December Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| TXT | 1.3% |

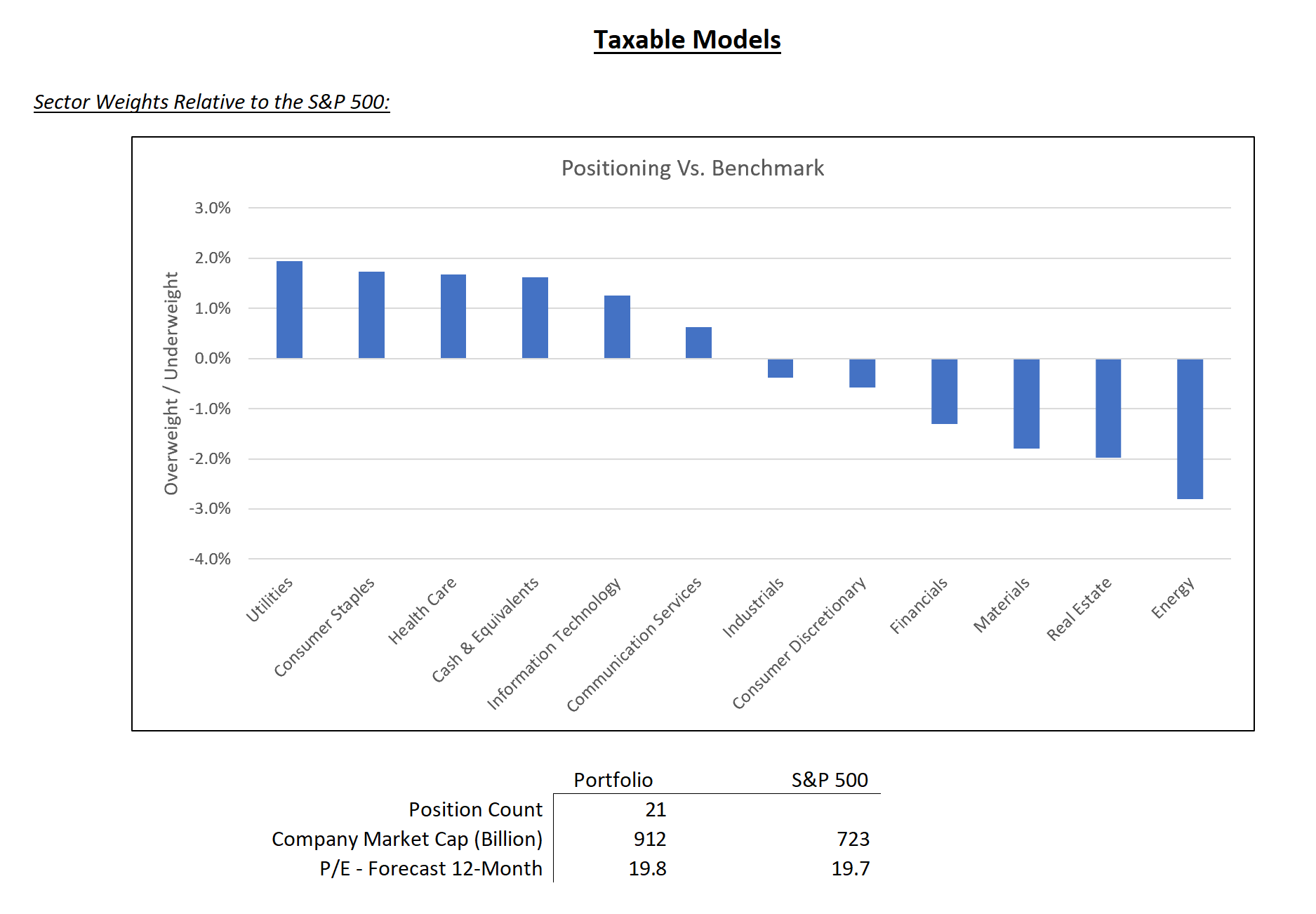

