November Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| AMD | 1.2% | |||

| VVV | 2.6% | |||

| NMIH | 1.9% | |||

| ROST | 1.2% |

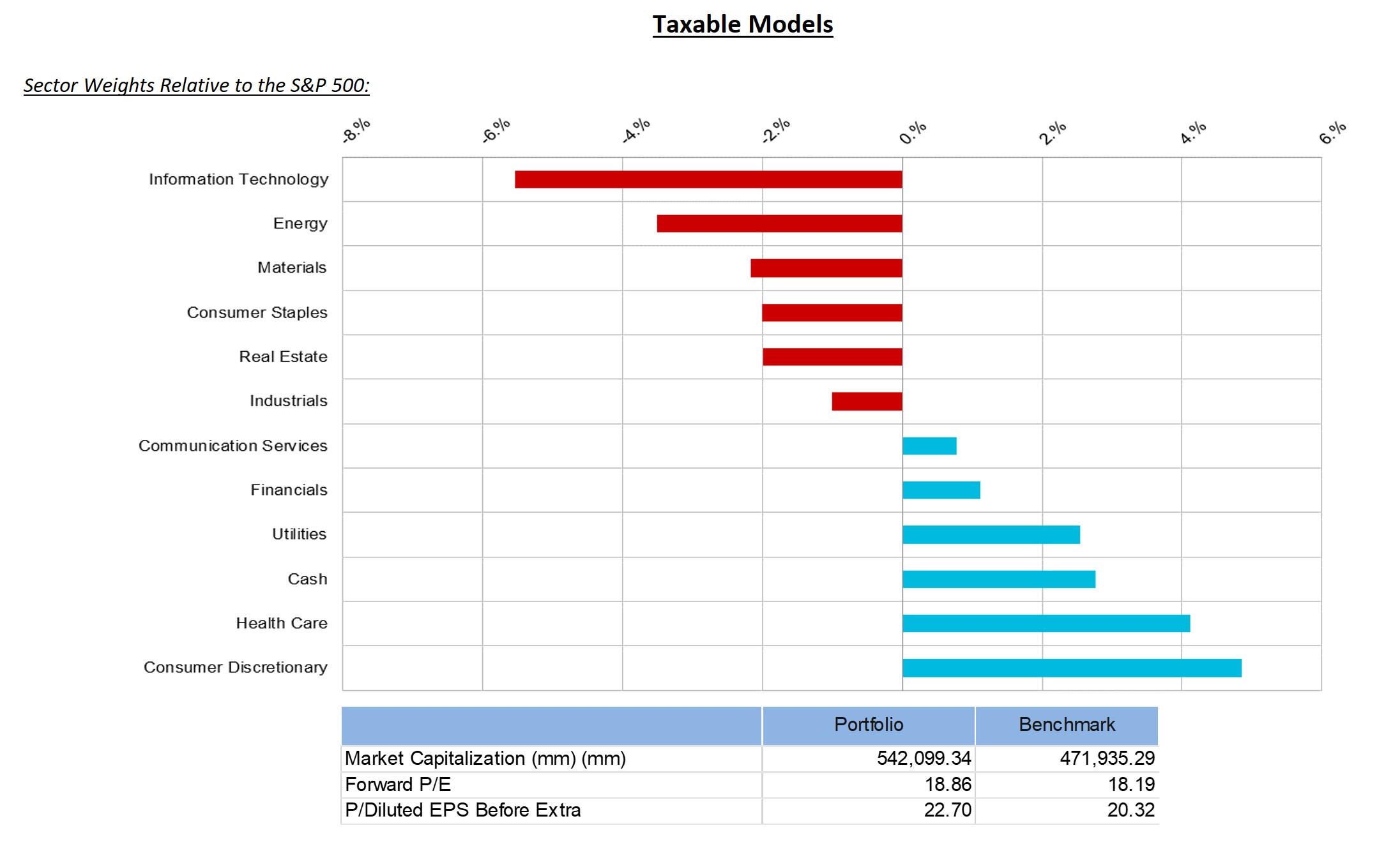

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| AMD | 1.2% | |||

| VVV | 2.6% | |||

| NMIH | 1.2% |

Summary of Month’s Action:

The S&P 500 gained 5.6% in November. Materials, industrials, and financials outperformed in November, while consumer discretionary, energy, and healthcare were the biggest laggards.

