February Changes

There were no changes to the portfolios in February following our last update.

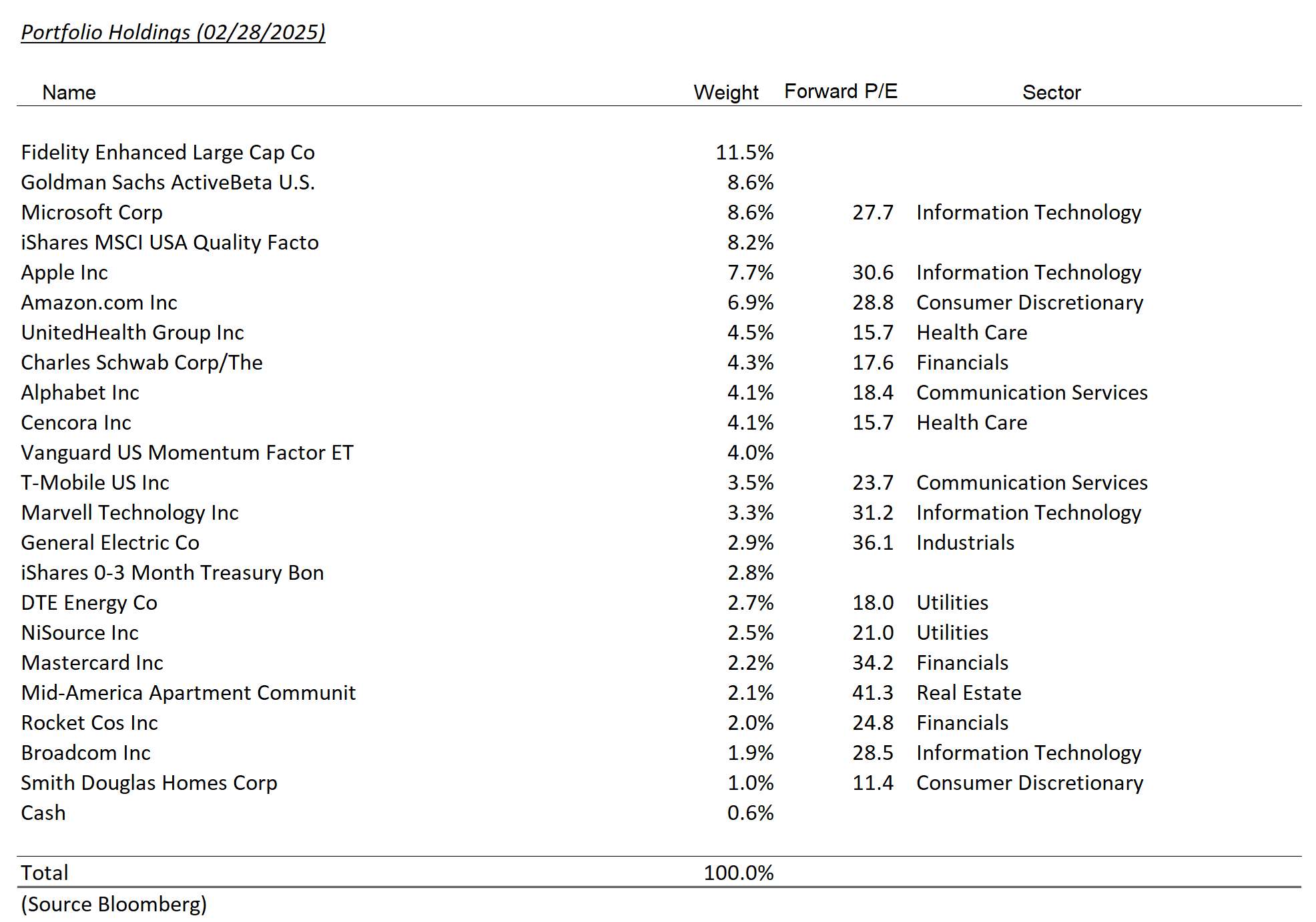

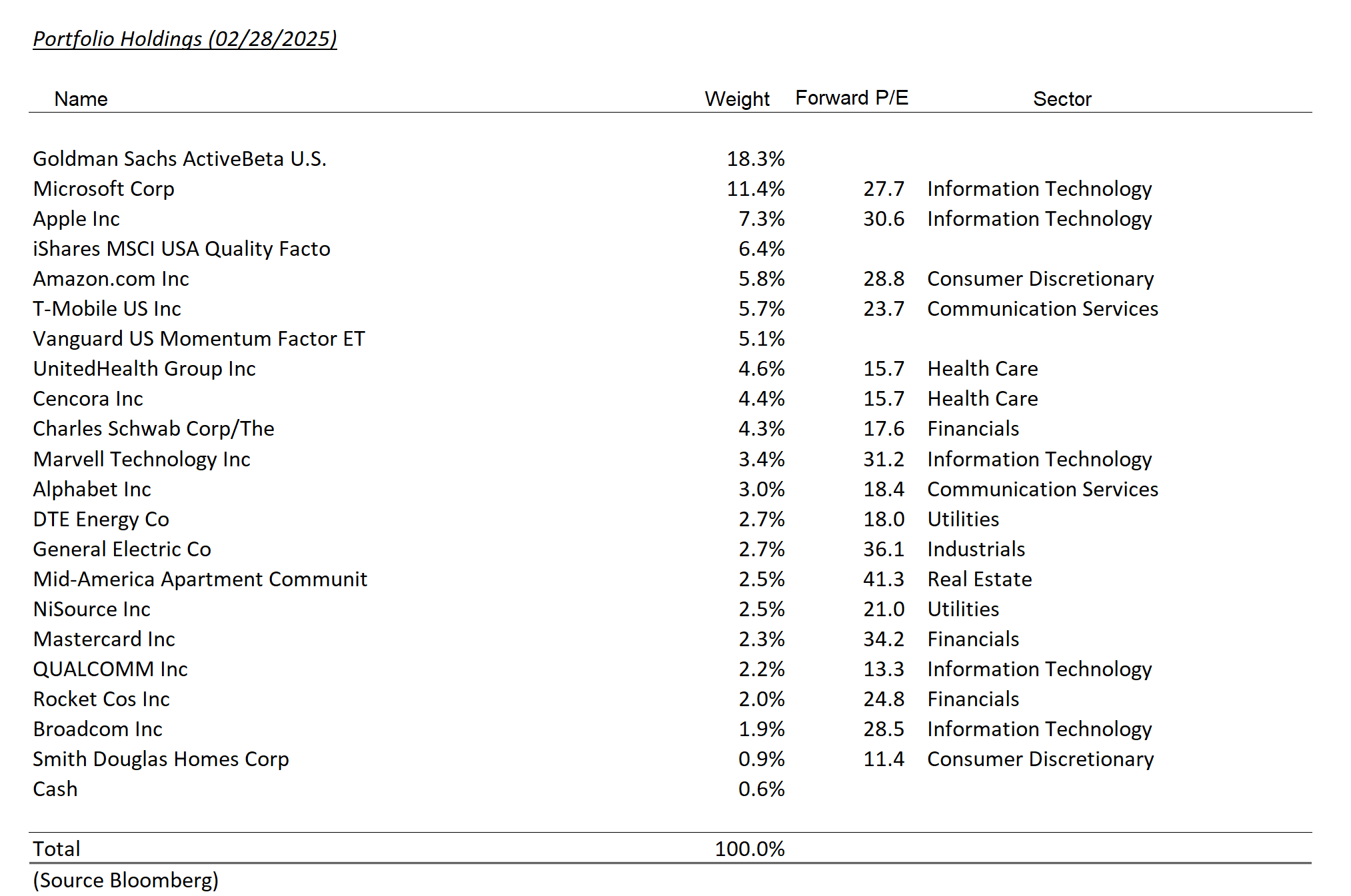

However, in March, we made a slight addition to our position in Broadcom (AVGO).

February Market Performance

The market experienced turbulence in mid-February due to signs of economic weakness. Recent data has been softer than expected, and the Citi Economic Surprise Index has turned firmly negative. Some of this decline may be attributed to seasonality and adverse weather, but it remains a trend worth monitoring. Given the U.S. economy’s reliance on consumer spending, we believe the labor market holds the key, and upcoming jobs reports will provide critical signals for the market’s direction.

