Highlights

- Gold and silver have surged amid monetary uncertainty and geopolitical risk

- History shows precious metals rallies are difficult to time and sustain

- Industrial demand has supported metals like silver, but volatility remains

- Long-term portfolios benefit more from diversified, income-producing assets

Estimated read time: 4-5 mins

Gold, silver, and other precious metals have rallied over the past two years, capturing the attention of investors. Prior to last week’s pullback, gold had recently surpassed $5,500 per ounce, while silver breached $120—historic milestones for both metals. These price movements have naturally raised questions about the role of precious metals in a portfolio. While we do not generally advocate investing in them, it’s important to take a broader view and consider how they may fit into a well-constructed investment strategy.

Tailwinds Behind Precious Metals

Several factors have contributed to the recent surge in gold and silver prices:

- Monetary and fiscal policy, interest rate expectations, inflation trends, geopolitics, and price momentum have all played a role in driving precious metal prices higher

- Actions by the White House have raised concerns about the future independence of the Federal Reserve, particularly as Jerome Powell’s term as Fed Chair concludes in May 2026. These concerns have amplified uncertainty around the direction of monetary policy

- Lower interest rates and the prospect of rising inflation tend to place downward pressure on the U.S. dollar, prompting investors to seek assets perceived as stores of value

- Central banks globally have been consistent buyers of gold in recent years, diversifying away from dollar-denominated reserves amid heightened geopolitical risk and concerns about long-term currency stability

- Industrial demand, particularly for silver, has also provided support, driven by applications in electric vehicles, solar energy, and artificial intelligence hardware

Historical Context

Historically, periods of monetary policy uncertainty have often coincided with strong performance in precious metals. During the 1970s, both gold and silver rose sharply as stagflation took hold, peaking around 1980. Similarly, the metals advanced between 2008 and 2011 during the global financial crisis, and again during the 2020 pandemic.

In each of these episodes, investors gravitated toward precious metals as uncertainty around monetary policy and economic conditions intensified. However, prices tended to reverse once conditions began to stabilize.

This history highlights two important challenges for investors drawn to precious metals based on recent performance.

First, forecasting gold and silver prices effectively requires predicting the future path of interest rates, inflation, tariffs, and trade dynamics—factors that have proven extremely difficult to forecast with consistency.

Second, while it is natural to be attracted to assets that have performed well, history shows that precious metals rallies are notoriously difficult to time. Gold’s surge in the late 1970s, for example, was followed by nearly two decades of declining prices. After peaking above $800 per ounce in 1980, gold did not reclaim that level until 2007.

