February Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| QCOM | 1.6% |

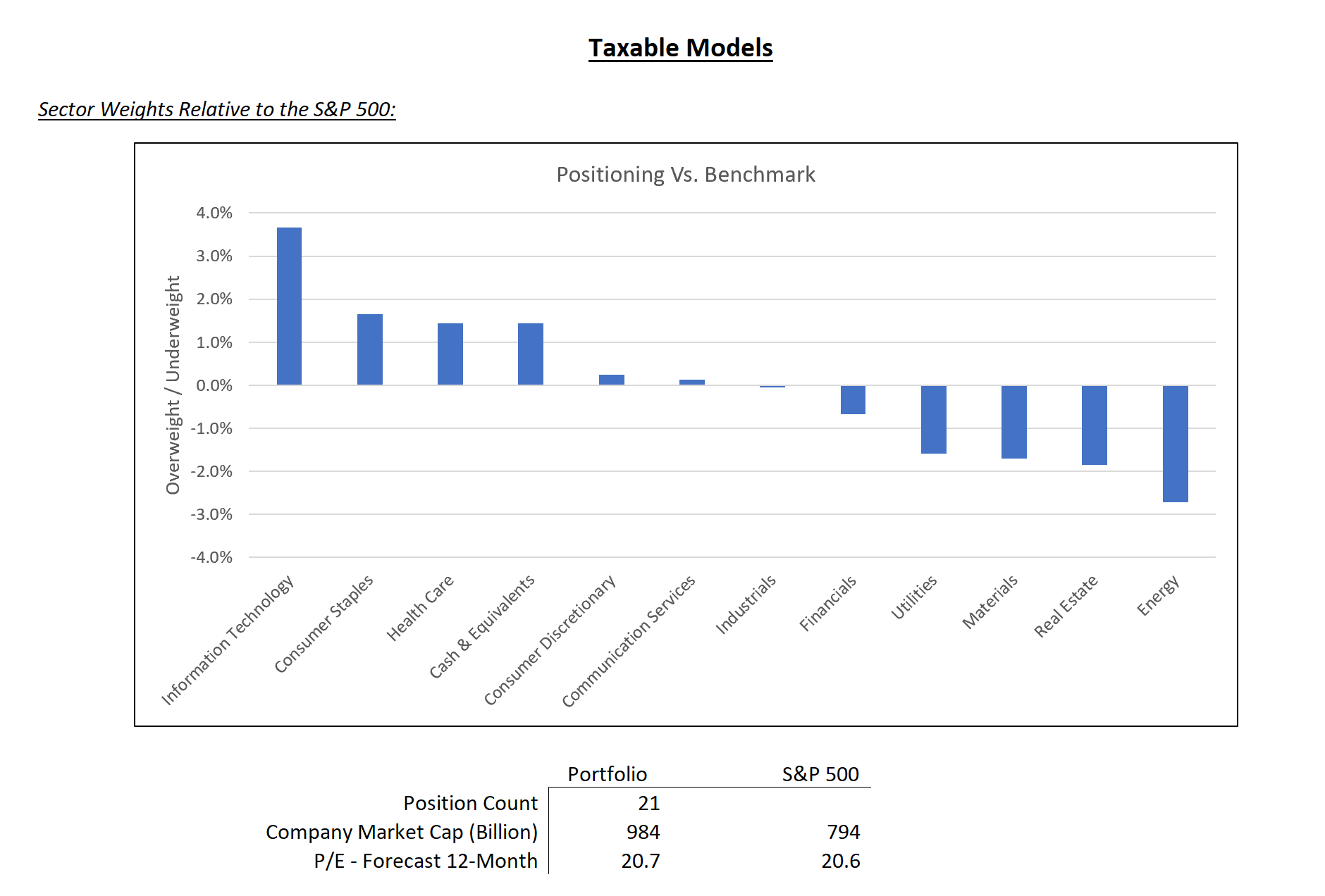

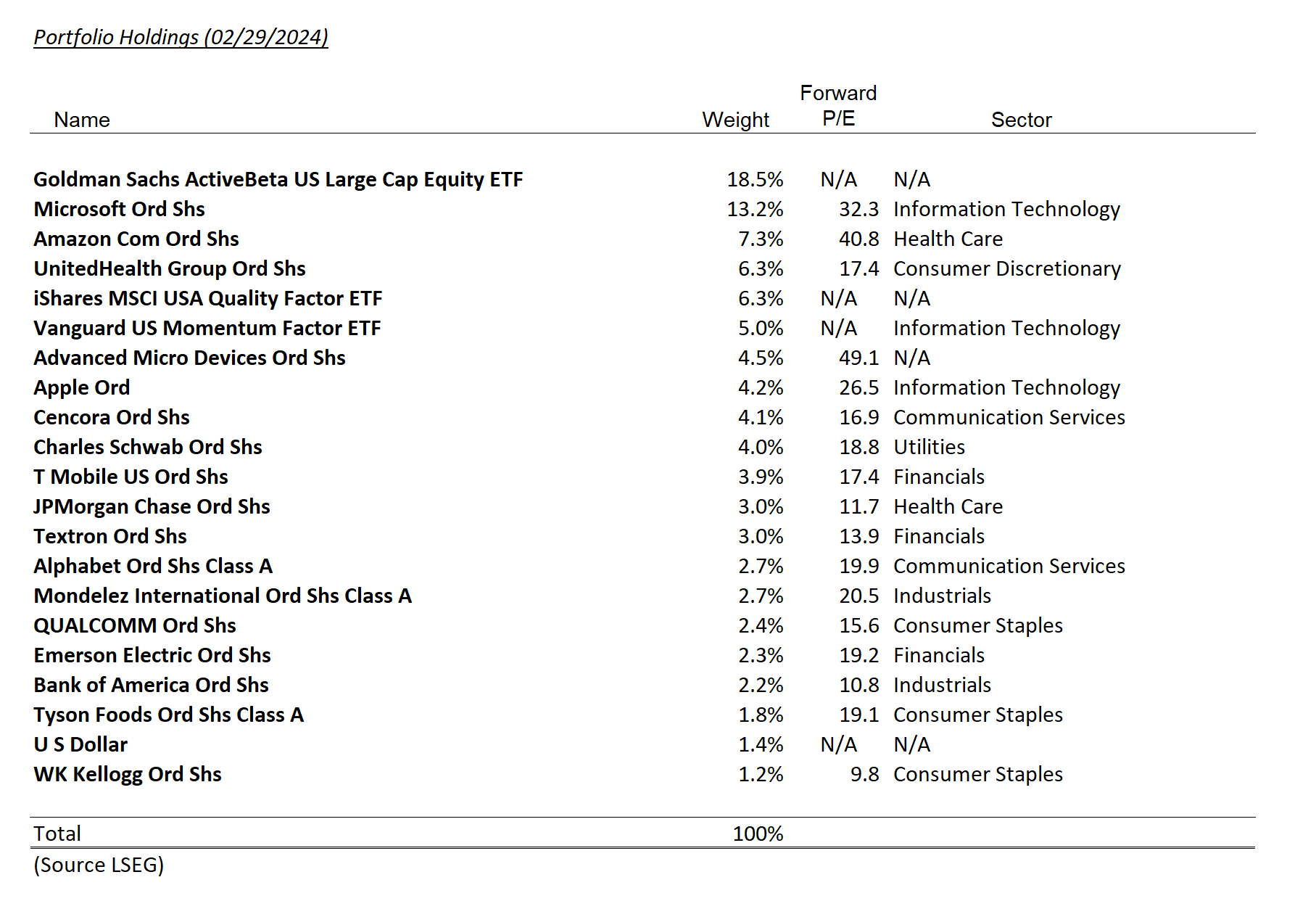

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| QCOM | 1.5% |

Summary of Month’s Action:

The S&P 500 gained 5.3% in February, with particular strength seen in the Consumer Discretionary, Industrials and Materials sectors. Conversely, sector laggards were Utilities, Consumer Staples and Real Estate (according to Koyfin).

The strength of the market was notable as Fed Funds expectations ratcheted higher. Year-end 2024 Fed Funds expectations entered February at 4.0% and went as high as 4.75% during the month (per LSEG).