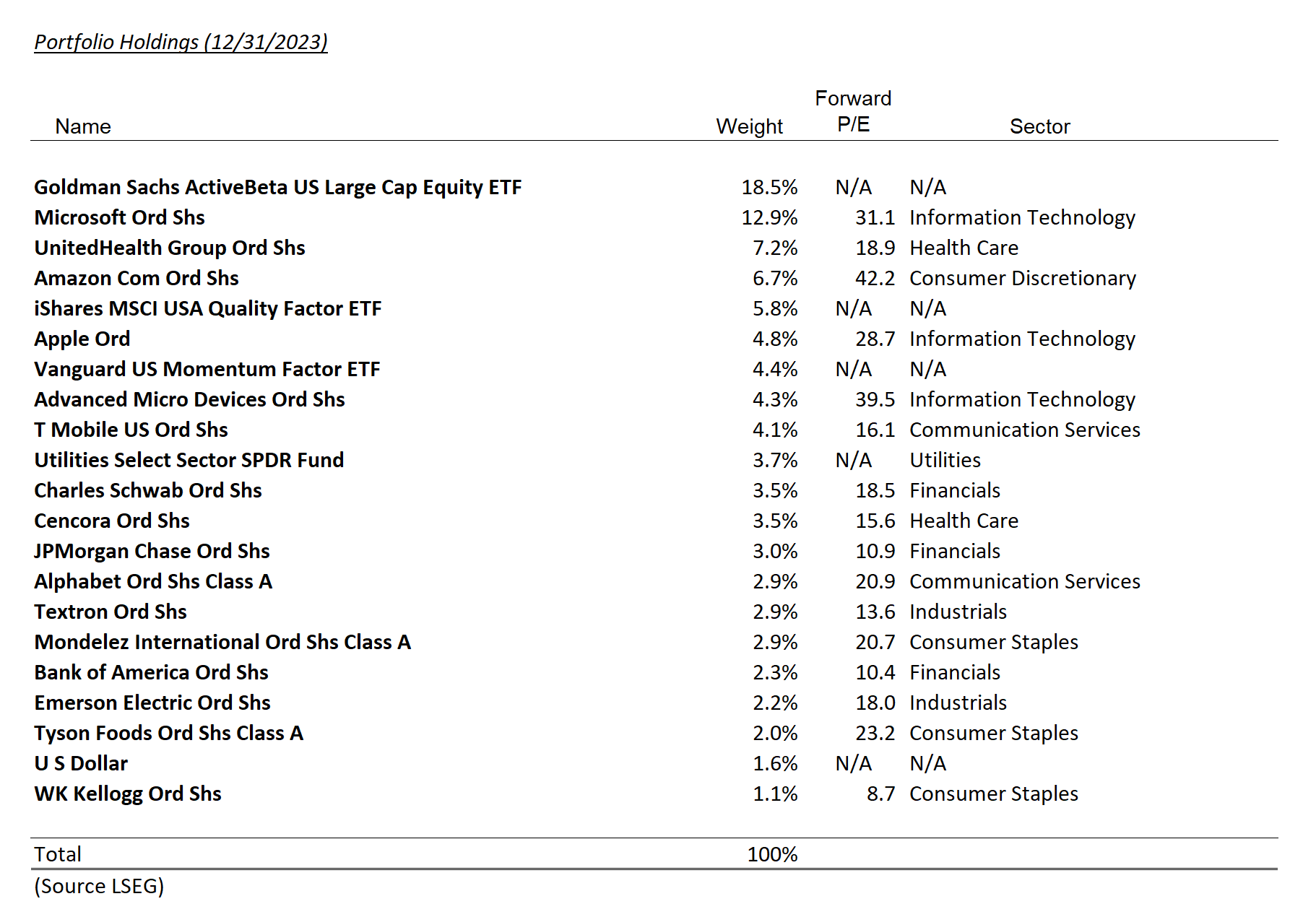

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| TXT | 1.4% |

Summary of Month’s Action:

