May Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| None |

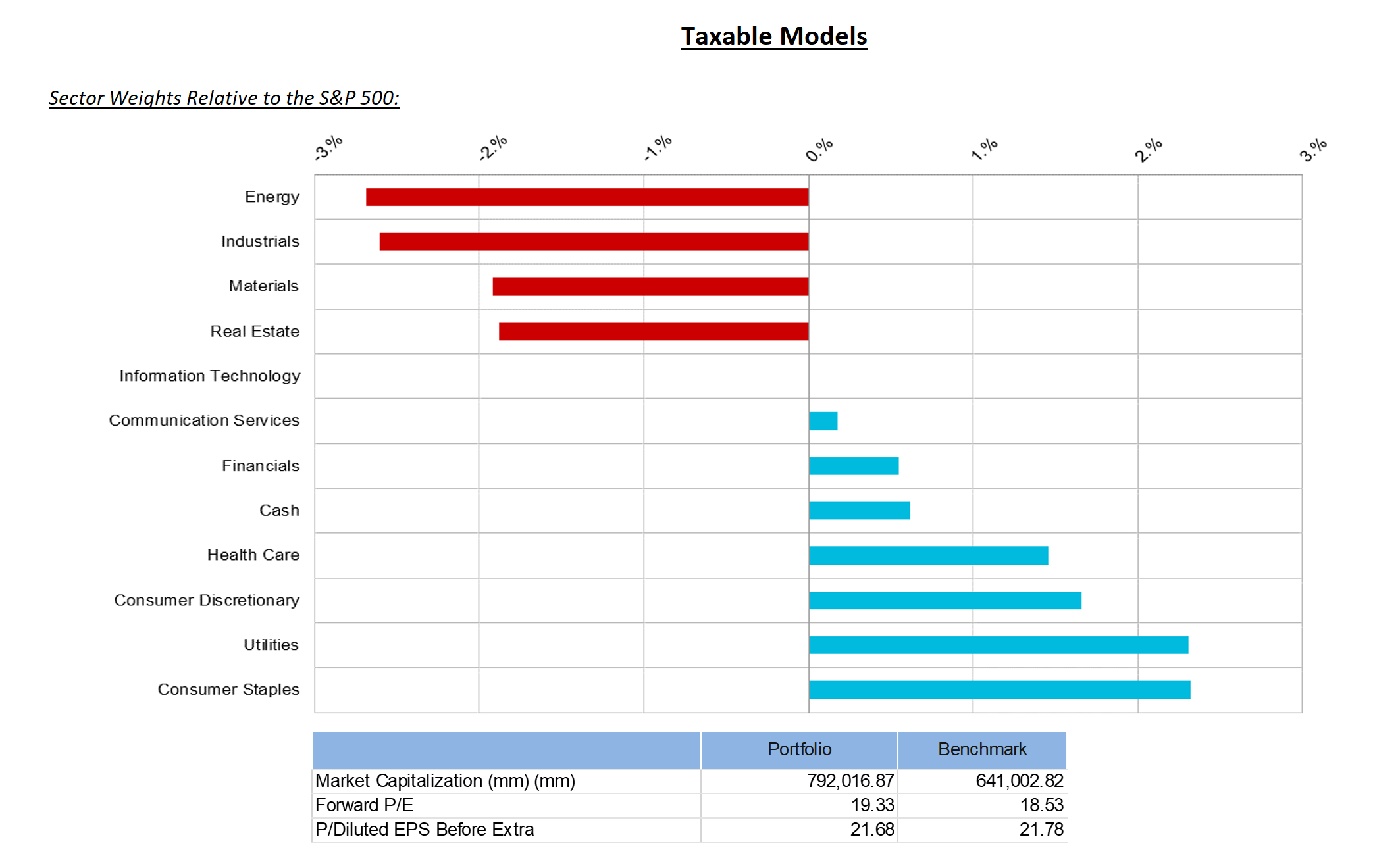

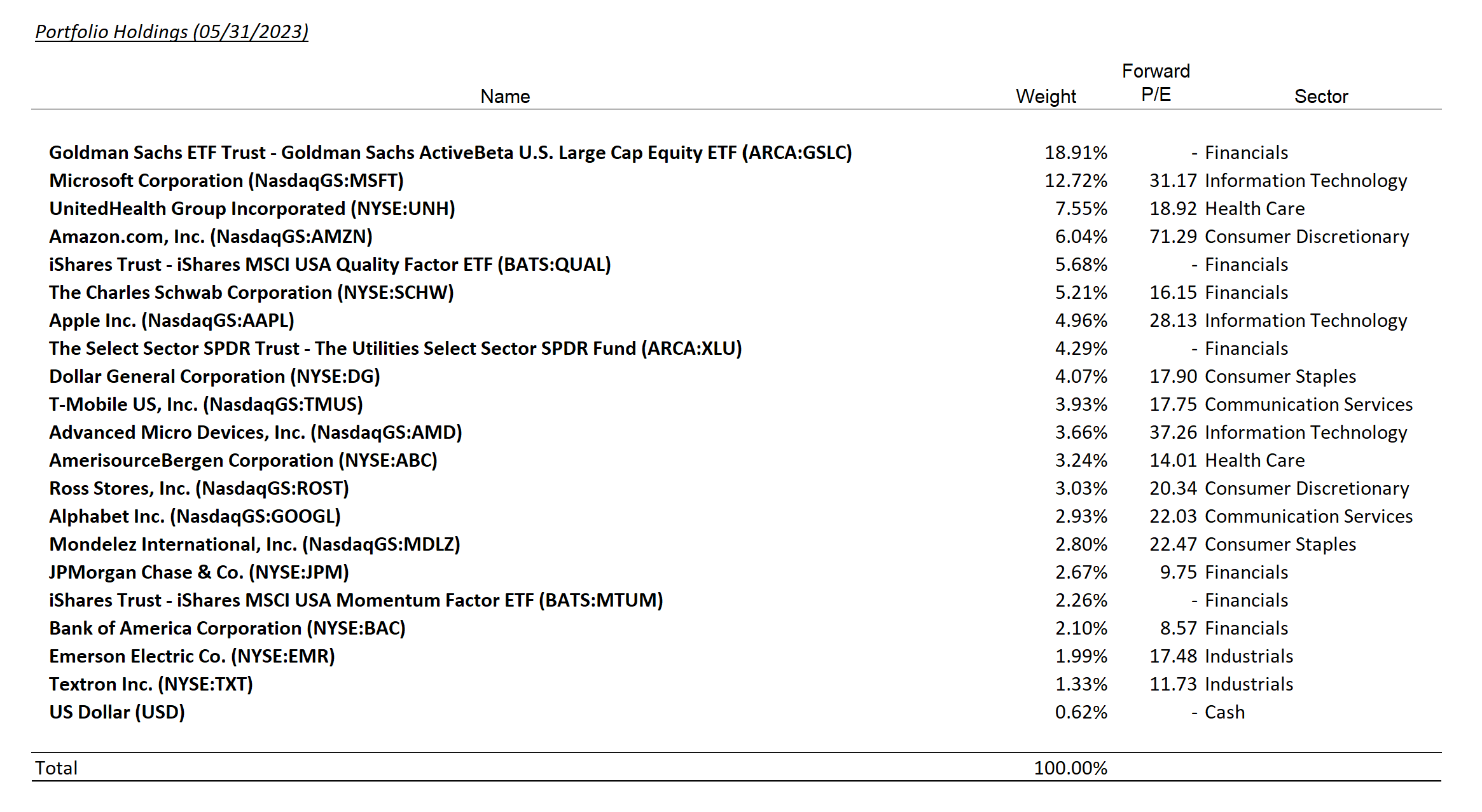

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| None |

Summary of Month’s Action:

The S&P 500 was relatively flat during the month of May; however, the benign index performance masked sharp sector moves. The technology sector rallied 9% led by shares of NVIDIA, which gained 36% during the month. The major sector laggard for May was Real Estate, which dropped 9%.

We continue to believe that an economic slowdown is the most likely outcome near-term. While some of the worst-case scenarios surrounding the banking crisis have not come to pass, it is likely that credit growth will continue to be constrained as deposits are removed from the system. In fact, the recent debt ceiling agreement, while a net positive, can potentially further the depletion of deposits as the treasury issues new bonds to top off its coffers.

Banking hesitancy, coupled with a restrictive Fed Funds rate will eventually impact growth and employment. However, a case can also reasonably be made for a soft landing—where inflation continues to drift lower, job openings decline without meaningful increases in unemployment, while the Fed can slowly remove their foot from the brake.

To date, the hard data received generally supports the soft-landing narrative. Inflation is indeed falling (with more to come as rent and housing ease later this year), while employment is still exceptionally strong. Even interest rate sensitive sectors like housing are showing signs of bottoming despite 7% mortgage rates.

The current expectation is for the Fed to skip a hike at the June meeting, while providing one last boost in July. Admittedly, we underappreciated the strength and longevity of this expansion; however, we still believe it pays to be conservative despite the lack of evidence of a downward shift in the economy. Given today’s valuation, we struggle to see scenarios with abnormal upside for equities.

