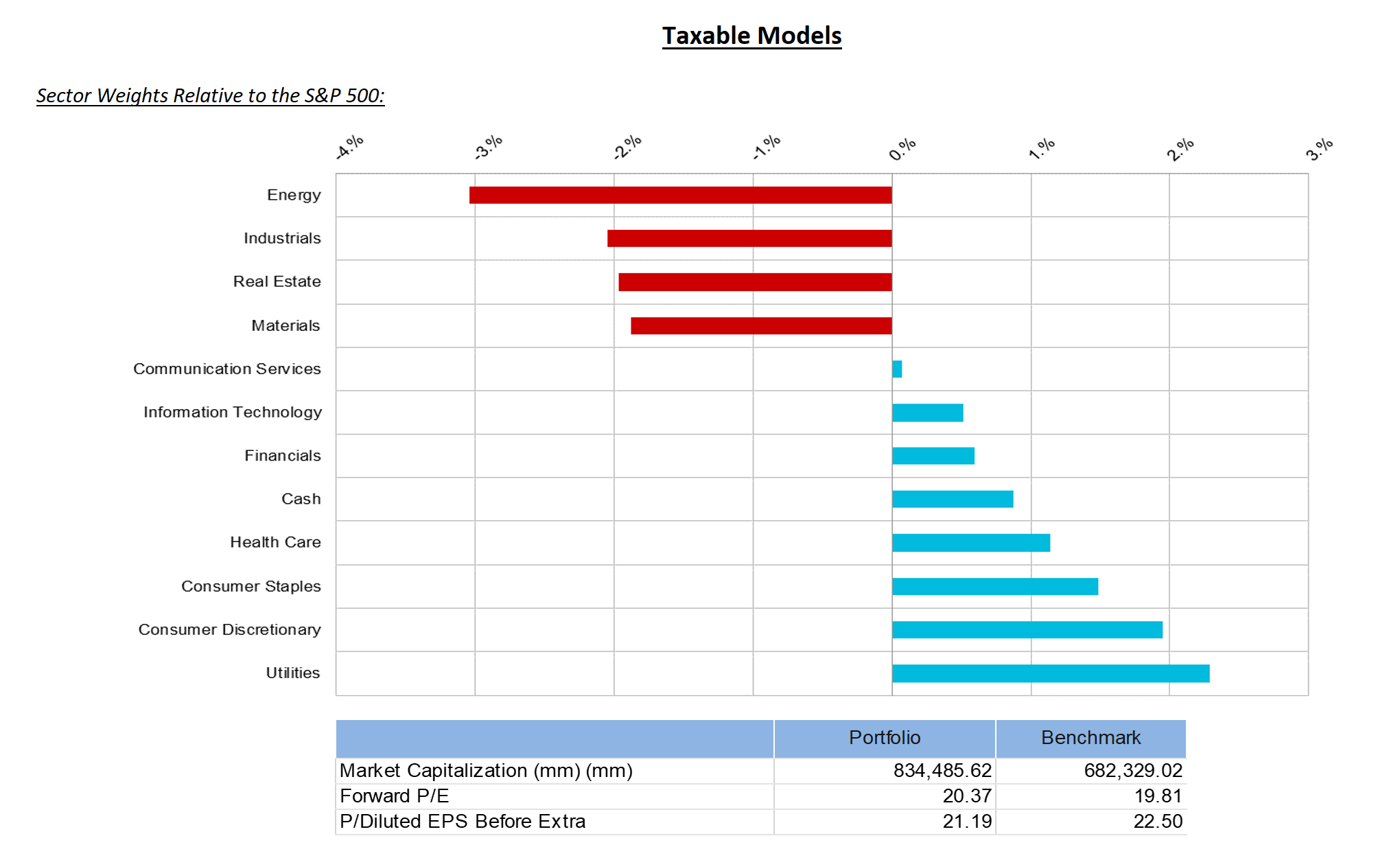

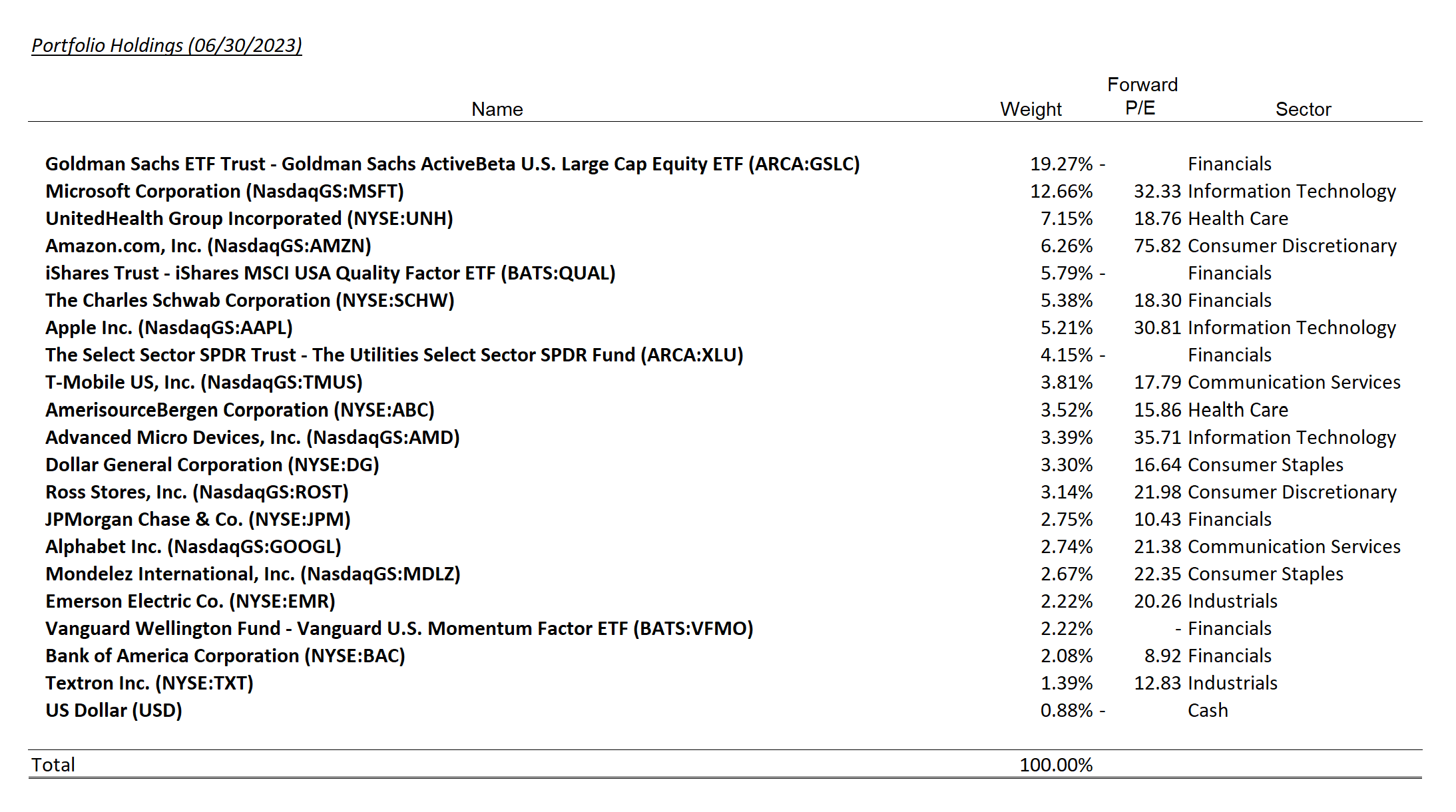

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| None |

Summary of Month’s Action:

The S&P 500 gained 6.6% during the month of June, an abnormally sharp return to close out the first half of 2023. Consumer discretionary, Industrials, and Materials sectors led the month, each gaining over 10%. Defensive equities lagged, with Utilities, Consumer Staples, and Healthcare sectors increasing less than the broader market in June.

For stocks within Lincoln Capital’s model, the only notable mention for the month is Dollar General, which we covered in last month’s commentary. The stock has stabilized and rebounded approximately 10% off of its low reached June 9th. There was little incremental news on DG, and we intend to hold it for now.

For the market broadly, there is a growing consensus that a downturn will be avoided as long as economic growth remains solid and inflation continues to cool. The market anticipates additional rate hikes from the Fed in the coming months, but it has done little to dampen investors’ enthusiasm to date.

We continue to see the risk/reward in the stock market as abnormally asymmetric. A P/E ratio of 18.9x for the next twelve months’ earnings and 20.1x for 2023 earnings seems stretched. To justify this valuation, stocks would need interest rates to decline and/or earnings growth to accelerate, in our opinion. Interest rates will not decline much if we avoid a recession, so it would then depend on earnings to do the heavy lifting, but the immediate outlook appears mixed. Earnings are projected to grow 0.9% this year, well below long-term averages. Typically, estimates get cut throughout the quarter and, positively, estimates are getting cut less than average right now. That said, Q2 2023 expectations are for a 6.8% decline in EPS from last year, which is nothing to get too excited about.

We will elaborate on how we see the economy and our current investment outlook in the upcoming Q2 2023 Tally and Perspective. In summary, we believe remaining defensive is advisable.