Market Activity

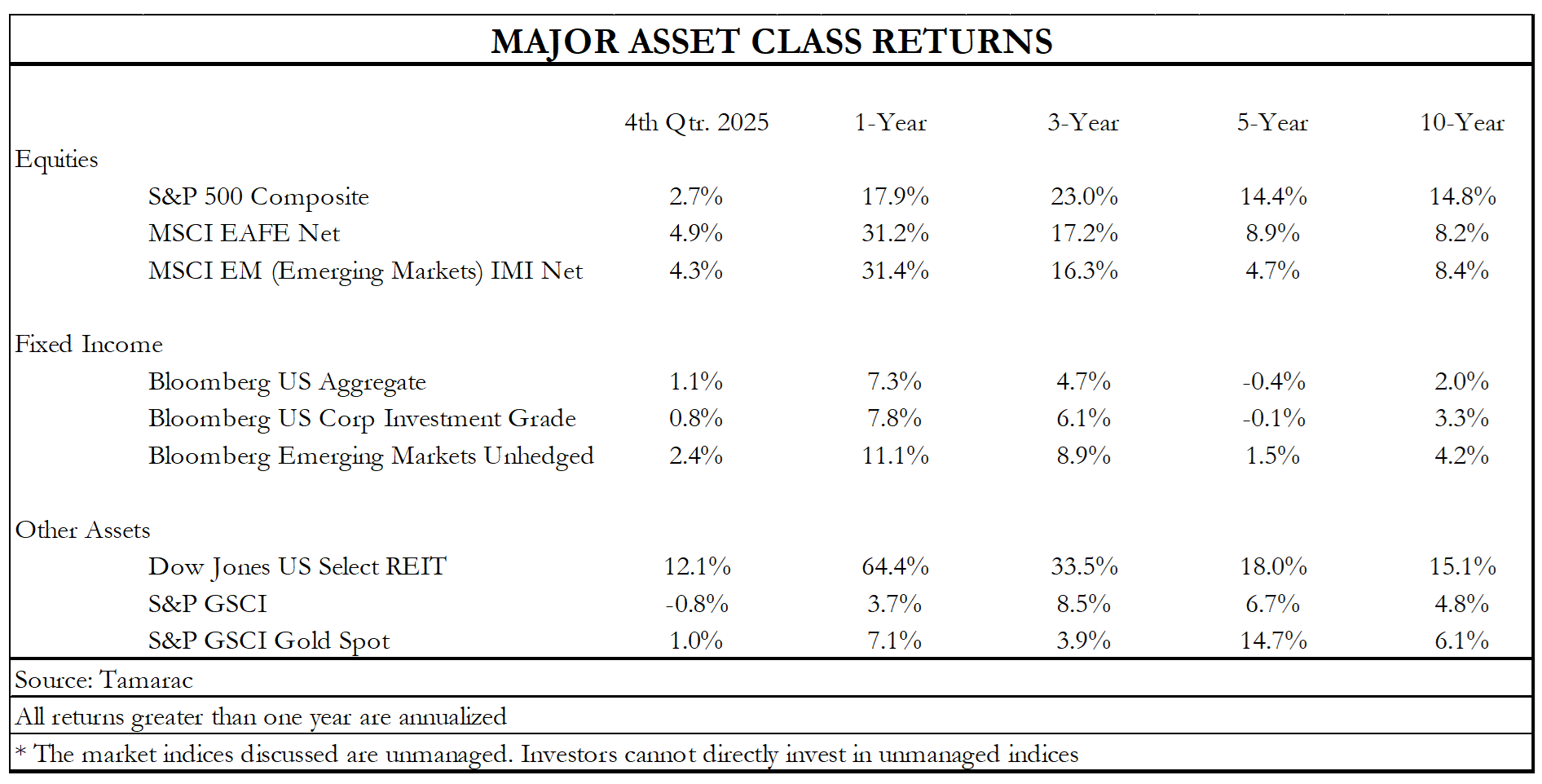

Equity markets continued their upward trajectory in the fourth quarter of 2025, though the pace of gains moderated compared to earlier in the year. The S&P 500 rose 2.7% in Q4, capping off a stellar year with an 18% total return, despite a sharp selloff in April and a volatile macro backdrop.

