April Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| None |

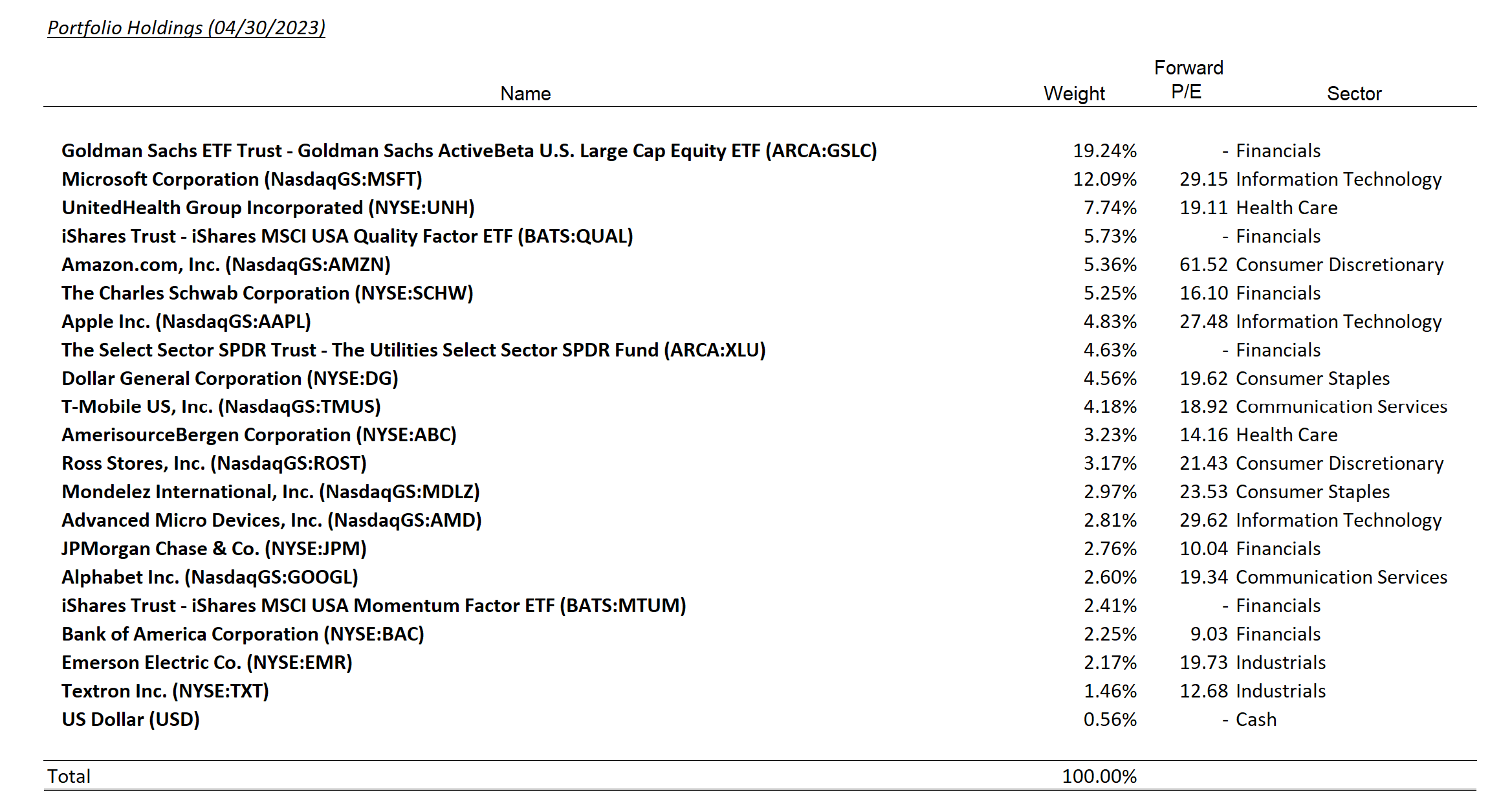

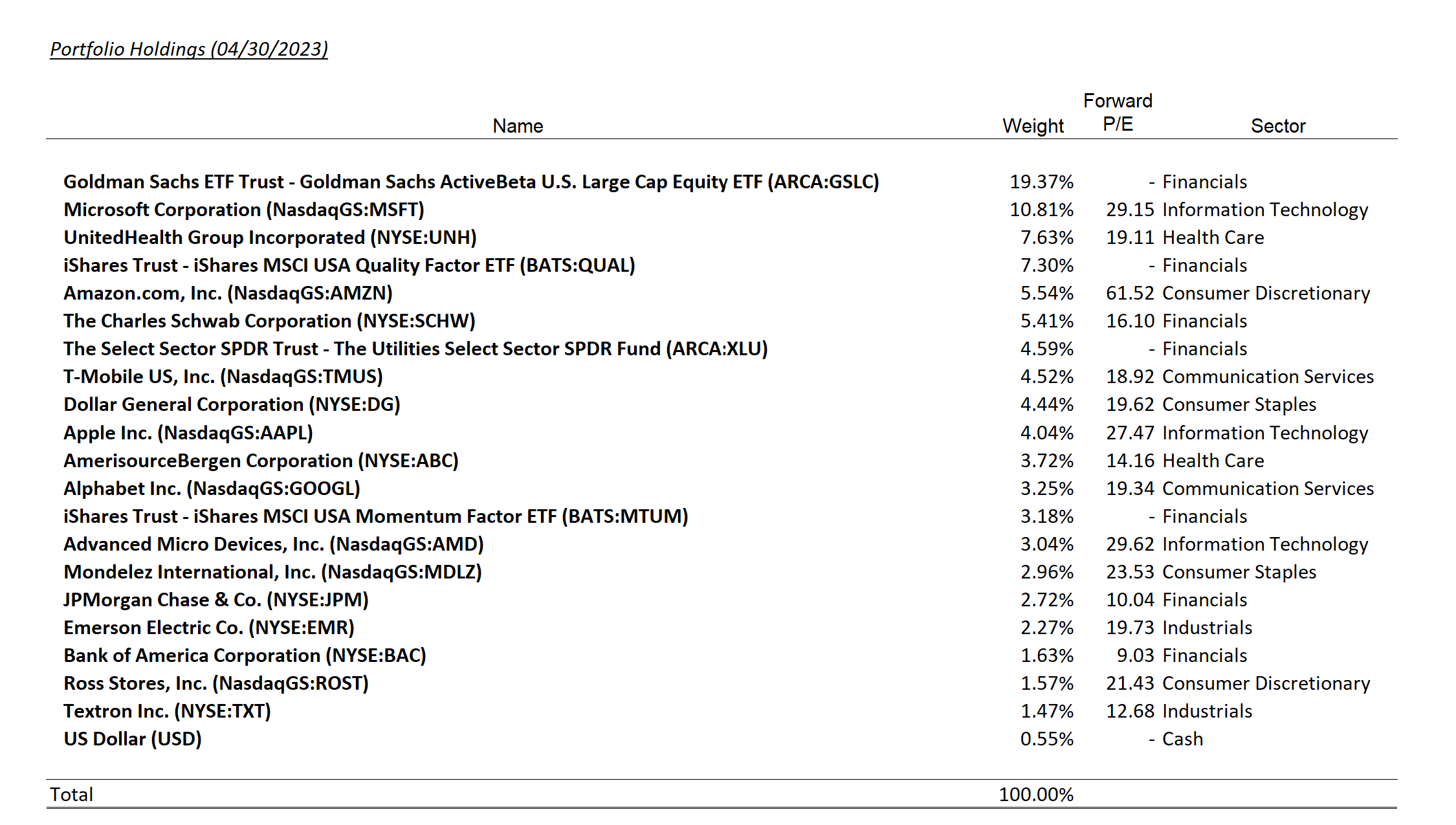

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| None |

Summary of Month’s Action:

The S&P 500 generated returns of 1.6% for the month of April. Multiple sectors posted returns in the 2.8% to 3.7% range, while the laggards included Industrials and Consumer Discretionary, which declined 1.2% and 1.0%, respectively.

For Lincoln Capital’s model, the biggest contributors to performance were not owning Tesla, which was down over 20% on the month, and Mondelez, which gained 10% in April. The main detractor for the month was Advanced Micro Devices, which declined 8.8% and is falling further in May.

Mondelez Poised for Growth

Mondelez posted strong results for their first quarter, reporting organic sales growth of 19.4% versus analyst expectations of 10.2%. Unlike its peers, who reported strong sales growth but volume declines, Mondelez was able to grow volumes and price simultaneously. Additionally, the company is pressing on the accelerator—by increasing their advertising and marketing investments close to 20% year over year.

