November Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| GE | 2.4% | |||

| RKT | 2.0% | |||

| TXT | 2.4% |

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| RKT | 2.0% |

Summary of Month’s Action

The S&P 500 had a strong performance in November, gaining 5.9% for the month. Leading the charge were Consumer Discretionary, Financials, and Industrials, while sectors like Health Care, Materials, and Communication Services lagged behind. All data sourced from Bloomberg. (Source: Bloomberg)

Lincoln Capital’s holdings experienced few notable changes in November. Schwab stood out as a top contributor once again, building on its October performance with an impressive 17.3% gain. This marked the second consecutive month of strong growth in client cash balances, which have increased by $24.2 billion since the end of August—a robust 8% rise. While this series can be volatile and the current pace may not be sustainable, we are encouraged by the progress achieved so far.

Added General Electric (GE): Aerospace Business Poised for Long-Term Growth

GE has undergone a significant transformation in recent years. Following the spin-off of its Power business (GE Vernova) in 2024 and its healthcare business (GE Healthcare) in 2022, the company is now focused on GE Aerospace, a leading supplier of airplane engines.

In the short term, GE Aerospace benefits from reduced airplane retirements due to supply chain challenges at Boeing and Airbus. Fewer retirements mean more high-margin shop visits for the older CFM56 engines. Looking further ahead, the investment case centers on the LEAP engine, GE’s latest innovation. Currently, 19,000 CFM56 engines are in service, and Goldman Sachs estimates this will grow to 50,000 by 2040, driven by the addition of LEAP engines. This growth is supported by GE’s market share gains and an increase in original equipment manufacturer (OEM) deliveries.

Servicing revenues are also poised for robust growth, with peak LEAP service sales projected to triple the levels seen with CFM56 engines. With strong OEM delivery growth, competitive market share gains, and expanding aftermarket sales, GE Aerospace is well-positioned for sustained success. We added shares at what we believe to be a reasonable valuation for such a high-quality business.

Added Rocket Companies (RKT): Positioned for Long-Term Mortgage Market Leadership

Formerly known as Quicken Loans, Rocket is a leading mortgage provider in the United States, originating $73.4 billion in mortgages year-to-date. The company’s primary revenue drivers are fees from mortgage origination and servicing, complemented by smaller segments such as Rocket Homes, Rocket Money, Rocket Loans, and Amrock, which offers title insurance, valuation, and settlement services.

Rocket’s business is heavily reliant on refinance volumes, where it commands a market share of over 12%, compared to just 3.7% in the purchase market as of 2023. Following the refinance boom of 2020–2021, Rocket experienced a significant 70% decline in revenue from its peak. Despite this, the company has maintained profitability through targeted cost-cutting and productivity improvements. Rocket’s strong position has also allowed it to retain capacity—management reports the current structure can support $150 billion in originations—while many competitors have retrenched. In contrast, industry capacity has declined by approximately 35% during this downturn.

Although the refinance market remains under pressure due to high interest rates, it is expected to normalize over time as the market rebalances. Rocket’s continued reinvestment and focus on gaining market share in a fragmented industry (where the top 10 players hold just 24% of the market) position it well for long-term success. We added shares of this secular winner at what we believe is an attractive valuation.

Reallocated Textron Shares: Positioned for Strategic Growth with GE

In our tax-exempt accounts, we sold our entire position in Textron to create room for GE. While the business jet segment experienced disruption from a recently resolved strike, we expect it to resume its growth trajectory next year. However, other segments face challenges. Specialized vehicles, including Arctic Cat, E-Z-Go golf carts, and other application-specific vehicles, have come under pressure, with high interest rates and cautious consumer spending expected to weigh on performance. Additionally, Kautex, a key supplier of fuel tanks to the automotive market, remains sluggish.

Given these mixed fundamental trends, we believe reallocating capital to other opportunities is a better strategic choice. As noted in recent updates, we plan to make similar adjustments in taxable accounts in 2025 to optimize tax outcomes for 2024.

