June Changes

There were no changes to the portfolios in June following our last update.

Summary of Month’s Action

U.S. equities posted strong gains in June, with the S&P 500 rising 5.2% for the month. This brings the total return for the second quarter to 10.8%. Top-performing sectors in June were Information Technology, Communication Services, and Energy, while Consumer Staples, Real Estate, and Utilities underperformed.

Resilience in the Face of Geopolitical Risk

The strength of the market in June is particularly notable given the escalation of tensions in the Middle East. In a surprising development, the U.S. launched attacks on Iranian nuclear facilities. Under normal circumstances, such an event might be expected to trigger market volatility or a downturn.

However, Iran—already weakened by last year’s Israeli strikes and lacking support from regional allies—opted for a limited and largely symbolic response. It appears they sought the least disruptive off-ramp possible while preserving some political posture.

Shifting Rate Expectations and the Fed’s Future

Meanwhile, the Trump administration’s tariffs have yet to show up in inflation data. Combined with the decreased likelihood of a spike in crude oil prices due to the Iran situation, markets have begun to price in additional Federal Reserve rate cuts for the remainder of 2025.

Another factor influencing rate expectations is speculation that President Trump may name a successor to Jerome Powell well before his term ends in May 2026. An early announcement of a “shadow chair” could shift sentiment toward looser monetary policy, especially if the appointee openly advocates for lower rates and contrasts with Powell’s current messaging.

These developments—the potential for further rate cuts, contained geopolitical risks, and steady economic and employment data—provided ample reason for the S&P 500 to continue its rebound in June.