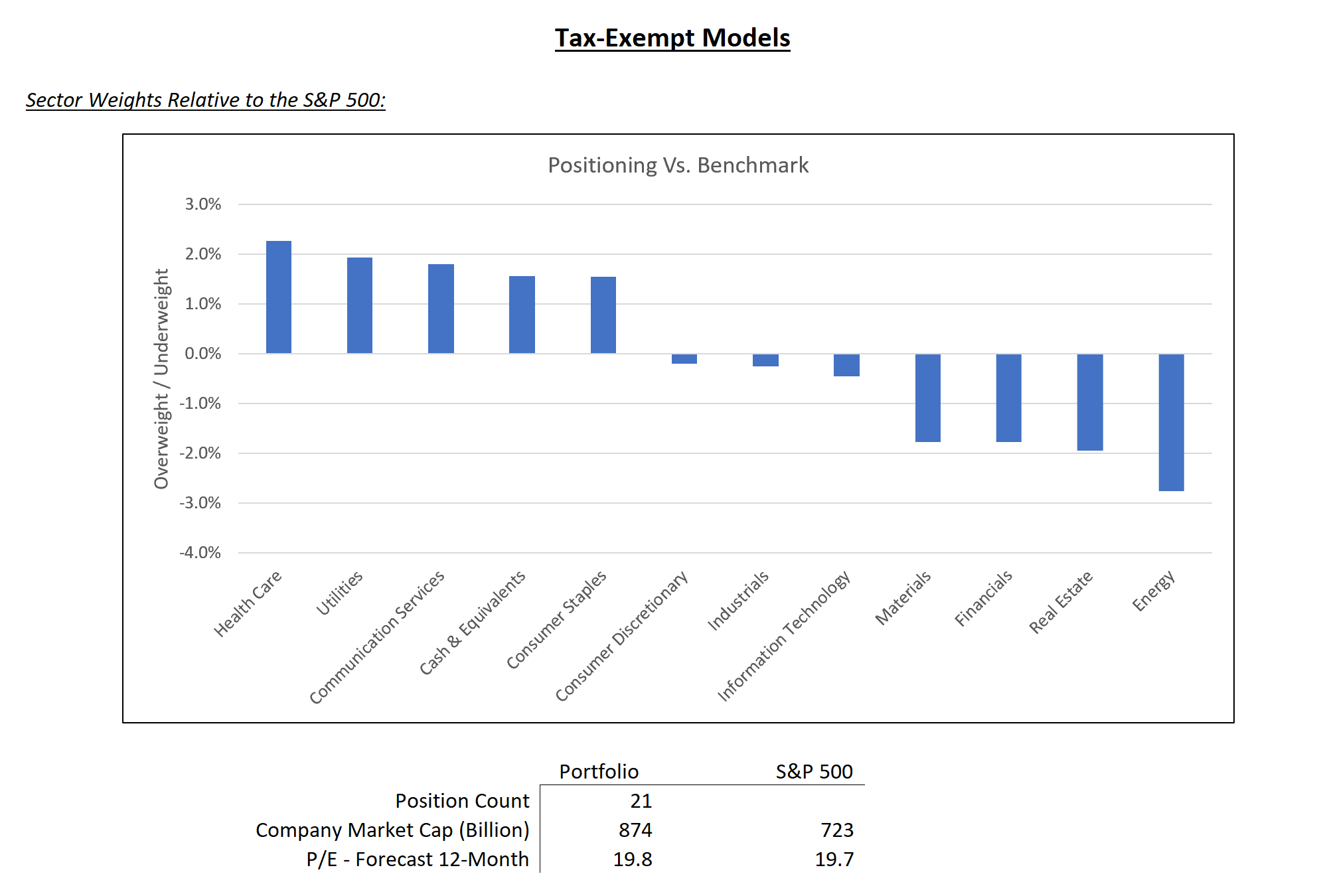

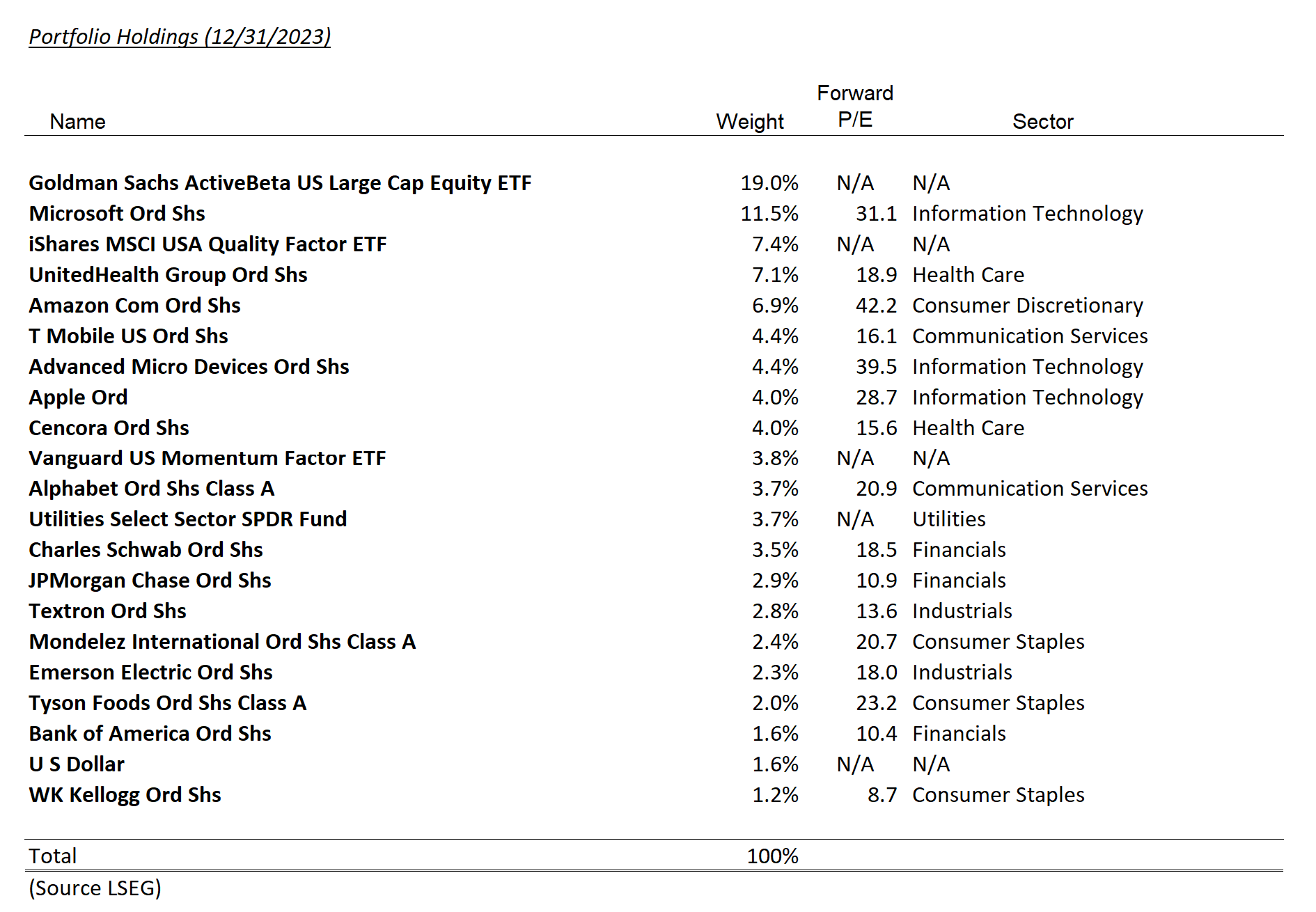

Equities continued to rebound in the month of December, with the S&P 500 gaining more than 4.5%. Real Estate, Industrials, and Consumer Discretionary were the sector leaders. Laggards for the month were Energy, Utilities and Consumer Staples.

As the press has widely reported, 2023 saw a large bounce from sectors that underperformed in 2022 due to improving fundamentals, an avoidance of recession and generative AI excitement. Information Technology, Communication Services (mostly Google), and Consumer Discretionary (mostly Amazon) all increased more than 40% in 2023. For the full year, Utilities, Energy and Consumer Staples underperformed. These sector groups were identical in 2022, but on the other end of the performance scale (all data compiled by LSEG).

For Lincoln Capital’s stock model, top contributors to performance in December were Advanced Micro Devices, Charles Schwab and Tyson Foods, which rose 21.7%, 12.2% and 14.8%, respectively. The major drag on performance was UnitedHealth Group, which declined 4.5% for the month. There were no company-specific news items driving share prices.

Interest Rate Cuts Anticipated for 2024

The highlight of December was the Federal Open Market Committee (FOMC) press conference. At the event, Chairman Powell blessed the growing market consensus that the next move from the central bank would be a cut to the Fed Funds rate. With FOMC participants penciling in 3 cuts to their 2024 forecasts, the market took the message and ran with it. The market priced in a Fed Funds rate that was 1.5% lower (six, 0.25% cuts) by the end of 2024. This dovish shift allowed stocks to move higher into a quiet year-end.

Textron, Inc. – (TXT)

We added to shares of Textron during December. There is widespread skepticism that strong business jet fundamentals can persist, which is keeping a lid on TXT’s share price. As of today, the company is trading at 13.1x forward EPS, much cheaper than the market despite similar earnings growth outlooks. The fundamentals of the business jet market – flight miles, used inventory availability, and pricing – are all positive, and Textron has been under-shipping orders allowing backlogs to grow and pricing to remain firm. We expect the business jet market will be stronger than the market anticipates in 2024. Key risks include the current grounding of the V-22 Osprey, the implications of the grounding on the V-280 Valor, and recent rumors of a bid for United Launch Alliance.

Tear Sheets

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.