Lincoln Capital’s tax-exempt model underperformed during the month. The model suffered a large drawdown, approaching 2.0% on a relative basis, during the days following the October CPI report on November 10th. Since that time, the portfolio has clawed back most of this underperformance. The CPI report was bullish from every angle. When excluding food, housing, and energy, prices declined 0.1% from September. Services, less housing and medical care, was flat on the month. Housing, while still growing 0.5% from September, is moderating and leading indicators like rents and home prices are showing promise. This positive report led to a sharp shift from defensive positions to offensive, seeing speculative companies jump sharply. For reference ARKK, the ARK Innovation ETF, was up 24% over the two days following the release, versus the S&P 500 up 6.5%. When traders – as opposed to long-term buy and hold investors – concentrate their holdings in a few securities and sectors (in this case, owning defensives over cyclicals and quality over unprofitable firms), modest changes in the fundamental outlook can lead to outsized relative returns.

At present, we continue to feel like a defensive posture is warranted but do believe recent evidence has increased the probability of a soft landing.

From a single stock perspective, the biggest detractors for November were UnitedHealth Group, T-Mobile, and Dollar General. The biggest contributors to performance were Ross Stores, Valvoline, and Advanced Micro Devices. Ross and Valvoline both reported positive results during November, while the other stocks did not have specific events impact their prices.

Security Specific Comments:

NMI Holdings, Inc. – (NMIH) – We decided to sell ½ of our NMI Holdings position during the month, with the expectation that the balance will be sold soon. NMI, and its mortgage insurance peers, are different businesses today than they were during the financial crisis. Underwriting standards have been much more stringent for Freddie- and Fannie-backed mortgages, which are the only kind underwritten at NMIH. Additionally, NMI has extensive reinsurance on virtually all policies currently in force, so even under a financial crisis type of scenario, the company would not be significantly impaired. However, it is tough to see the shares outperforming in a period of rising unemployment and falling home prices and, unfortunately, this is where we are likely heading. We may revisit this company in the future if the share price offers an attractive discount.

Valvoline Inc. – (VVV) – Valvoline reported a strong quarter, with sales at its instant oil change business growing 16% due to both unit expansion and sales growth at existing locations. Long-term, the top line outlook is bright, likely pointing to mid-teens revenue growth. However, subsequent to the sale of its global products business to Saudi Aramco, it became clear the margins of the instant oil change business were lower than we originally anticipated. More importantly, we continue to struggle with the terminal value (see ‘Terminal Value’ section below) investors will place on VVV due to the transition, both real and perceived, to electric vehicles. At present, VVV trades at 23.5x 2023 EPS, which is a steep premium to the market. This can be compared to a company like Alison Transmission, which is also shrouded in concern from electrification of trucks, which trades at 8.5x earnings. Ultimately, this risk is tough to handicap, and therefore we decided to exit at a reasonable price.

Ross Stores, Inc. – (ROST) – We trimmed Ross Stores in tax-exempt accounts. This position has been a big winner for clients. Shares have risen approximately 50% since purchasing in May, versus the market’s gain of approximately 1%. The company reported very strong results for its Q3, with sales handily beating expectations. The company also appears to be providing conservative guidance for its Q4, which had a difficult quarter last year due to the Omicron surge. There is a lot to like at ROST, but we believe investors have too quickly priced in a return to strong sales growth and peak margins. We plan on holding the remaining shares for now, but could sell them if ROST were to approach the mid-$120’s. We would also consider re-buying the shares if ROST returned to the $100 area or below. We did not sell shares in taxable accounts as the short-term capital gains treatment will likely result in a tax bill of $10-$15 for most clients. The tax bill would be close to the amount saved from selling and buying back the shares. If shares continue to rally, we will consider selling in taxable accounts too.

‘Terminal Value’

A company’s value is derived from future cash flows discounted to the present. Since companies are expected to have infinite lives, this means cash flows extend infinitely, in theory. In practice, typically 70%-80% of the value of a business is from cash flows that will occur beyond 5 years. Investors will typically ‘model’ out the next five years and use the ‘terminal value’ to capture the value from years 5+. Due to this dynamic, companies in shrinking markets tend to trade at very low valuations (using next year’s EPS), because investors anticipate little terminal value.