Key Contributors and Detractors

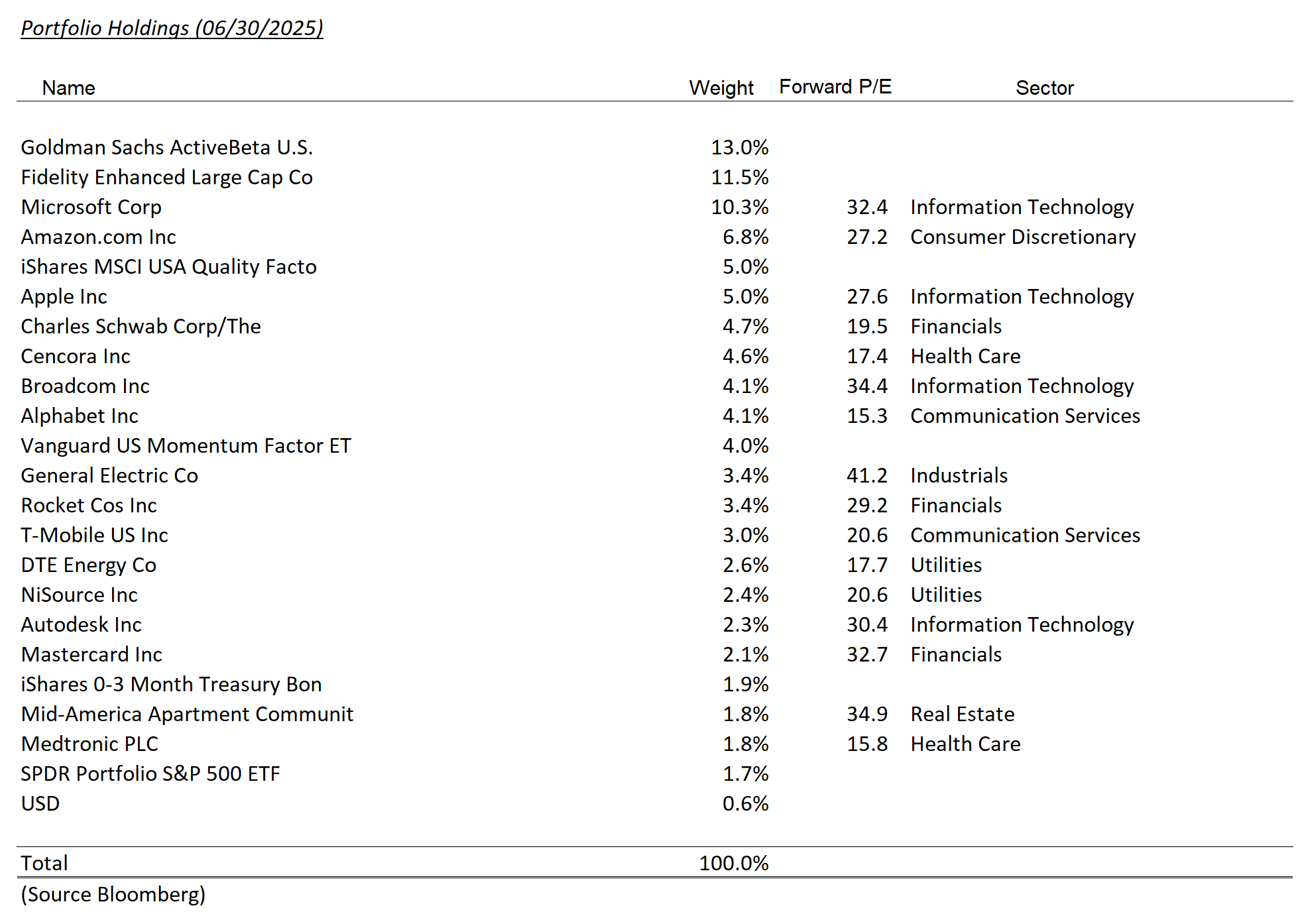

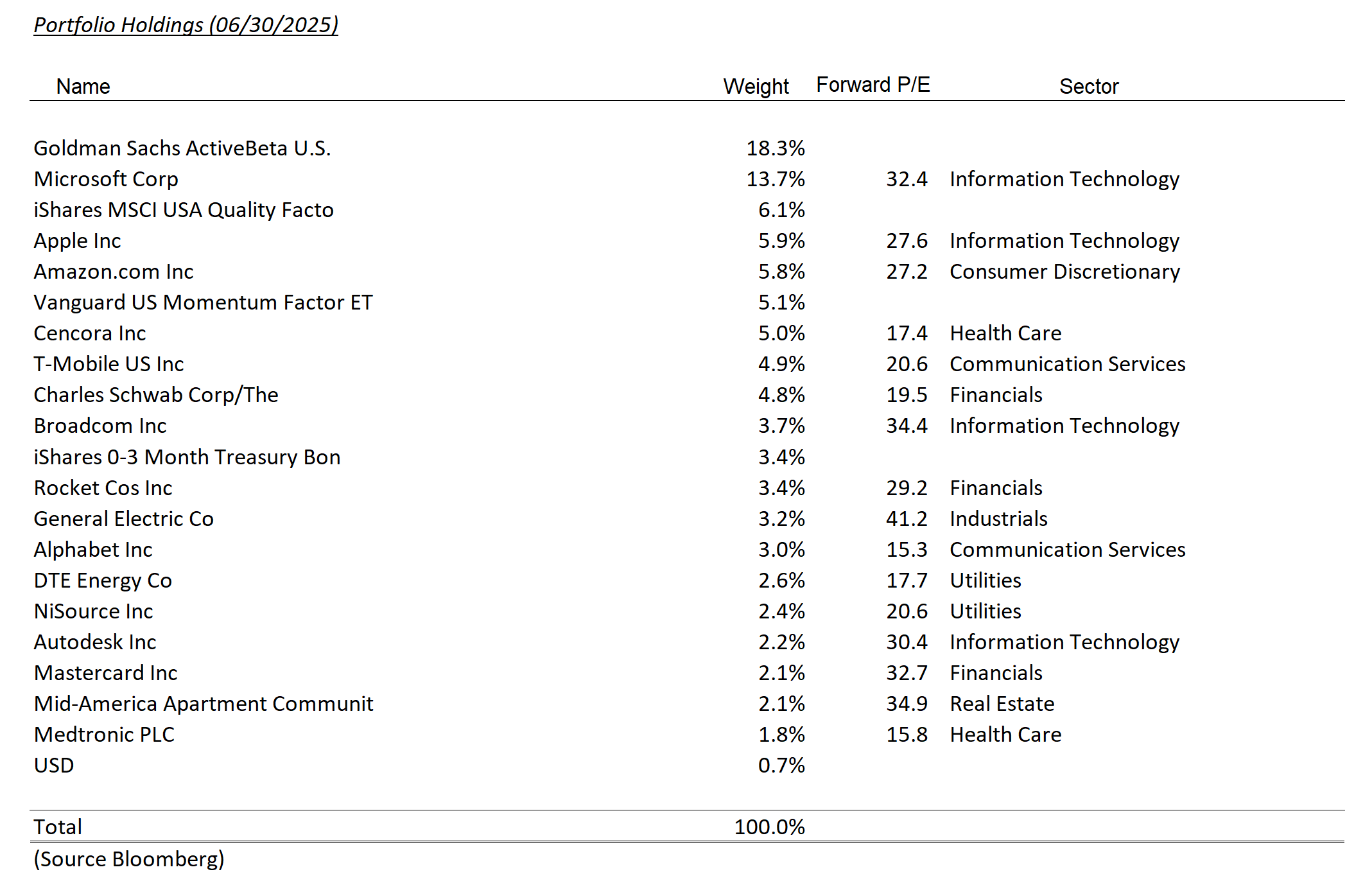

The largest contributors to relative performance this month were Microsoft, Rocket Companies, and Amazon. Meanwhile, Mastercard and Mid-America Apartments were the most significant detractors.

Mastercard and the Rise of Stablecoins

Of the names mentioned, Mastercard saw the most noteworthy developments during the month. Stablecoins, which are cryptocurrencies pegged to fiat currencies like the U.S. dollar, gained momentum following the Senate’s passage of the GENIUS bill, which lays the groundwork for a regulatory framework in this space.

Further attention was drawn to the sector after Circle, the issuer of USDC, went public with strong investor enthusiasm. These developments raised concerns that stablecoins could disintermediate traditional payment networks like Mastercard.

Despite these fears, we remain confident in Mastercard’s ability to adapt and thrive in a stablecoin-enabled environment. The company is already taking proactive steps—allowing crypto holders to spend stablecoins at Mastercard merchants, offering settlement options in stablecoins, and supporting cross-border applications.

While areas like remittances and cross border transactions may face disruption, we view retail card payments as more insulated, thanks largely to consumers’ strong preference for rewards programs—a key feature funded by merchants and enabled by card networks.

*All figures sourced from Bloomberg. Please note that due to rounding differences, certain data presented may not sum to 100%.

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Past performance is not a guarantee of future results. Please note that due to rounding differences, certain data presented may not sum to 100%.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.