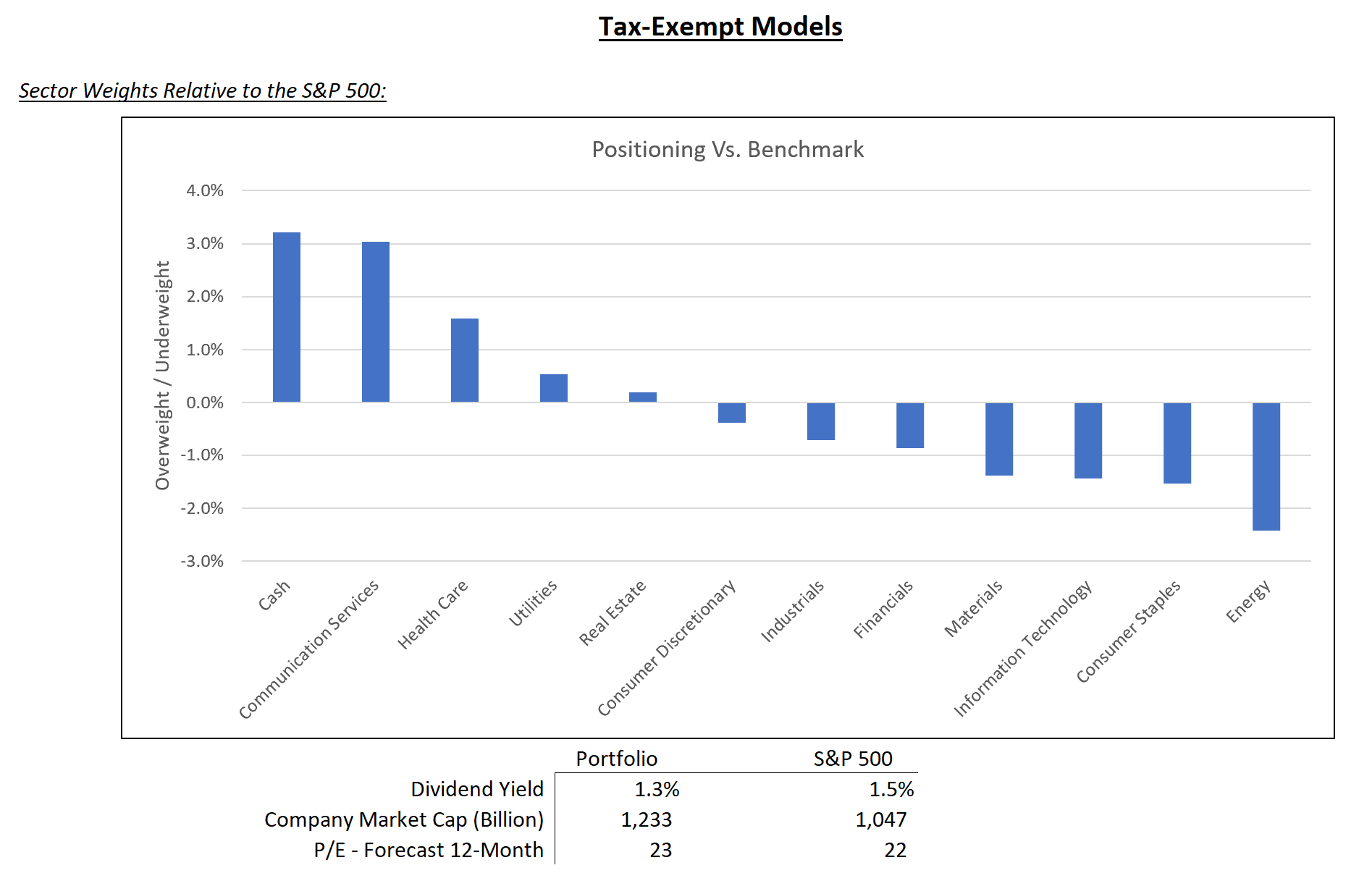

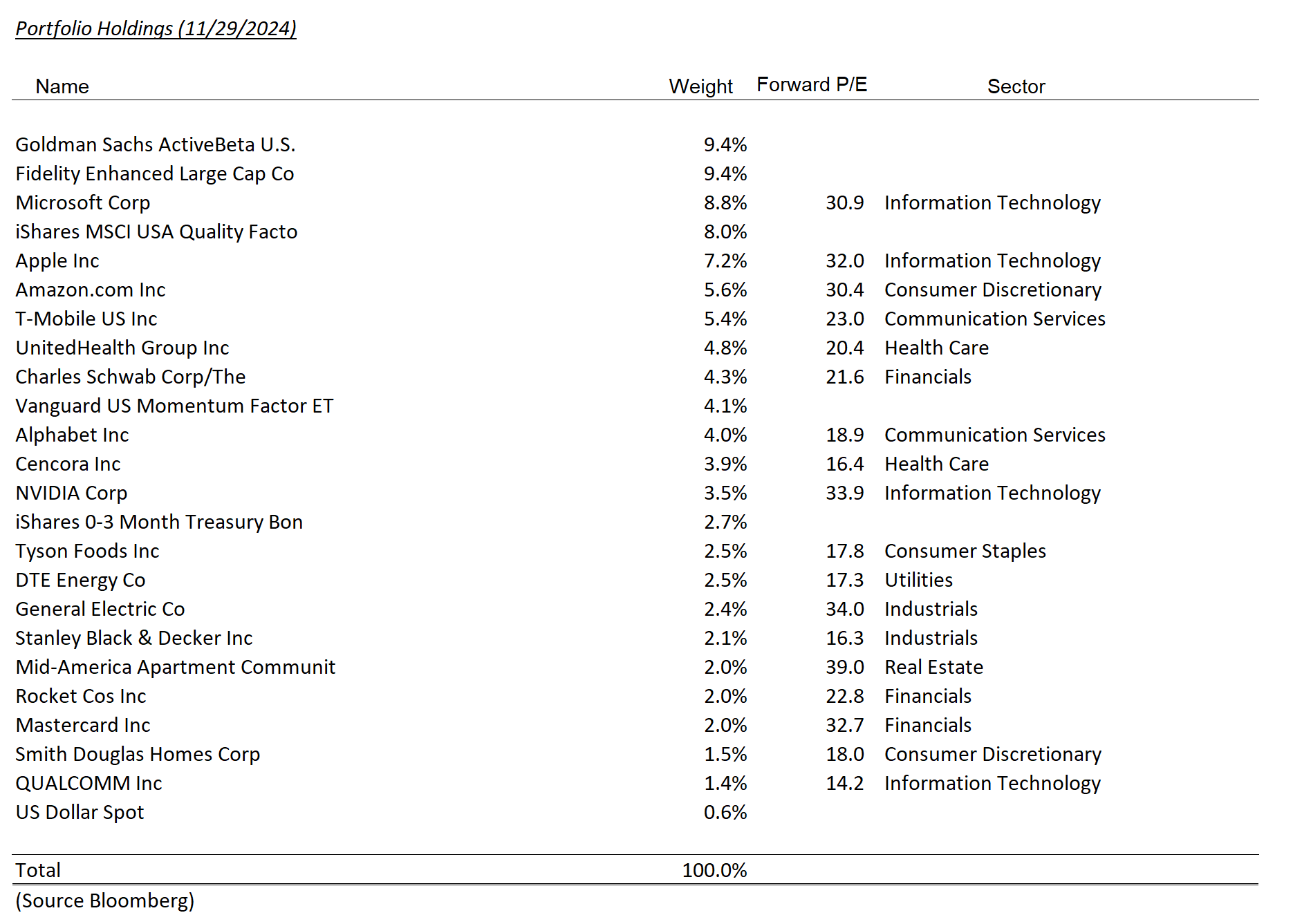

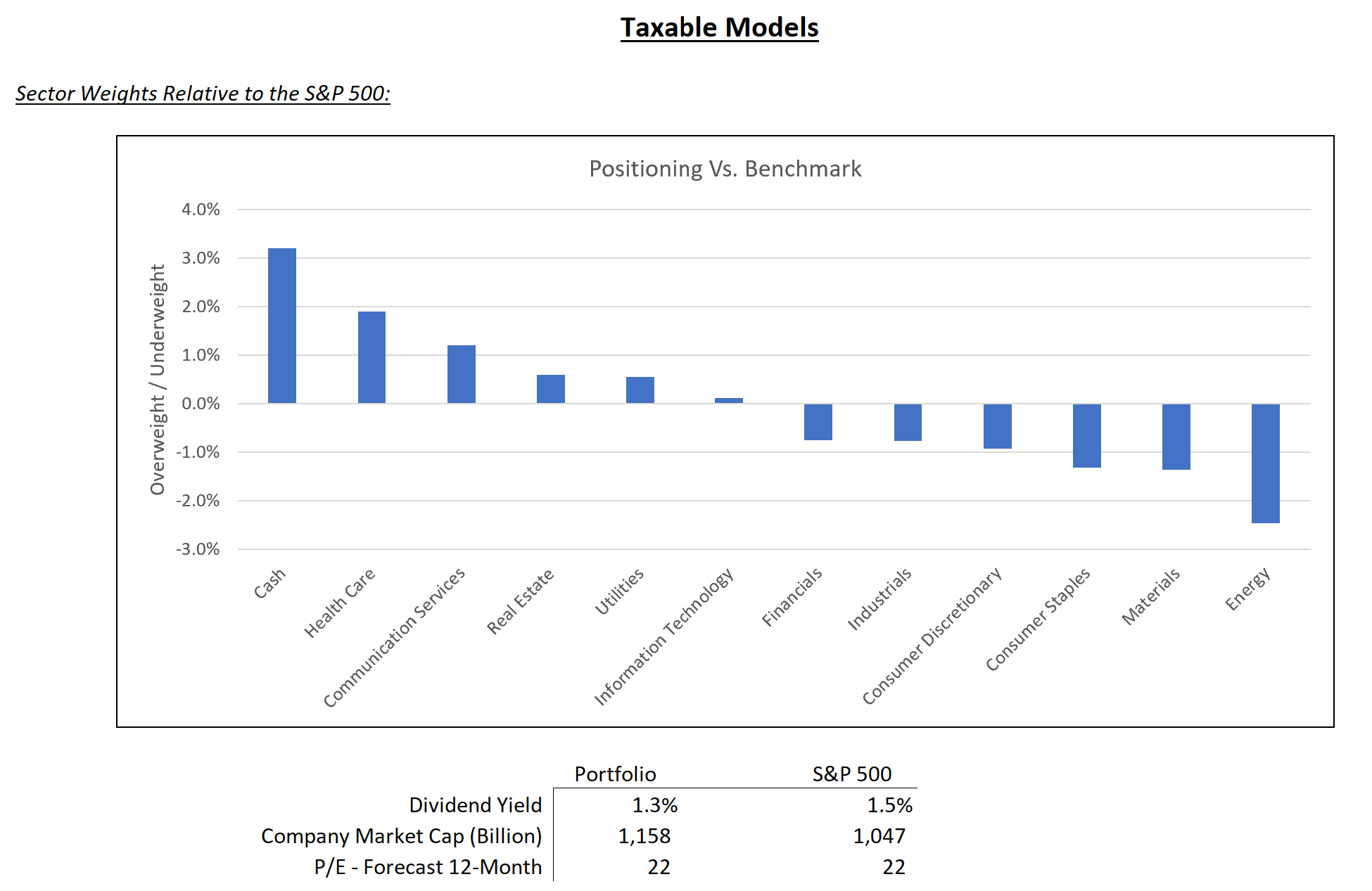