Advanced Micro Devices Sees Light on the Horizon

Advanced Micro Devices is continuing to weather a downturn in the semiconductor industry. We view the pullback as digestion of strong year-to-date gains for the stock in addition to concerns about inventory levels in the data center. The company believes Q1 will be the bottom in terms of desktop and notebook CPUs, while the second half of the year should exhibit strong growth in data center sales.

Current Market Outlook

Our market outlook has not changed much since March. We continue to struggle to see upside surprise potential, while multiple downside risks remain. Per FactSet, with 53% of the S&P 500 reporting, it appears that Q1 2023 earnings will decline 3.7% from last Q1—the second consecutive quarter of contraction. That said, the silver lining is that Q1 performance (-3.7%) was generally better than what was expected (-6.7%). In fact, looking at EPS surprises, the average surprise is above the 10-year average, which is positive. Outside of rate sensitive sectors, the economy appears to be doing okay.

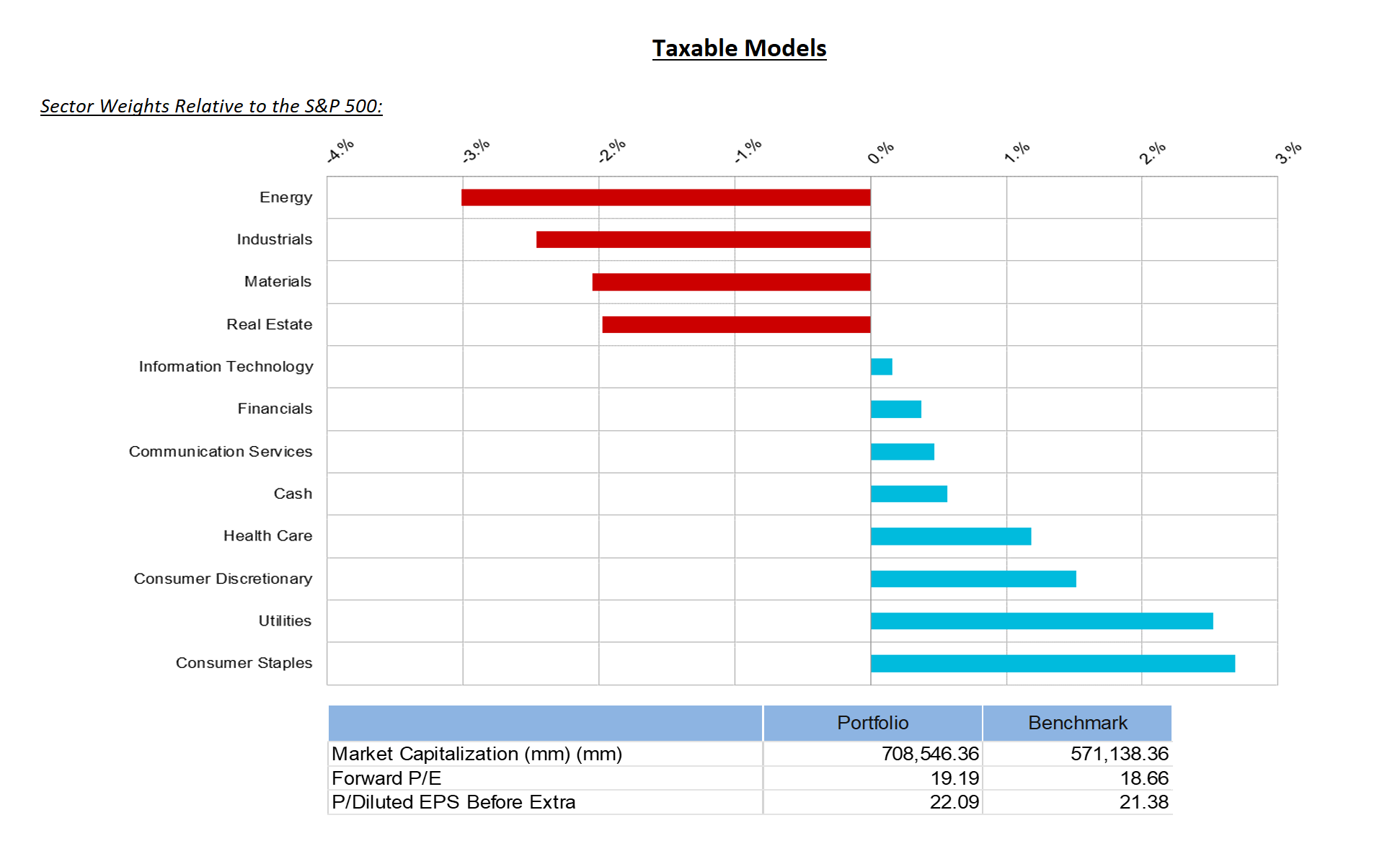

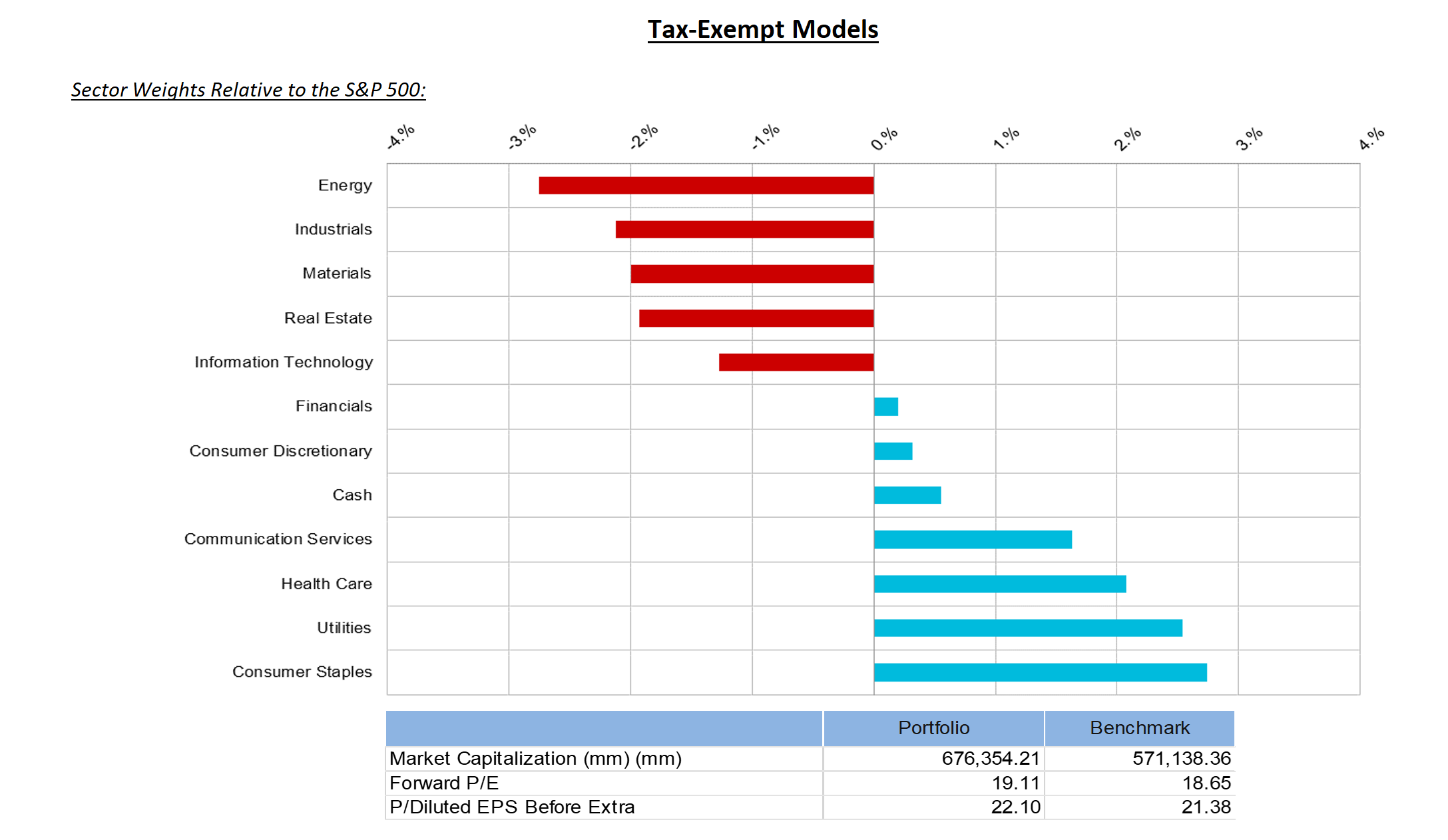

However, at > 18x EPS, the market valuation is full, especially considering short-term treasury rates above 5% and longer-term rates in the mid- 3.00’s. The Fed’s continued fight against inflation, a slowing manufacturing sector, another major bank failure, and the looming debt ceiling standoff are all potential shocks that could knock the market down. Our defensive positioning should do relatively well in this environment.