September Changes

Tax Deferred

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| WISE | 1.6% |

Taxable

(for mobile swipe left to right)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

Market Overview

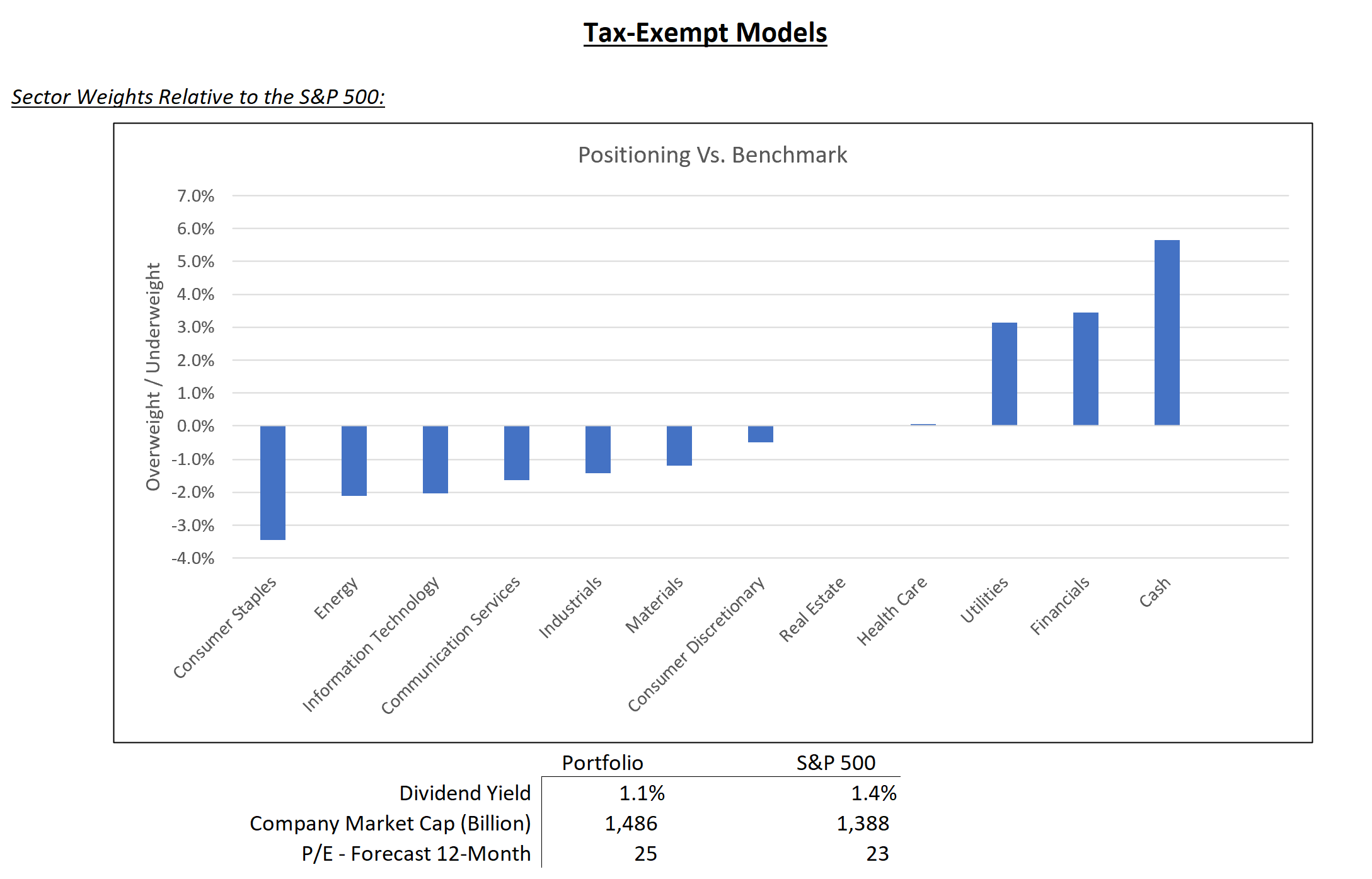

