No Trades in October

There were no model portfolio changes during the month.

Market Overview

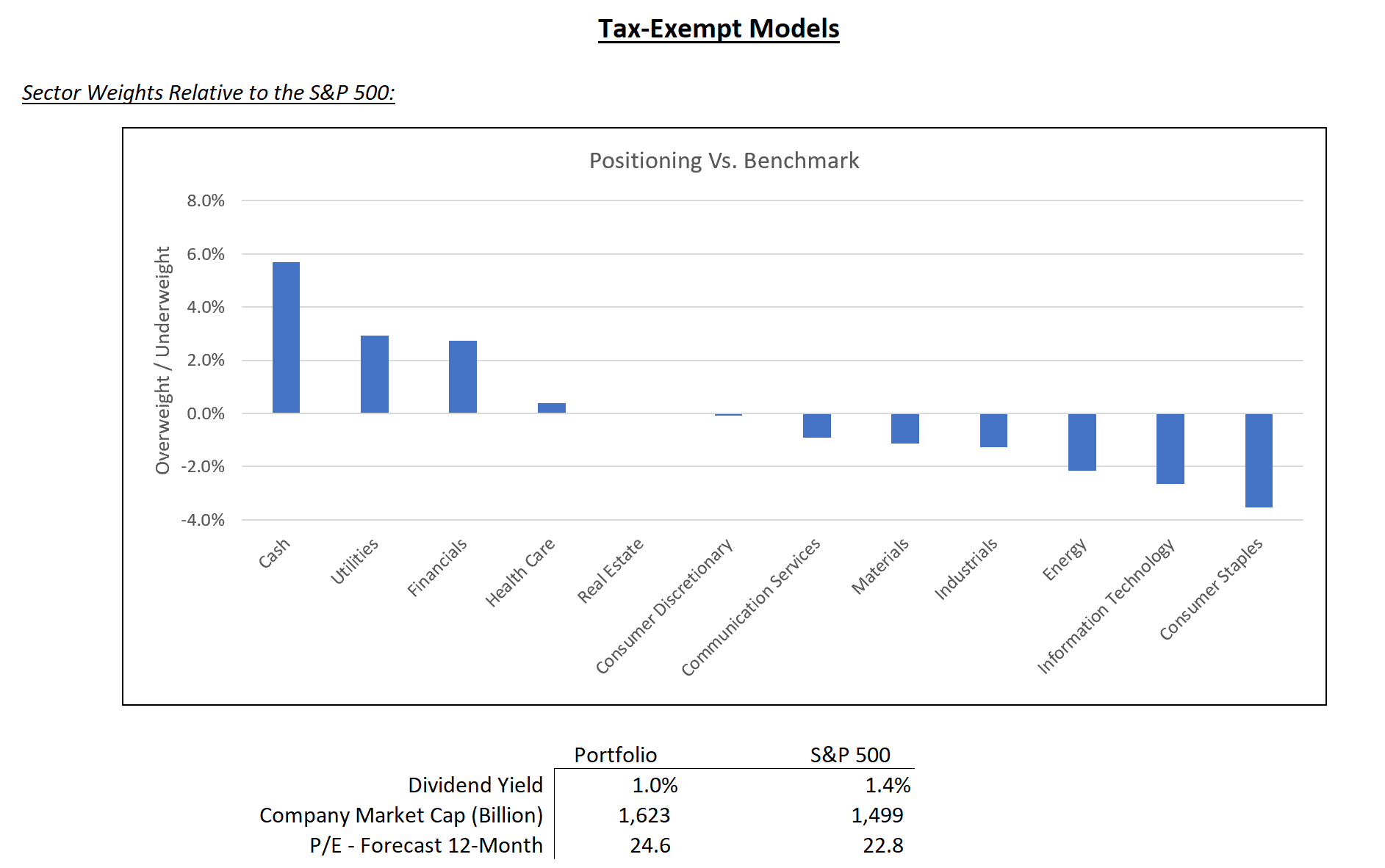

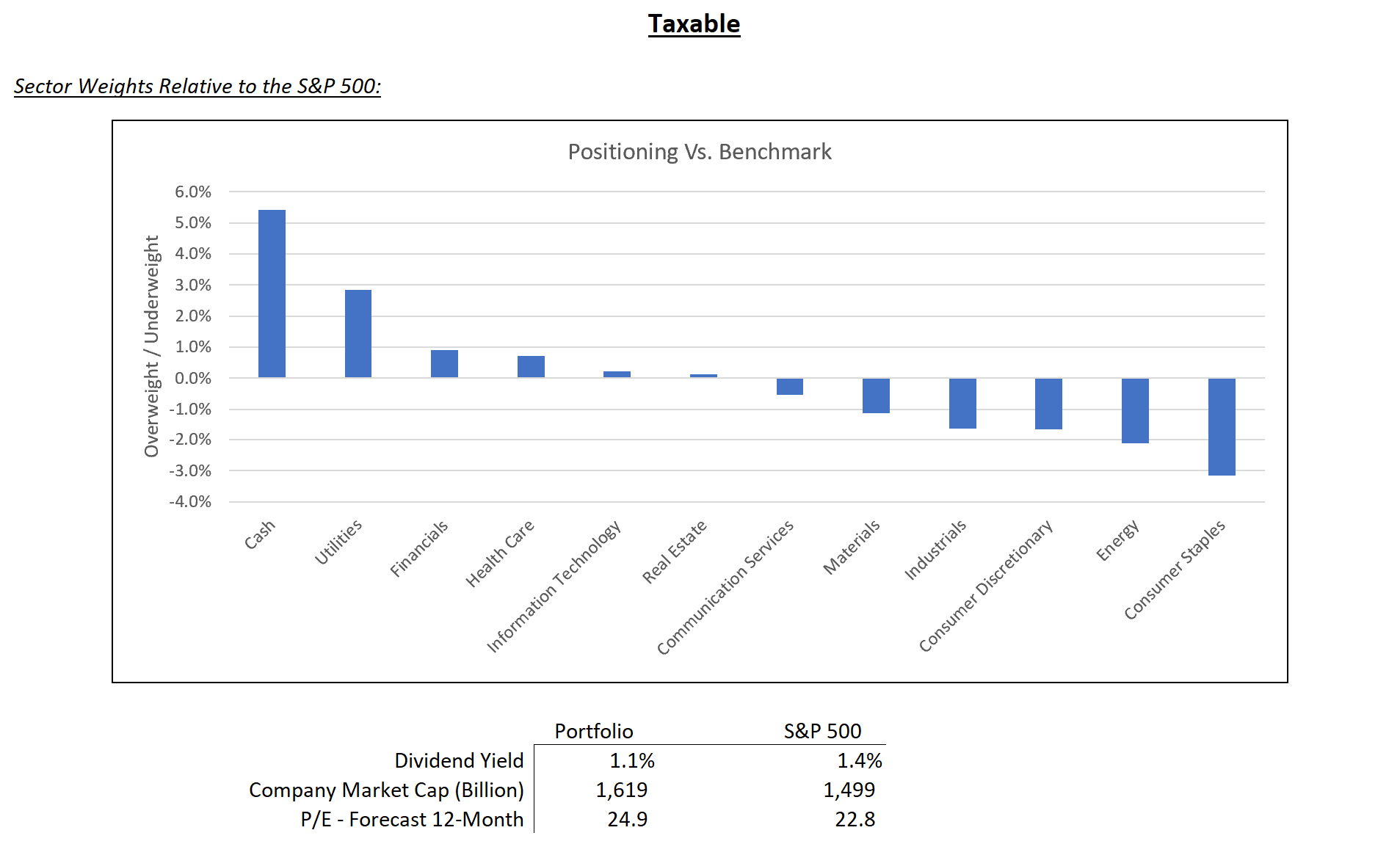

U.S. equities, as measured by the S&P 500, advanced 2.3% in October. Leading sectors included Information Technology, Health Care, and Consumer Discretionary, while Materials, Financials, and Real Estate lagged.

