January Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| TXT | 1.5% |

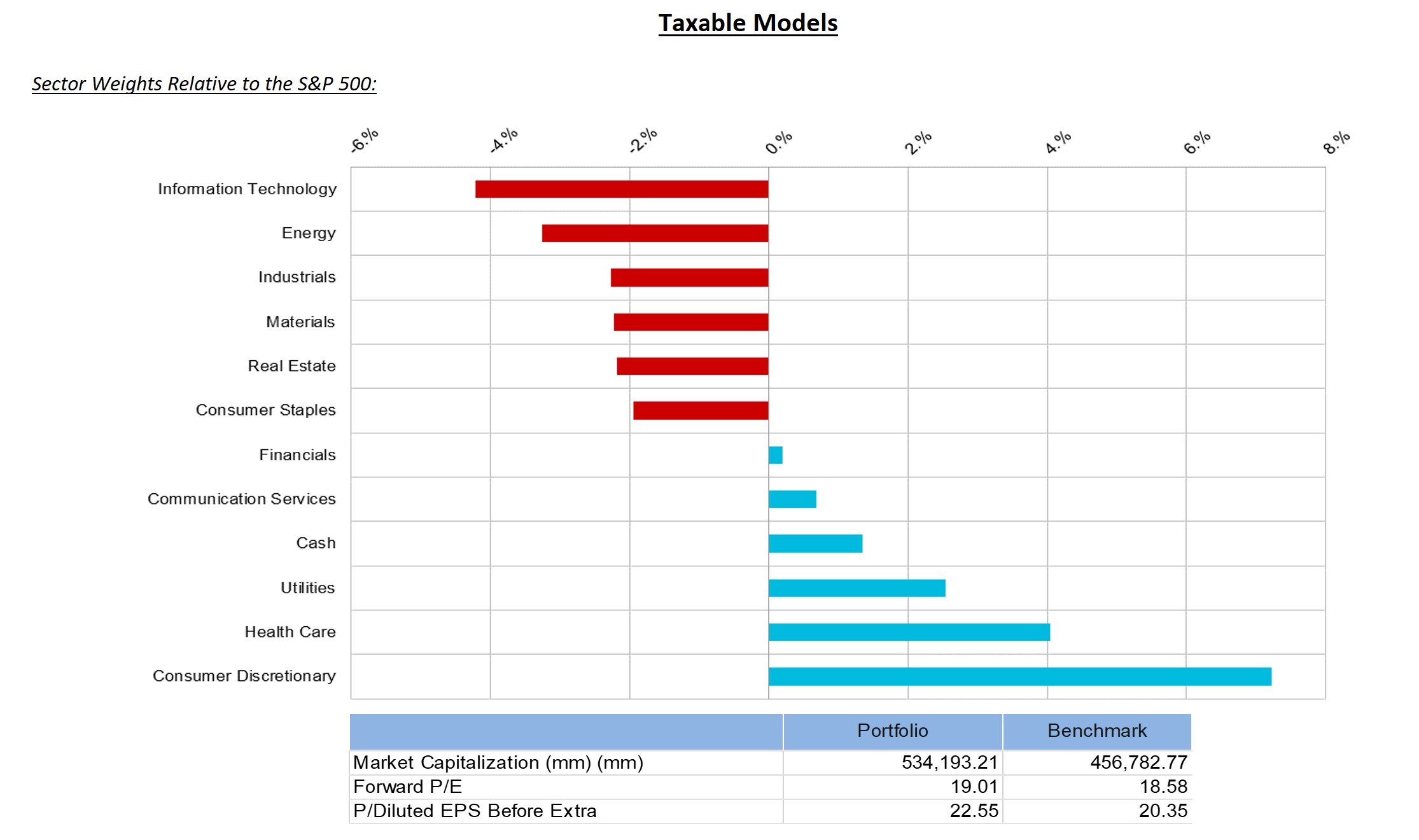

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| TXT | 1.5% |

Summary of Month’s Action:

The S&P 500 started 2023 with a bang, with the index gaining 6.3% during the month of January. International equities continued their recent trend of outperforming their U.S. counterparts. From a factor perspective, the only factor to meaningfully outperform the S&P 500 was small cap. Notably, stocks that have been exhibiting strong momentum were negative for the month of January. From a sector perspective, consumer discretionary and communication services led the way, while consumer staples, health care, and utilities were the worst performers, and all declined in January. Interestingly, when excluding energy, this month’s leaders were last year’s laggards, and vice versa, corroborating the poor performance of the momentum factor.