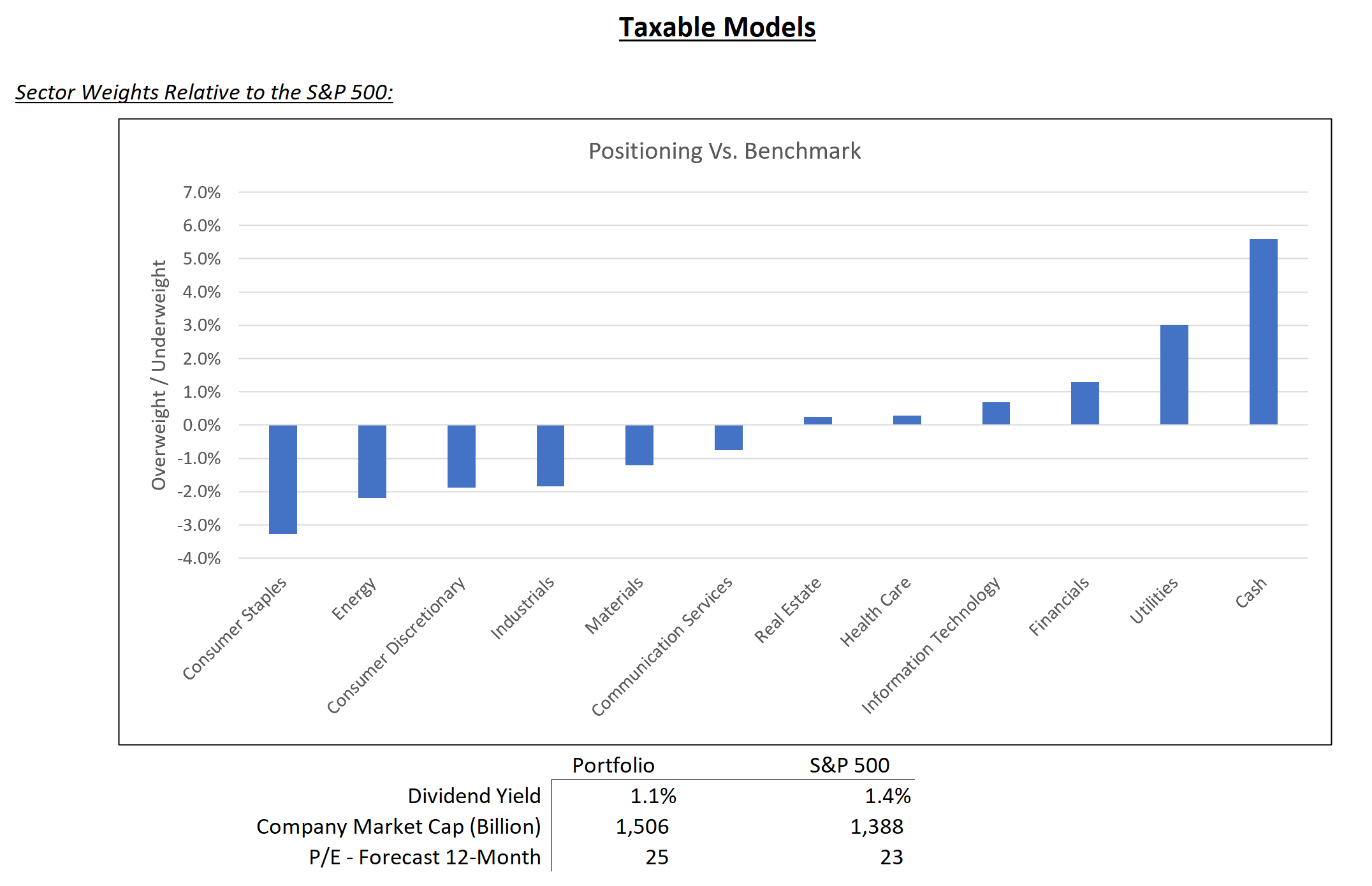

U.S. equities, as measured by the S&P 500, returned 3.6% in September. Top performing sectors for the month were Information Technology, Communication Services, and Utilities, while Materials, Consumer Staples, and Energy underperformed.