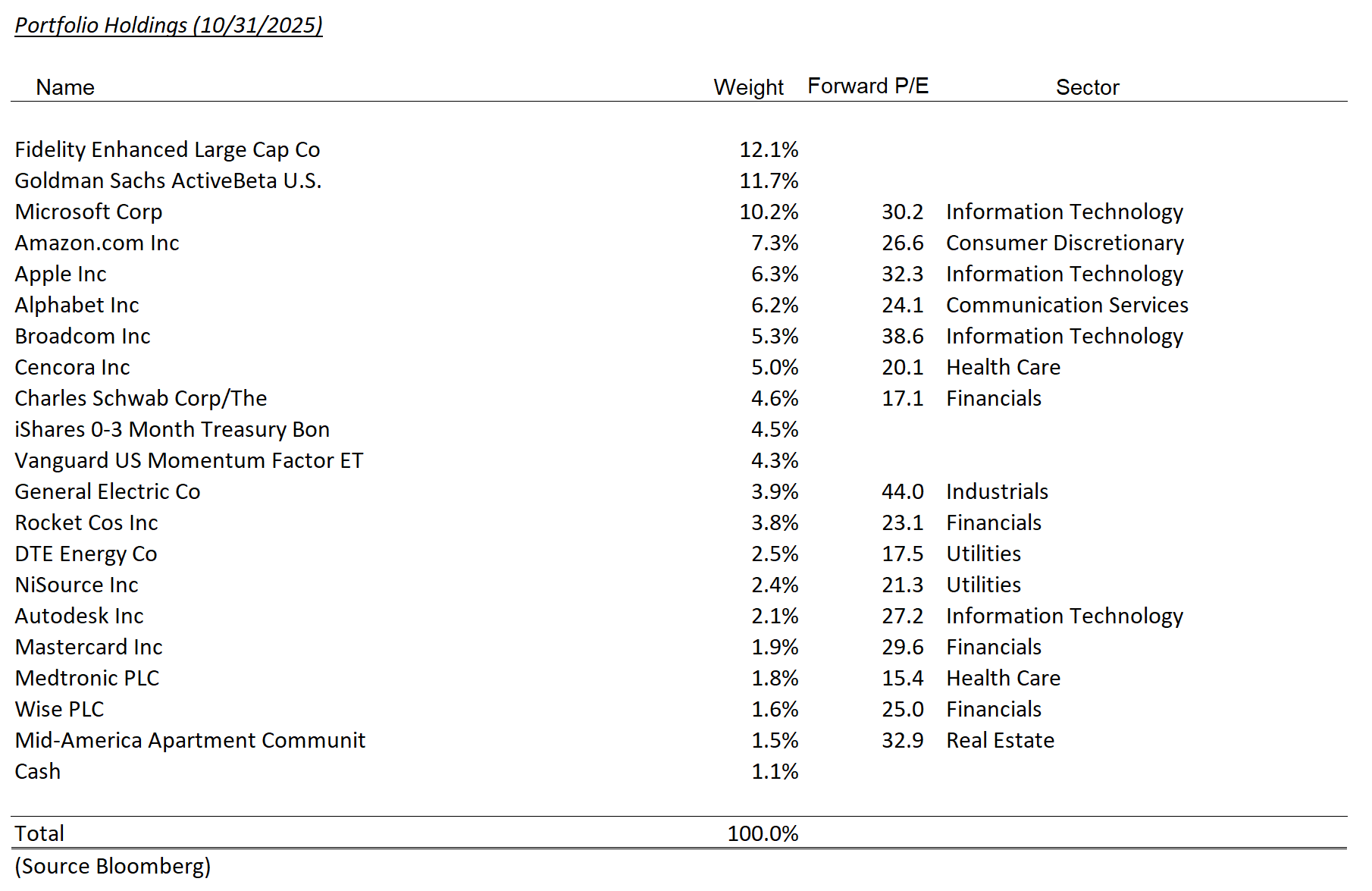

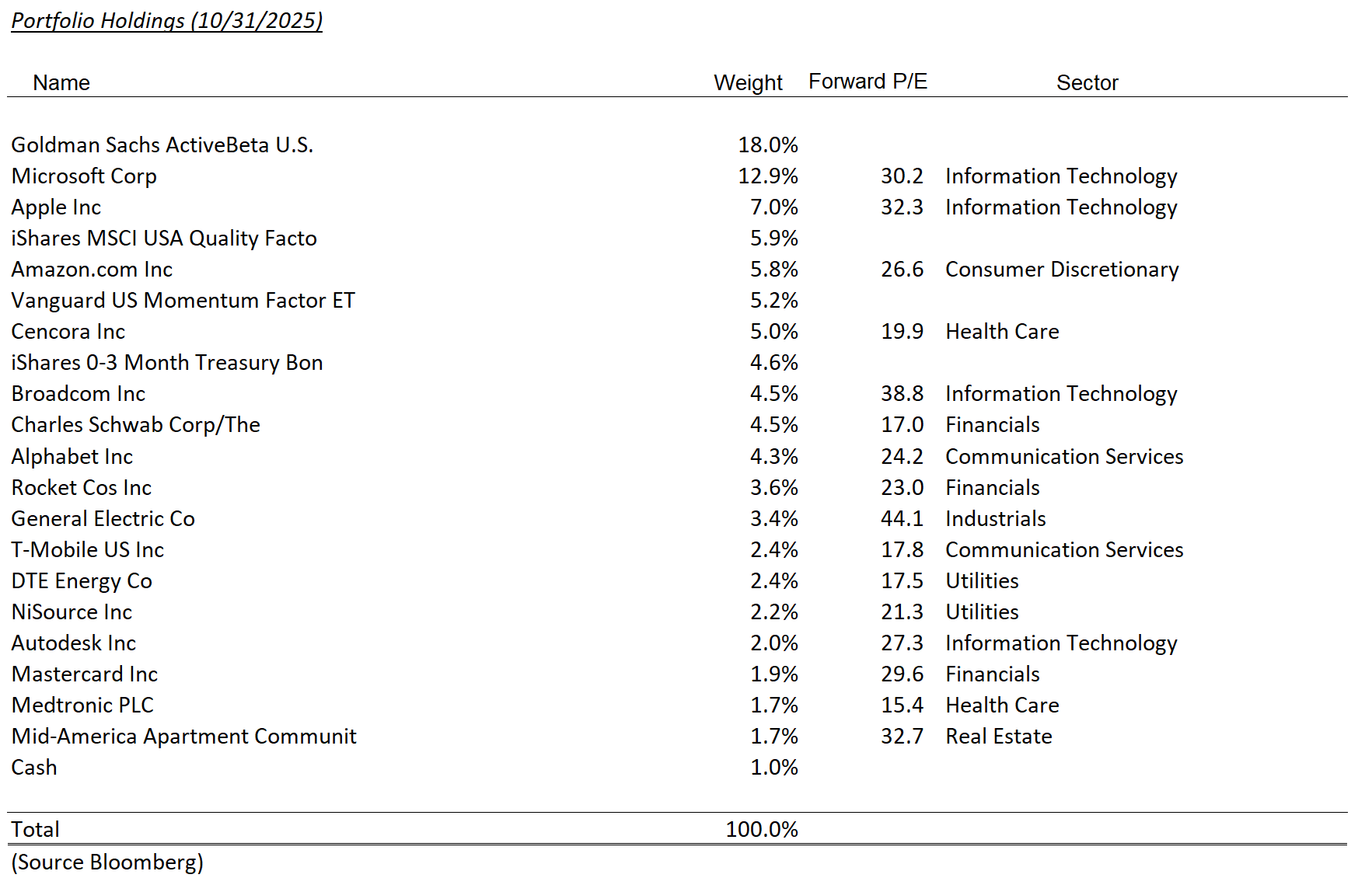

Top contributors to client portfolios during the month were Alphabet, Amazon, and Broadcom, while Rocket Companies, Wise, and DTE Energy were the largest detractors.

AI CapEx Outlook Drives Investor Focus

Amid growing chatter about a potential AI bubble, investor attention in October was firmly fixed on Q3 earnings and capital expenditure forecasts from major players in the space. Among large-cap AI companies, Alphabet delivered the most positive surprise, followed by Amazon, while Microsoft and Meta underwhelmed.

Despite some earnings dispersion, infrastructure providers across the board reported demand that exceeds their current capacity to deliver AI infrastructure services. These firms also signaled that capital expenditures are expected to remain elevated well into 2026.

AI-related CapEx Estimates:

- Revised 2026 forecast: $470 billion (up from $410 billion a month ago)

- 2025 estimate: Approximately $370 billion

These figures underscore the continued investment momentum fueling the AI ecosystem.