International equities outperformed U.S. stocks by one of the widest margins in recent memory. Developed markets, as measured by the MSCI EAFE, and emerging markets both posted gains exceeding 30% for the year. This outperformance was driven in part by a 9% decline in the U.S. dollar, which boosted returns for U.S. investors holding foreign assets.

Fixed income delivered positive returns as well. The Bloomberg U.S. Aggregate Bond Index returned 7.3% for the year. The fourth quarter saw modest returns, as yields ended the quarter essentially where they started. Investment grade bonds underperformed this quarter. Amidst a backdrop of strong economic growth and low defaults, the added yield for owning corporate bonds continues to be historically tight. Municipal bonds did well in the quarter and also had a strong 2025, with taxable-equivalent returns in the mid-single-digits range.

Economic Activity

The U.S. economy showed resilience in 2025, but signs of cooling emerged in Q4. For the just finished quarter, the Atlanta Fed’s GDPNow model projects a 5.1% increase. Consensus estimates point to a softer finish to the year with real GDP growth estimated at 1.0%, according to Bloomberg. The largest contributor to the diverging views is trade, with the GDPNow forecast showing a strong boost to growth due to sagging imports and growing exports. Government spending will likely contract in Q4, and consumer spending should remain positive but less robust.

The first half of 2026 should see some benefits from the One Big Beautiful Bill. According to the Congressional Budget Office, the impact on 2026 growth should be a 0.9% boost to GDP. Part of this is coming through tax changes, which are expected to result in bigger tax refunds this year. J.P. Morgan expects the average tax refund to climb from just over $3,000 per filer to close to $4,000.