Trade Completed for QUALCOMM Incorporated – (QCOM)

We added to Qualcomm during the month. We started buying this position before earnings in late January and completed the trade in February. The following is what we shared last month, which still holds:

The company has changed a lot in recent years, with intellectual property licensing now representing a much smaller portion of the business. Automotive and internet of things – a category that includes wi-fi, 5G, virtual and augmented reality, and industrial applications – have grown to be increasingly important at QCOM. However, between the licensing business and Snapdragon chipsets, QCOM is still primarily a smartphone company.

QCOM fundamentals should improve in 2024, as the smartphone industry returns to underlying growth and exits a period of inventory correction. The stock should do well with this fundamental backdrop and an undemanding valuation of 14x 2024 EPS. Snapdragon has a strong position if on-device generative AI takes off (see recent Samsung S24 Ultra), while QCOM will soon ship its first iteration of a central processing unit for Windows PCs, which is a large and lucrative market.

One functional example of Qualcomm’s on-device generative AI.

Recent Troubles at UnitedHealth Group Incorporated – (UNH)

UNH had a difficult month and declined 3.5%, a slide that continued into March. On the heels of Humana’s scary outlook for elevated medical costs in 2024, UNH shares were hit hard on the revelations of a potential antitrust probe into its business. Separately, a cybersecurity breach at recently acquired Change Healthcare is sending ripples through the industry.

The antitrust inquiry seems to be relatively early with regulators looking at Optum (UNH’s provider business) and UnitedHealth (the insurer) business dealings with one another and with other ecosystem participants. The more concerning aspect of the report was scrutiny of UNH’s ability to skirt medical loss ratio rules. This is a key aspect of the bull case—the insurer is capped on how much profit they can earn per premium dollar; however, moving risk to the providers (Optum) allows for more margin.

For clarity, instead of paying a fee for each service, Optum doctor and physician groups charge insurers a fee per member per month while being on the hook to provide the necessary health services to keep that patient population healthy. The aim is that there is more preventative care and more emphasis on the most complex patients lowering the costs for keeping the entire patient group healthy. Early results have shown promise. The end result is the insurer collecting $100 in premium, paying Optum $85, and then Optum does its best to lower costs while improving quality. Importantly, Optum doesn’t just work with UnitedHealth, they also have the same arrangement with third-party insurers.

It is somewhat ironic that the Centers for Medicare and Medicaid services are pushing providers away from fee-for-service to risk-based care, while another arm of the government looks into this practice as being anti-competitive. We will be watching developments here closely and will adjust our position accordingly.

An Optum Health provider checks the breathing of a patient

Weighing a Future Purchase of Nvidia – (NVDA)

Nvidia has been the topic du jour, really since last year. Presently, the focus has intensified given its continued move higher. Lincoln Capital clients have been participating in the AI trend with our holdings of AMD. In fact, AMD has outperformed NVDA over the last six months. Nevertheless, while progress is being made to close the NVDA advantage, it is still our opinion that AMD is winning in AI only due to supply constraints at NVDA. AMD claims their chips are more performant in inferencing (i.e. prompts sent to the model versus training), but whether they play a larger role here is to be determined.

We agree with the market that AI will continue to proliferate. Its use will likely grow each year for the foreseeable future. However, semiconductors are inherently cyclical and trying to find the appropriate baseline for “graphics processing unit” (GPU) demand has been challenging. Will there be a cycle in GPUs? The probability is very high. Will it be in 2024 or 2025? We have not found concrete evidence to answer this question.

Approximately 50% of NVDA’s sales are to cloud providers, which are an inherently cyclical bunch. Goldman Sachs estimates cloud capex declined 6% in 2023 after growing 24% the year prior. Foundry capacity, cloud spending expectations, and channel inventory all add complexity to the ecosystem. We would not be surprised if there is over-ordering going on today as customers don’t want to wait until they need GPUs to get in the queue. There are already indications that lead times for H100s (NVDA’s top chip) are falling back to historical levels.

In summary, NVDA’s software advantage appears insurmountable, and there will be more demand for AI longer-term—where baseline demand is today versus a cyclical surge is the key question (it is also possible we are still below baseline). Competitive responses from AMD, Intel, and custom application specific chips at NVDA customers are all evolving. We will continue to assess these questions. While not owned today, it would not surprise us if NVDA pops into client portfolios at a later date.

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.