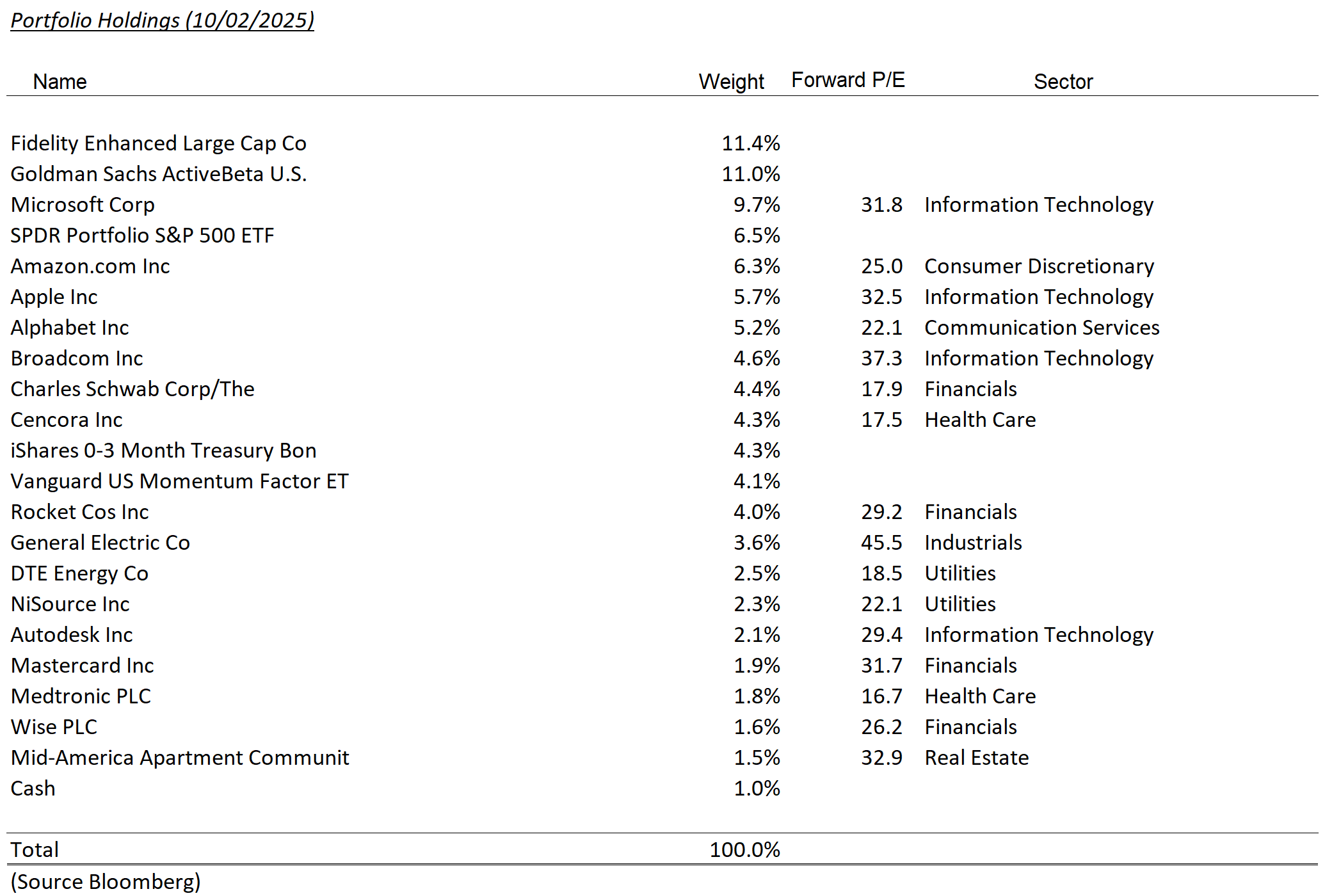

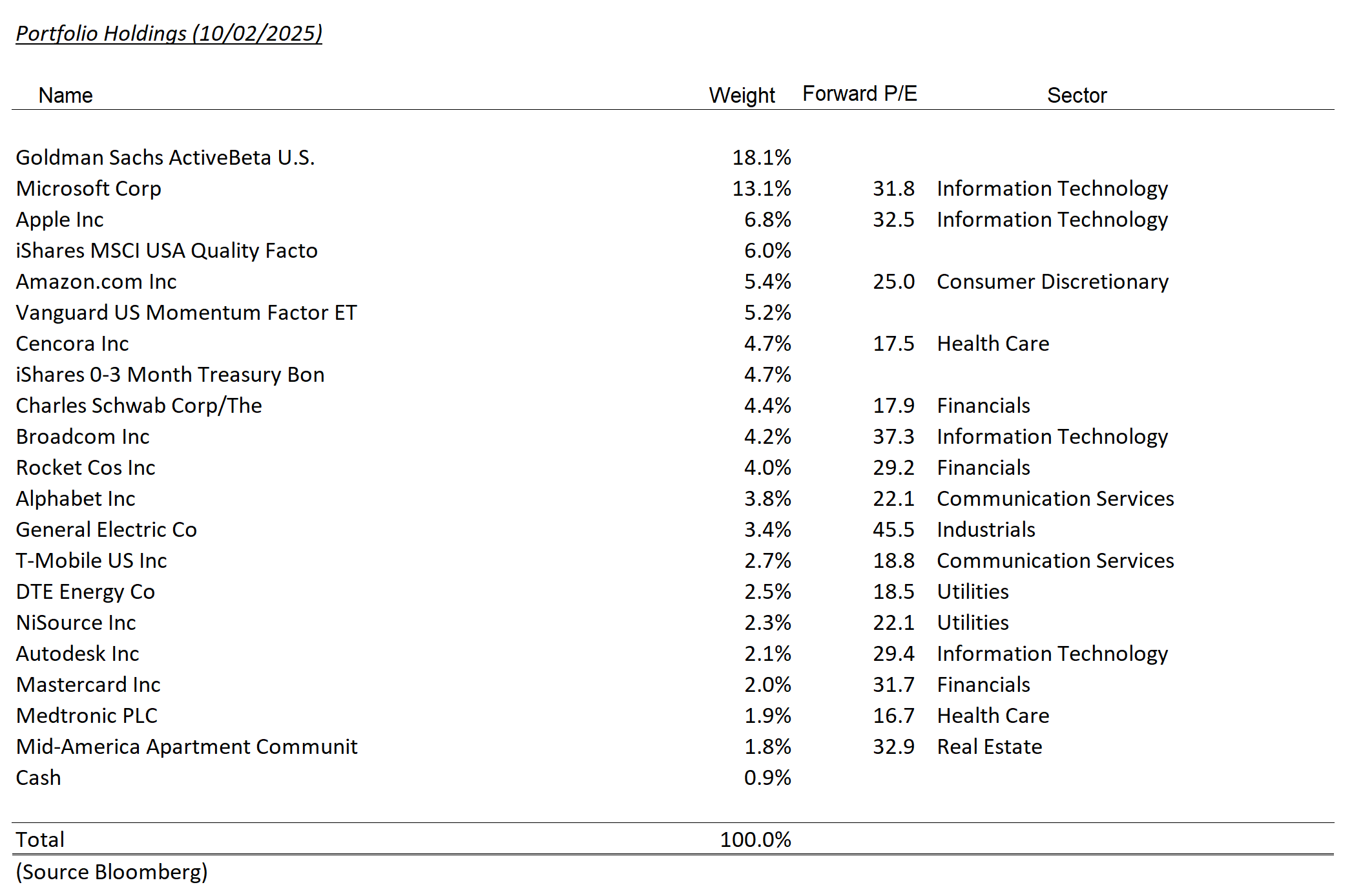

Top contributors to Lincoln Capital client portfolios were Alphabet, Rocket Companies, and General Electric, each gaining more than 9%. Amazon, Charles Schwab, and Mid-America Apartments were the most significant detractors.

Rocket Companies: Well-Positioned for a Rate Shift

Rocket continues to trade in response to mortgage rate movements. While the Federal Funds rate garners most headlines, the 10-year treasury yield is more relevant to mortgage pricing. The 10-year treasury yield fell by 7 basis points in September, according to the U.S. Treasury, and Freddie Mac’s mortgage survey indicates rates have returned to levels not seen since last fall (6.30% as of the last reading). Outside of macroeconomic trends, Rocket also closed on its acquisition of Mr. Cooper, building on its earlier acquisition of Redfin. These acquisitions support Rocket’s strategy of offering a fully integrated homeownership experience, from property search to closing, mortgage origination, and now loan servicing.

Post-Month-End Update: Wise PLC Purchase

Subsequent to month-end, we purchased Wise PLC within tax-exempt accounts and may consider adding it to taxable accounts once we better understand the tax implications. Wise, a company launched in 2011 and went public in 2021, is disrupting the legacy ‘correspondent banking’ system for international (cross-border) payments with a faster, novel, and lower-cost alternative.

Moving funds via the correspondent banking system, powered by SWIFT, can take multiple days and costs over 3%, depending on the sending and receiving bank locations. Wise settles 70% of its transfers within 20 seconds, charging an average fee of just over 0.50%. The company now processes $190 billion per year, nearly triple its volume from four years ago. With 83% of cross border volume still routed through legacy systems (i.e. correspondent banking), the market opportunity is substantial, estimated at $23 trillion for consumer and small business transfers.

Aside from the fundamentals, Wise is preparing to change its primary listing to the United States, either on the NYSE or NASDAQ. As of today, the company is only listed in London (we own the U.S. traded ADR) and the shares average about $10 million in daily trading volume, relatively low for a company with a $14 billion market capitalization. We expect the primary listing switch to be the first step to becoming a U.S. domiciled company. This process should improve liquidity, attract larger institutional investors, and pave the way for future index inclusion.

Disclosures

The views expressed represent the opinions of Lincoln Capital Corporation as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Past performance is not a guarantee of future results. Please note that due to rounding differences, certain data presented may not sum to 100%.

The investments presented are examples of the securities held, bought and/or sold in Lincoln Capital Corporation strategies during the last 12 months. These investments may not be representative of the current or future investments of those strategies. You should not assume that investments in the securities identified in this presentation were or will be profitable. We will furnish, upon your request, a list of all securities purchased, sold or held in the strategies during the 12 months preceding the date of this presentation. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities identified in this presentation. Lincoln Capital Corporation or one or more of its officers or employees, may have a position in the securities presented, and may purchase or sell such securities from time to time.