Spotlight: Mid-America Apartment Communities (MAA)

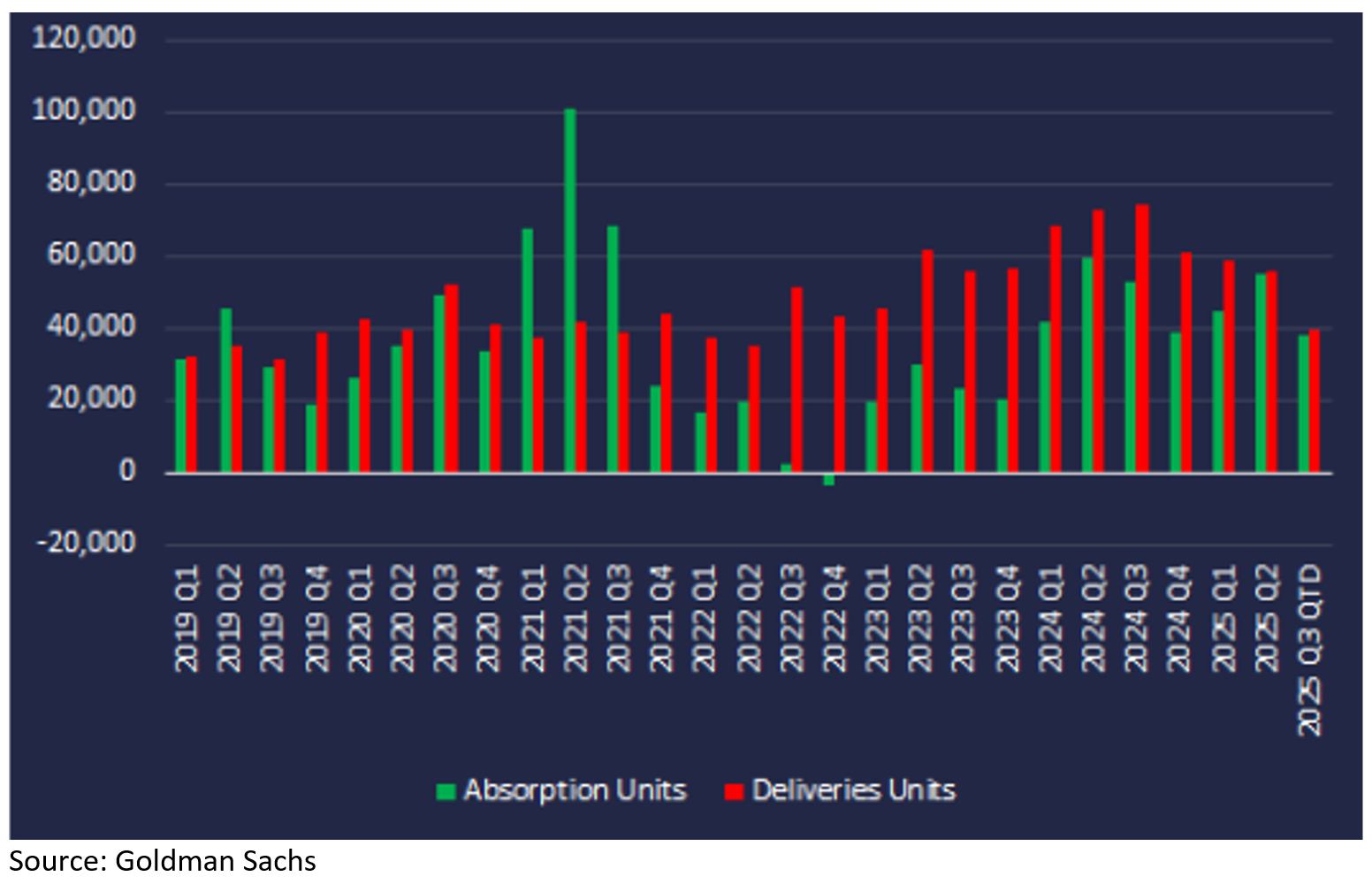

MAA has underperformed in recent months, deviating from our original thesis. We initially viewed the investment as a play on a temporary glut of apartment supply. As interest rates rose in 2022 and rents softened in MAA’s core markets, new apartment development fell sharply. Given typical construction timelines, we expected supply to normalize in 2024 and beyond.