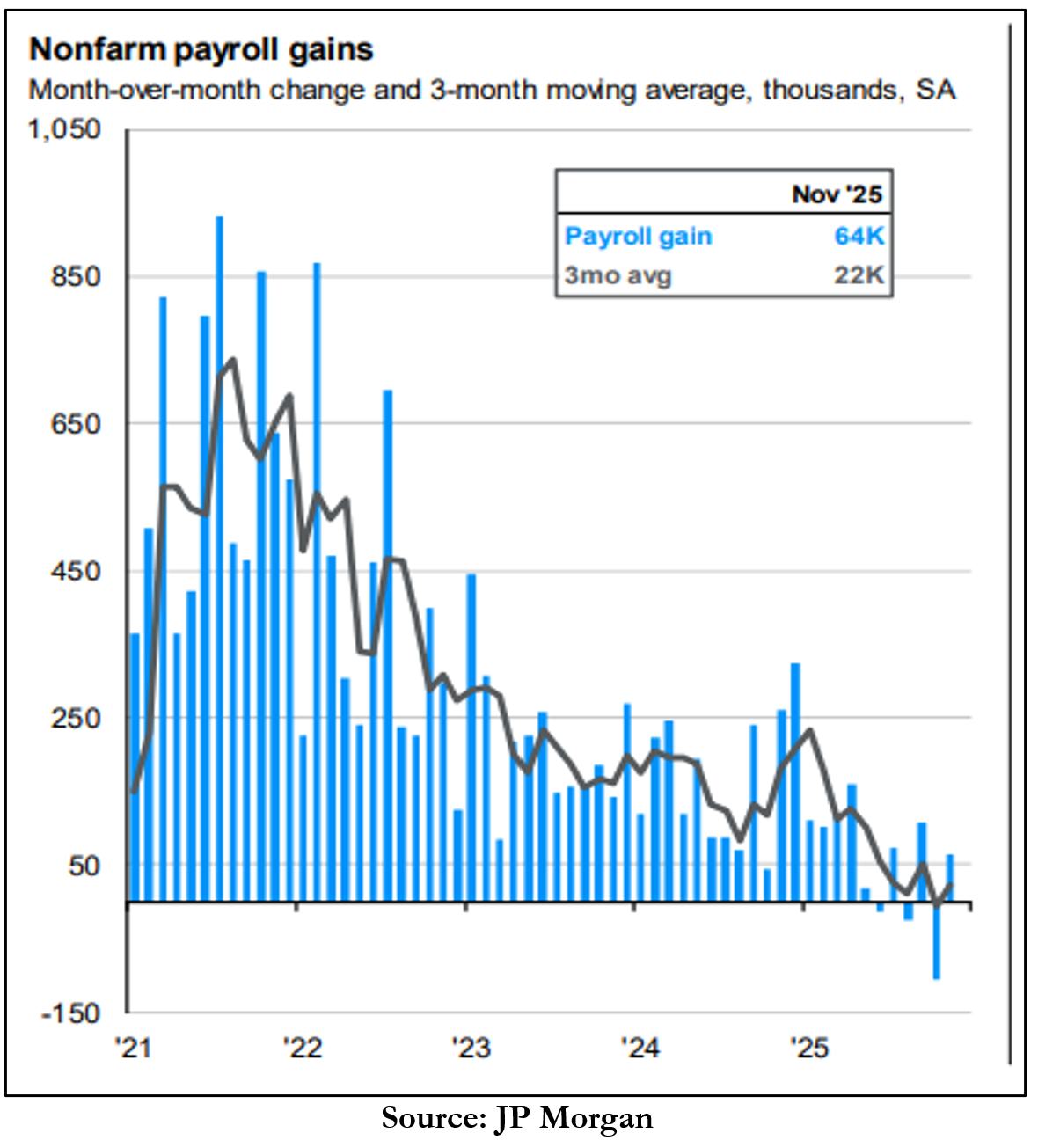

With the government shut down for close to ½ the quarter, economic data was sparse, and the data we did receive was viewed suspiciously. Nonetheless, the readouts on the labor market continue to cause concern. Through November, the 3-month average of monthly payroll growth was just 22,000.

The lack of immigration has helped keep the unemployment rate from soaring, so for now, supply is meeting demand. Looking at a broader measure like the employment-to-population ratio of 25-54 year olds, this statistic has been flat since early 2023.

One interesting aspect of hiring this year is how concentrated it’s been in just a few sectors. Healthcare, social assistance, leisure, and hospitality accounted for more than 100% of the job growth seen from May through September. Without these sectors, the economy would have shed 220,000 jobs. With the consumer still the dominant driver of the U.S. economy, trends in the labor market bear watching.

Monetary Policy

The Federal Reserve cut rates by 25 basis points at its December meeting, lowering the target range to 3.50%– 3.75%. Concerns of committee members were tilted towards a slowdown in the labor market. Nine of the 12 decision makers voted to reduce rates by 0.25% in December, two wanted to hold steady, and one, Stephen Miran, wanted to cut rates by 0.50%. This is the first time since 2019 that there were three or more dissents at a rate setting meeting. Fed Chair Jerome Powell poured cold water on the idea of additional cuts anytime soon, and the median projection of the Fed is for a funds rate of 3.4% at the end of 2026, just 0.25% lower than the level today.

Globally the central bank picture is very similar. The market is implying two cuts for both the U.S. Federal Reserve, and the Bank of England; no cuts for the Bank of Canada and the European Central Bank; while the only major central bank expected to be hiking rates in 2026 is the Bank of Japan, with one hike priced in.

Valuation and Sentiment

The S&P 500 appears set to grow earnings double digits this year, after posting a similar performance in 2024. Looking out at 2026 and 2027, analysts are penciling in more of the same. For reference, EPS growth averaged 7.3% from 2001 through 2024. Investors are rewarding these above average fundamentals with a commensurately high P/E multiple. Any disappointment on the earnings front could lead to a resetting of valuations.

Sentiment, as measured by multiple surveys and judged by market activity, appears to be fairly balanced. On average, artificial intelligence associated equities have been treading water relative to the S&P 500 since October. Bitcoin, which we view as the purest gauge of speculative behavior, is well off its high, though it appears to have stabilized around $90,000.

The Investment Outlook

Despite a turbulent start, 2025 turned out to be a momentous year for returns from every asset class. As we turn the calendar, how key themes develop will determine the path from here.