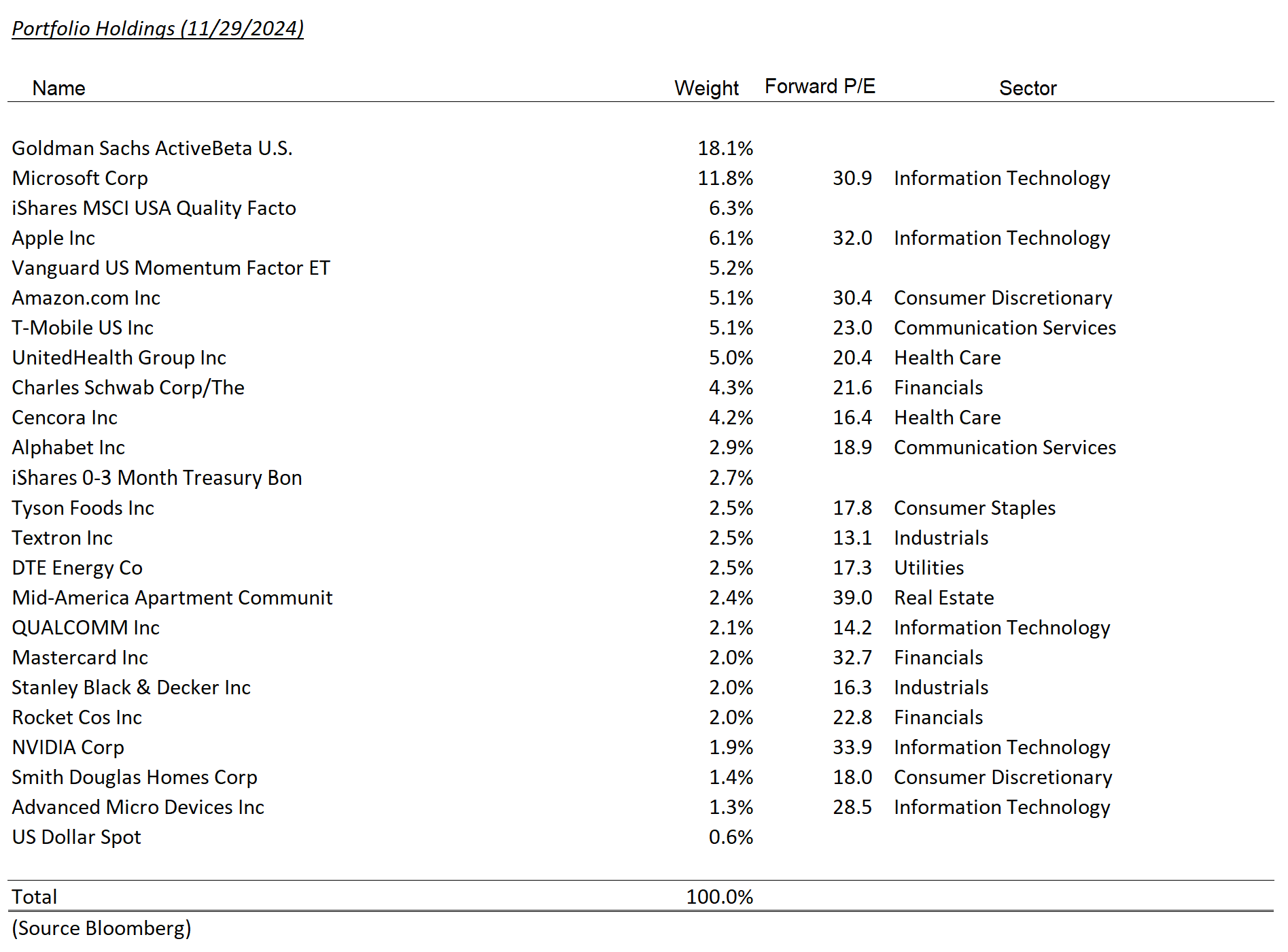

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Past performance is not a guarantee of future results. Please note that due to rounding differences, certain data presented may not sum to 100%.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.