That thesis still holds, but two concerns are currently weighing on the share price:

- Rising Supply Forecasts: Analysts now expect a longer runway for elevated apartment supply, pushing out the anticipated recovery

- Labor Market Risks: A weakening employment environment may slow household formation, as more individuals delay moving out on their own or choose to live with roommates

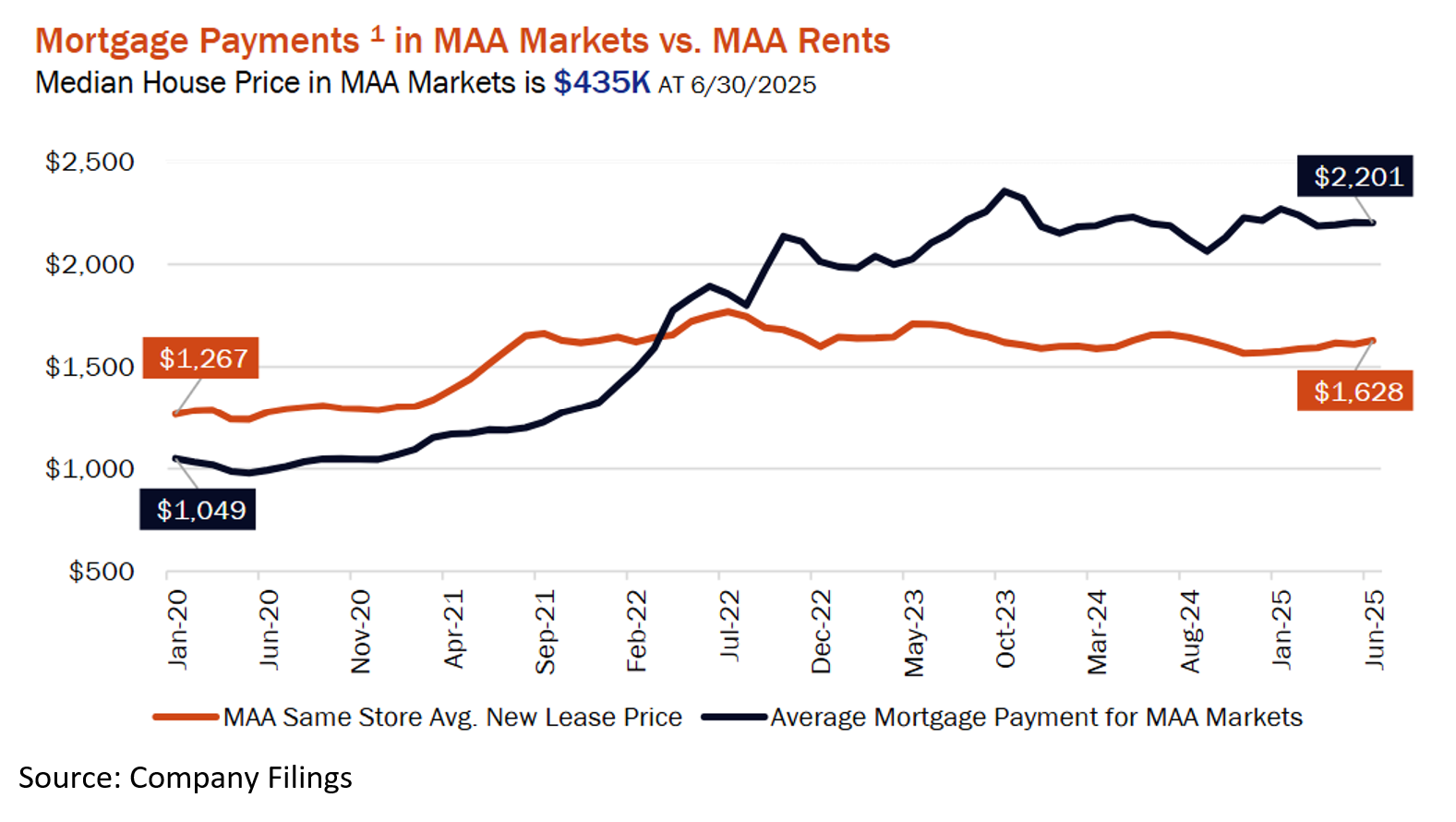

Despite these headwinds, the relative affordability of renting vs. owning in MAA’s markets remains highly attractive.

Looking Ahead on MAA

We continue to believe that falling supply will eventually favor MAA’s fundamentals. The stock currently reflects no material rent growth until 2027, which we see as overly pessimistic.

Key metrics:

- Dividend yield: ~5%

- Cap rate: 6.7% (vs. ~5% for comparable private-market deals)

We plan to realize the loss in taxable portfolios and re-enter the position after the required 30-day wash-sale window, as we continue to believe in the long-term investment case.

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Past performance is not a guarantee of future results. Please note that due to rounding differences, certain data presented may not sum to 100%.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.