Summary

We see the risks to economy and equity fundamentals as balanced. While we do not see a need to position portfolios more conservatively, we are increasingly and gradually tilting in a defensive direction. Equity valuations are high, yet they have been well supported by above average economic and profit growth.

In the area of fixed income, the compensation for providing credit is low and the returns earned for taking above average risk are unappealing today. While asset classes are priced on expectations for a continuation of the positive environment we have been enjoying post pandemic, we stand ready to move in either direction, if one of the themes outlined above presents opportunities or undue risks.

Major Retirement Rule Changes in 2026: What Savers Need to Know

New this year, a series of significant changes to retirement planning, savings limits, and tax rules will affect millions of retired (or retiring) Americans. These adjustments—driven by cost-of-living adjustments (COLAs), IRS inflation indexing, and provisions of the SECURE 2.0 Act—offer new opportunities to save more but also introduce complexities that require proactive planning.

Higher Contribution Limits

One of the most impactful updates for retirement savers in 2026 is the increase in contribution limits to key tax-advantaged retirement accounts. The IRS has boosted the annual 401(k), 403(b), and most 457(b) plan contribution limit to $24,500, up $1,000 from 2025. Traditional and Roth IRA contribution limits are also expanding—for 2026, the maximum amount individuals under age 50 can contribute to IRAs rises to $7,500. Those aged 50 and over get an increased catch-up contribution limit of $1,100.

Enhanced Catch-Up Savings for Older Workers

The SECURE 2.0 Act continues to refine retirement incentives for older workers. For those aged 50 and older, the “catch-up” contribution for 401(k), 403(b), and similar plans increases to $8,000 in 2026 (from $7,500). Workers aged 60–63 benefit from a higher “super catch-up” amount of $11,250—unchanged from 2025. However, the most consequential tax change involves how catch-up contributions are treated for high earners.

Starting in 2026, if an employee’s prior year earnings exceed a threshold ($150,000), all catch-up contributions must be made to Roth (after-tax) accounts. This alters the tax profile of contributions: instead of reducing taxable income today, the contributions grow tax-free and are withdrawn tax-free in retirement. This rule only affects the catch-up portion, not regular 401(k) deferrals. However, for savers without a Roth option in their employer plan, this change may restrict their ability to make any catch-up contributions, at least until plan terms are amended.

Broader Retirement Policy Adjustments

Beyond savings limits, broader economic and policy shifts will shape retirement outcomes in 2026. Social Security beneficiaries will receive a modest cost-of-living adjustment of 2.8%, but the base rate for Medicare Part B premiums will increase by close to 10%. Other changes include:

- Higher standard deductions

- An additional $6,000 deduction for people over age 65 with a modified adjusted gross income of up to $75,000 for individuals and $150,000 for joint filers. This phases out for incomes above $175,000 for individuals and $250,000 for joint filers

- Higher ceiling for qualified charitable deductions to $111,000 from IRAs

For most Americans, 2026 brings valuable opportunities to save more for retirement due to higher limits and expanded catch-up options. Please view us as your financial resource and, as always, please contact us if we may be of assistance in any manner.

DISCLOSURES – This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third party sources and is believed to be dependable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment advice and does not give investment recommendations. Any opinion included in this report constitutes the judgment of Lincoln Capital Corporation as of the date of this report and are subject to change without notice. Additional information, including management fees and expenses, is provided on Lincoln Capital Corporation’s Form ADV Part 2. As with any investment strategy, there is potential for profit as well as the possibility of loss. Lincoln Capital Corporation does not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk (the amount of which may vary significantly) and investment recommendations will not always be profitable. The investment return and principal value of an investment will fluctuate so that an investor’s portfolio may be worth more or less than its original cost at any given time. The underlying holdings of any presented portfolio are not federally or FDIC-insured and are not deposits or obligations of, or guaranteed by, any financial institution. Past performance is not a guarantee of future results. Lincoln Capital Corporation prepare presentation, 401.454.3040, www.lincolncapitalcorp.com Copyright © 2026, by Lincoln Capital Corporation.