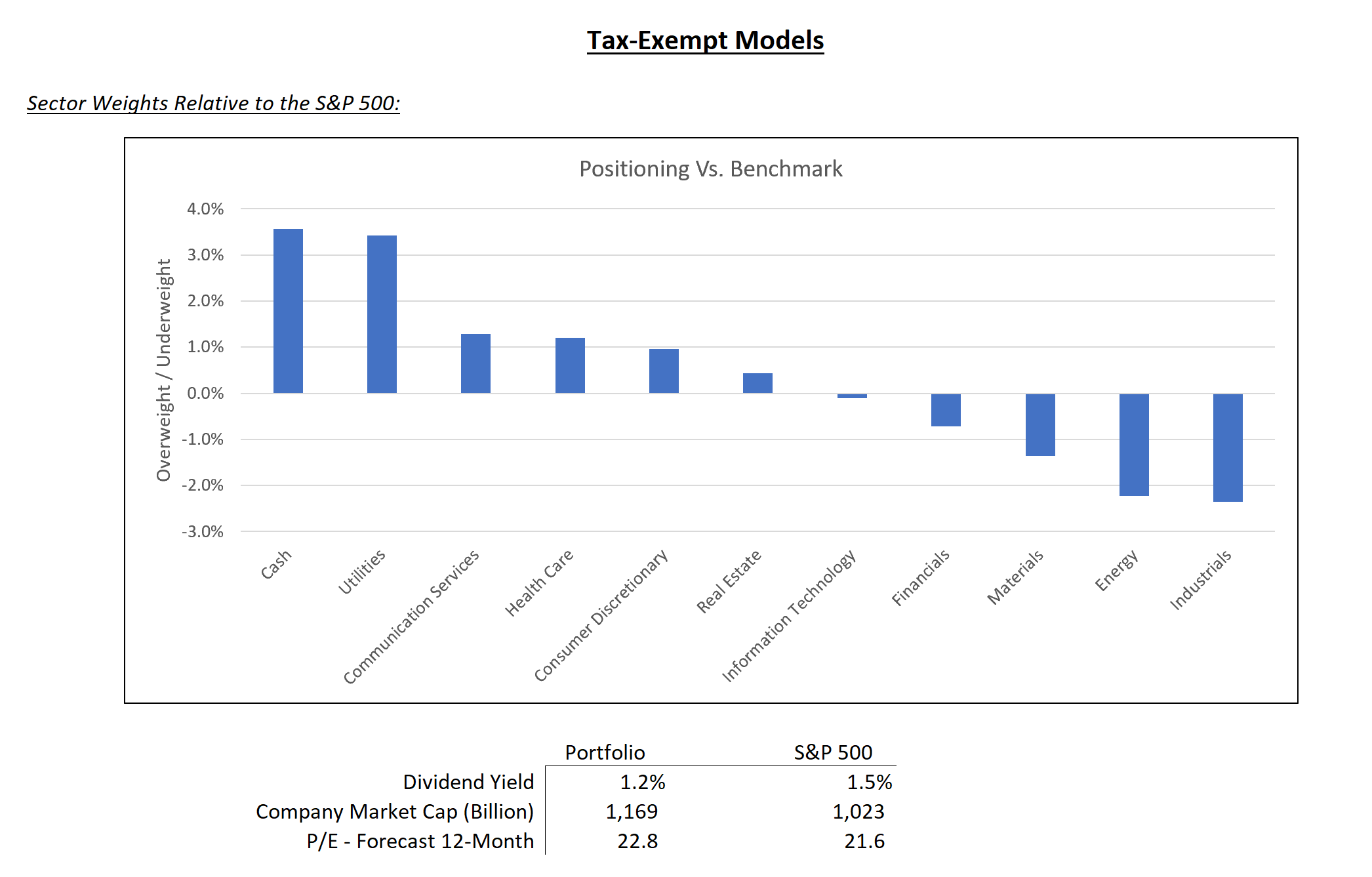

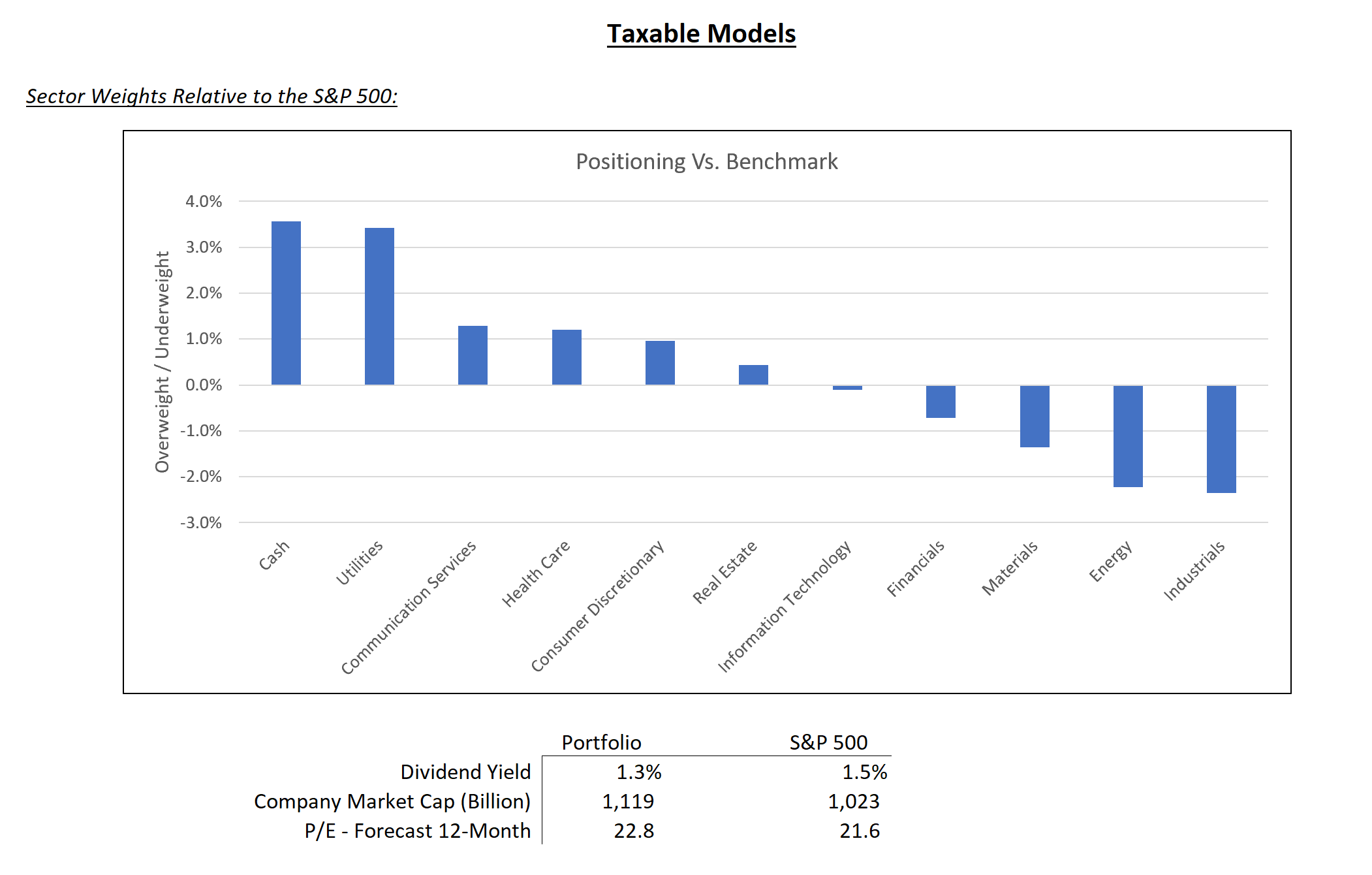

The S&P 500 declined 1.3% last month, and as of this writing, it has turned negative for the year. Defensive sectors led the market, with Consumer Staples, Real Estate, Utilities, and Health Care outperforming. The biggest laggard was Consumer Discretionary, which fell 9.4%, weighed down by Tesla (-27.6%) and Amazon (-10.7%), which together represent 55% of the sector.

Portfolio Highlights and Laggards

Our decision not to own Tesla was the largest contributor to relative outperformance in February. Additionally, T-Mobile, DTE Energy, and NiSource all delivered double-digit gains, contributing positively to portfolio performance. On the downside, Marvell Technology, UnitedHealth, and Amazon were the biggest detractors.

Security Specific Comments:

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Past performance is not a guarantee of future results. Please note that due to rounding differences, certain data presented may not sum to 100%.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.