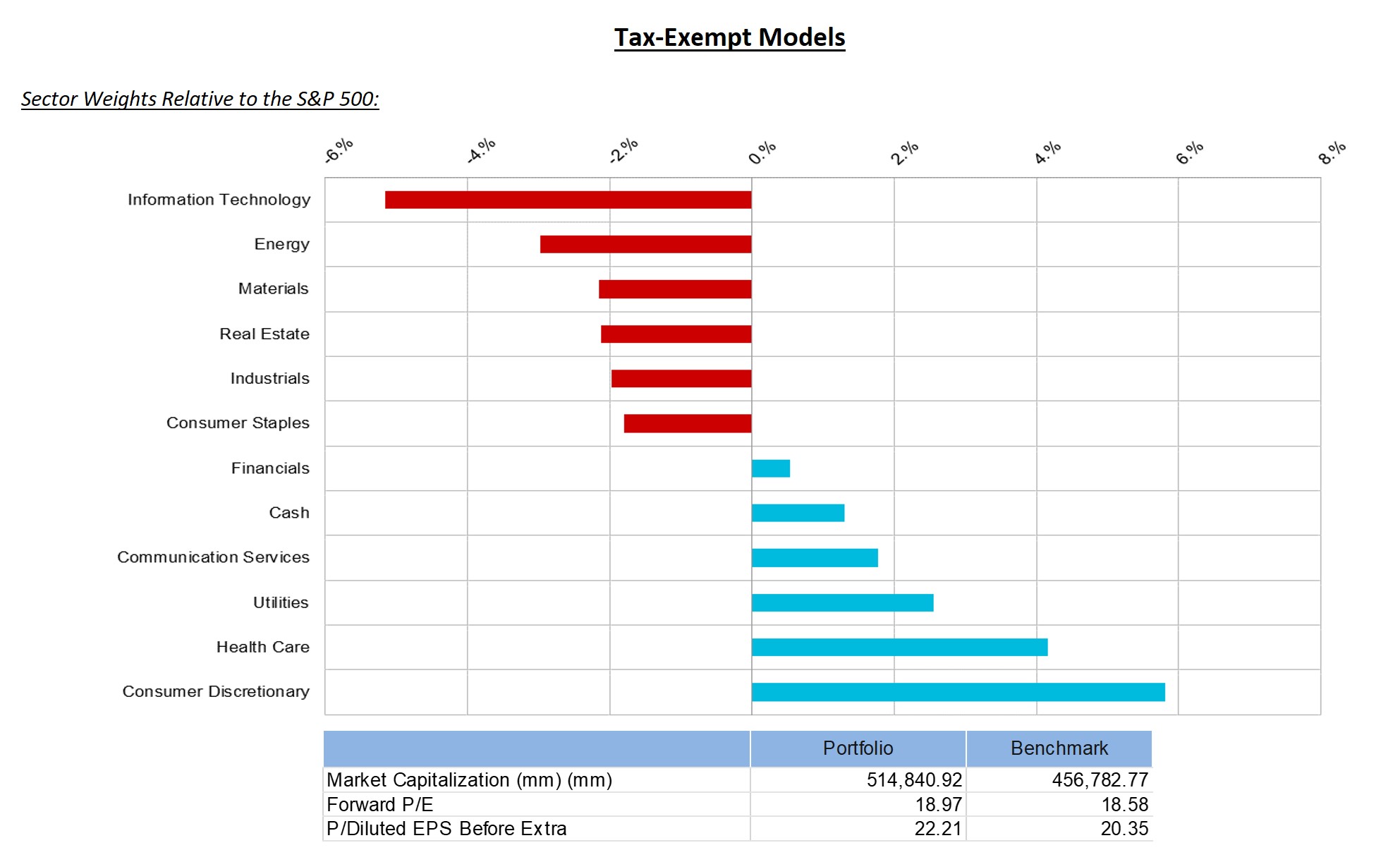

Lincoln Capital’s tax-exempt model dramatically underperformed in January. While things appeared to be turning back in our favor towards the end of the month, at the time of this writing, the previous trend has continued into February. When deconstructing returns, all of the underperformance can be explained by security selection. Stocks that have hurt performance the most include UnitedHealth Group, Charles Schwab, and Dollar General—all of which are down mid-single digits in 2023. Also hurting performance are stocks that we don’t own that have done well in 2023, such as Tesla and NVIDIA, which are up 40.6% and 33.7%, respectively. On the plus side for the month of January are positions in CarMax, Advanced Micro Devices, and Amazon, which are up 15.7%, 16.0%, and 22.8%, respectively.

The majority of the stock price changes outlined in the paragraph above have been driven by increased hopes of a pause in the Federal Reserve’s hiking campaign and a higher expected probability of a soft landing. These changes in the outlook have reignited some of the speculative fervor from 2021. For instance, after declining 68% in 2022, ARKK (The Ark Innovation ETF managed by Cathie Wood) is up 41% in 2023. Other stocks doing well during the first 32 calendar days include Carvana, Opendoor, and Coinbase, which are up 240%, 147%, and 131%, respectively. Bitcoin has also seen a resurgence in 2023, gaining 43% year to date. We agree with the markets assessment of the Fed and the prospects of a soft landing; however, the intensity of the rotation out of defensive positions and into high growth and speculative securities was exacerbated by extreme investor positioning exiting 2022. Therefore, we expect this painful period to pass soon but we’ll be on the lookout for evidence that our expectations are misplaced.

Security Specific Comments:

Textron Inc. – (TXT) – We trimmed our position in Textron during January, and expect to exit the remainder of the position over the coming weeks. A key part of our rationale for purchasing the shares was the expected award of the Army’s Future Long Range Assault Aircraft program. Textron shares jumped after winning the award on December 5th. However, soon thereafter, the shares gave back all of this gain leading us to believe that it is unlikely investors will give the company credit for a program that won’t meaningfully ramp up until later this decade. Meanwhile, the business jet segment is the strongest it’s been since the financial crisis, yet it’s difficult to see orders holding up with the macroeconomic environment poised to slow. Given this backdrop we think our capital is better deployed elsewhere.