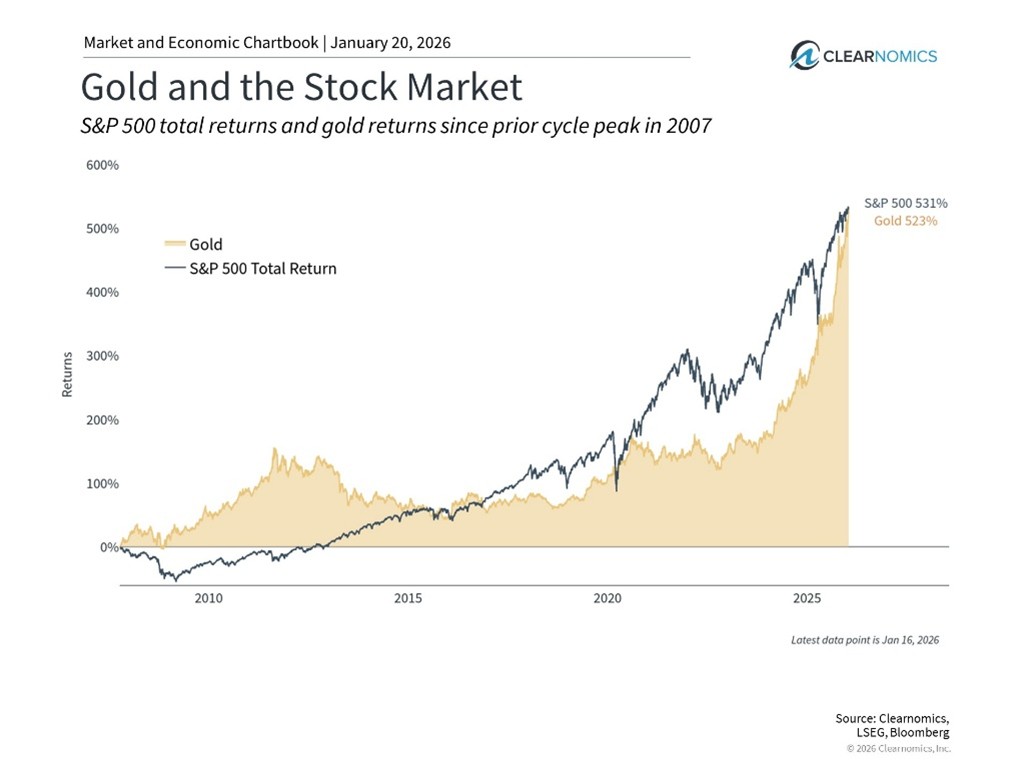

The accompanying chart compares gold’s performance to the S&P 500 since the 2007 market peak. While gold has experienced periods of strong performance, equities have also delivered substantial long-term returns. For investors focused on recent precious metals rallies, this broader perspective may be surprising, but it reflects the historical tendency of stocks to rise over extended periods.

Lessons from Silver and Other Precious Metals

Silver exhibits a similar pattern. Despite strong industrial demand, silver has experienced prolonged periods of weak performance between rallies. In the late 1970s, silver prices surged amid stagflation and a highly publicized episode in which the Hunt brothers attempted to corner the market by accumulating large physical holdings and futures contracts. While prices rose sharply for a time, they ultimately collapsed as supply increased and regulators imposed restrictions on leverage in commodity trading.

Other precious metals have followed comparable paths. Palladium, for instance, gained more than 500% between 2016 and early 2022, driven by constrained global supply and increased use in automotive catalytic converters. After peaking, however, prices declined sharply over the following two years.

Portfolio Diversifiers and Our View

Precious metals—and their digital counterpart, bitcoin—have increasingly come up in client conversations. Our view, both historically and today, is that we prefer assets that generate income or have the potential to do so. Assets with expected future cash flows allow investors to estimate a rate of return and compare that return to alternatives such as bonds or equities.

Precious metals and bitcoin, by contrast, generate no income and have relatively inelastic supply. As a result, their return profile depends largely on what another buyer is willing to pay in the future—an approach that resembles speculation more than investment.

We continue to believe that traditional stocks and bonds offer attractive long-term, risk-adjusted returns. For clients who wish to speculate in commodities or precious metals, we recommend doing so with small allocations built gradually over time.

While gold and silver have performed well in recent months, there will always be individual assets that shine during specific periods. Rather than concentrating on recent winners, we believe diversified portfolios of high-quality stocks and bonds remain the most effective way to build and preserve wealth over the long term.

All data and market insights referenced in this article were sourced through Clearnomics.

DISCLOSURES – This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third party sources and is believed to be dependable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment advice and does not give investment recommendations. Any opinion included in this report constitutes the judgment of Lincoln Capital Corporation as of the date of this report and are subject to change without notice. Additional information, including management fees and expenses, is provided on Lincoln Capital Corporation’s Form ADV Part 2. As with any investment strategy, there is potential for profit as well as the possibility of loss. Lincoln Capital Corporation does not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk (the amount of which may vary significantly) and investment recommendations will not always be profitable. The investment return and principal value of an investment will fluctuate so that an investor’s portfolio may be worth more or less than its original cost at any given time. The underlying holdings of any presented portfolio are not federally or FDIC-insured and are not deposits or obligations of, or guaranteed by, any financial institution. Past performance is not a guarantee of future results. Lincoln Capital Corporation prepare presentation, 401.454.3040, www.lincolncapitalcorp.com Copyright © 2026, by Lincoln Capital Corporation.