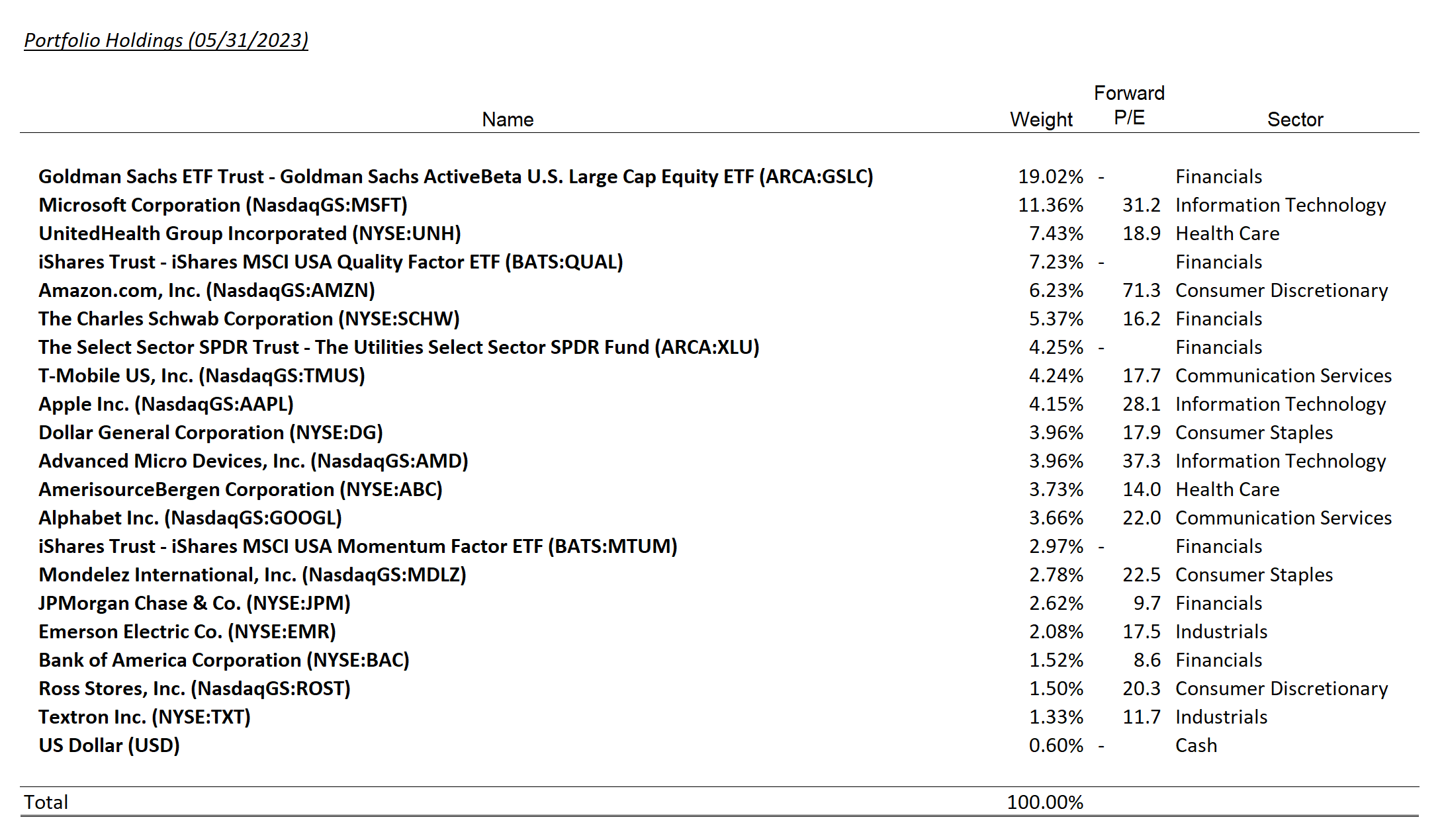

Once again there were no changes to Lincoln Capital’s models during the month. Advanced Micro Devices, Amazon, and Microsoft were all caught up in the artificial intelligence craze during May and performed well. Dollar General was a weaker holding during May and has had an abysmal start to June after reporting Q1 figures.

Dollar General Lagging From Macroeconomic Strain

Our original investment case on Dollar General was simple—as the economy slowed and household budgets got pinched, DG would benefit as its existing customer base had no alternative, while higher income shoppers would begin to shop at DG more often. This is what occurred through the last recession as the company saw sales at each comparable location increase in the high, single-digit range for multiple years.

This appeared to occur up until this quarter, when sales underperformed company and analyst expectations (sales are now expected to grow 1% to 2% at comparable locations this year versus prior expectations of 3 to 3.5%). Management cited macroeconomic strain on their core customer and little trade down from higher income cohorts. Also, despite suggesting limited impact from SNAP benefit reductions last quarter, management cited these as a headwind to Q1 sales in addition to lower tax refunds this year.

Management stated they will make targeted price cuts in the second quarter to help turn sales around. This spooked investors and raised concerns of a potential price war between discount retailers. DG is already priced below Family Dollar and Dollar Tree, and is typically on par with Wal-Mart. Additionally, there are only about 3,000 stores (out of DG’s 19,000-unit fleet) that overlap with the other dollar chains, given DG’s rural footprint. Despite these mitigating factors, investors still fear the worst.

Ultimately, we are disappointed by DG’s performance, but this appears to be fully baked into the price at today’s levels. For the past 10 years, DG traded at a 6% discount to WMT, pre covid, the company traded at a 2% premium. Today, DG trades at a 32% discount to WMT. Similar relationships can be observed between DG and the S&P 500 as well. We view the risk reward as favorable today for DG shares and will continue to monitor closely.