Market Activity

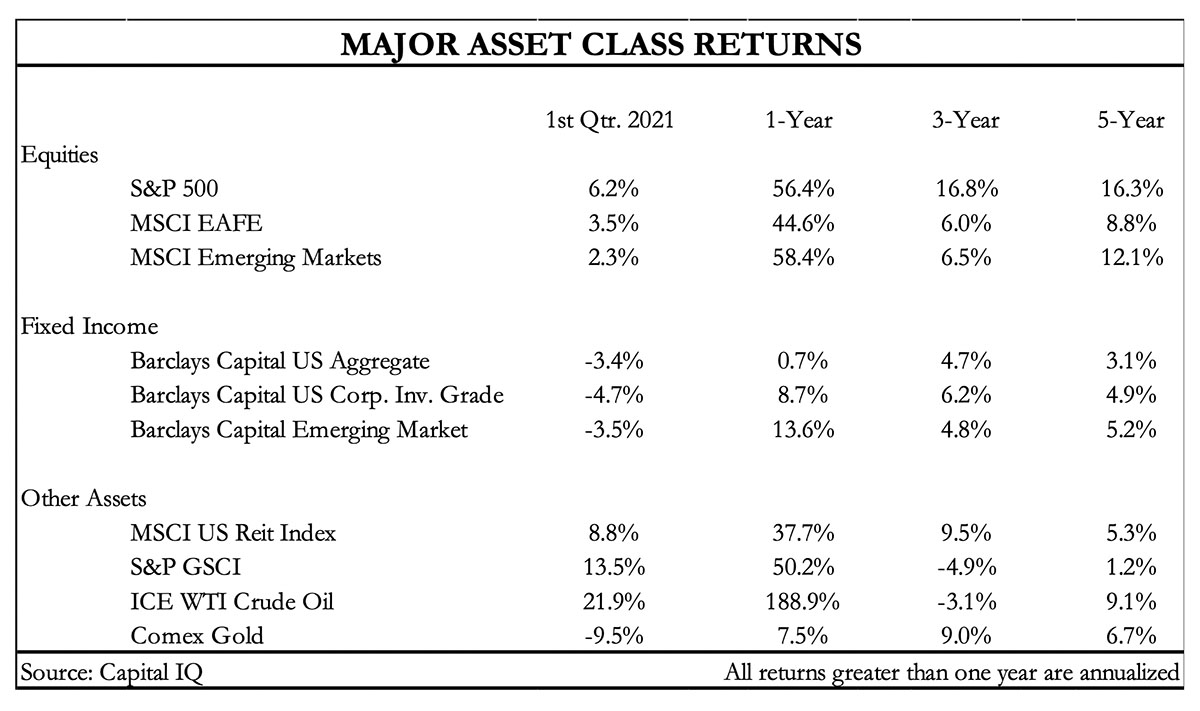

Markets performed as expected for an economy healing from the pandemic and supported by continued stimulus. U.S. equities outperformed global stocks, posting 6.2% returns in the first quarter. Value stocks and small cap stocks performed even better, posting double digit returns for the quarter. Industrial metals and oil surged. Against this backdrop of robust growth and the prospect of more inflation on the horizon, bonds posted negative returns for the quarter, as yields expanded sharply (pushing prices down).

Economic Activity

The U.S. economy continued its rebound from the April 2020 bottom, yet more improvement is needed to fully reclaim its prior peak. Real GDP (Gross Domestic Product) peaked at $19.3 trillion (on a seasonally adjusted annual basis) in Q4 2019 and most recently registered $18.8 trillion in Q4 2020. While the virus is still inflicting harm on the population and the economy, we expect above average growth in both 2021 and 2022, as we may be on the cusp of one of the strongest economies since the early 1980’s. According to BCA Research, fiscal stimulus and restricted spending have produced an excess savings pile of $1.9 trillion on consumer balance sheets. While some of this money will be saved, some will pay down debt, and some will be invested, the majority is likely to be spent. Signs are already present that pent-up demand is being unleashed. After starting the year down 60% from 2019 levels, the number of seated diners reported by OpenTable has markedly improved with some states – Florida, Nevada, Oklahoma, and Texas -showing more diners than in similar periods in 2019. So, go the airlines – American, United, and Delta have all recently commented that their businesses are quickly improving. Delta Airlines commented that bookings beyond 60 days are almost back to even with 2019 levels. Strong bookings far in advance suggest the consumer expects the virus to soon be under control.

Around the world, some regions are lagging the U.S., while others are leading. Economic prospects are largely tied to vaccination efforts. Israel and the United Kingdom are two countries that vaccinated their populations quickly. The European Union and emerging markets are lagging in their virus fight, with recent lockdowns in Germany and France providing evidence of this point. We do not expect the uneven pace of vaccinations to materially derail the global recovery and expansion.

Valuation and Sentiment

In past writings when discussing valuation, we have focused on valuation multiples, more specifically the P/E ratio – which compares the Price of an index or security against expected Earnings of the security. While the multiple for the S&P 500 has been stretched since last summer, and the media may tend to focus on the price of assets (the P in P/E), our view is this is an important time to pay close attention to the “E” in the equation.

In December 2019, analysts were forecasting 2021 S&P 500 Earnings of $197 per share (EPS). The emergence of the pandemic resulted in a large downward adjustment to this outlook. However, analyst’s initial adjustments were too harsh for the reality that played out. The 2021 EPS estimate has rebounded from $163 in June 2020 to $175 by the end of Q1 2021. Worth noting is that, historically, estimates start high and come down. However, this year has seen the opposite occur, with data and fundamentals positively surprising analysts, resulting in upward revisions. Earnings surprises (actual EPS reported by companies compared to the expected EPS) have been similar in number, but the magnitude is abnormally large. In Q4 2020, reported EPS figures were 14.5% ahead of estimates, historically surprises have been 6.3%.

To summarize, while stocks may be considered expensive based on standard metrics, they will appear less so if the trend of upward revisions in revenues and profits continues in the months and years ahead.

Investment Outlook and Strategy

The basic trend for the stock market is higher in sync with increasing economic activity and corporate profits, albeit with elevated investment risk. Topics worthy of mention are the virus, and our expectations for the economy, Fed policy, and the stock market.

COVID-19: While certain states and regions are experiencing an increase in virus cases, according to former FDA (Food and Drug Administration) Commissioner Dr. Scott Gottlieb, these increases are due to school re-openings, and higher levels of travel and mobility. Given the accelerating increase in the number of people being vaccinated, Dr. Gottlieb views a fourth wave as unlikely. Our view remains that we will reach herd immunity during the summer months (July to September).

The Economy: Expectations for economic growth to accelerate are fueled by the Fed, who remains committed to keeping short term interest rates pegged near zero for two to three years, and the federal government which, as they dole out trillions of dollars from past legislation, seeks more funds for other objectives. From an economic perspective, the stimulus from our government and central bank were required in 2020 to allow time for global economies to absorb and deal with the devastating shock inflicted by the COVID-19 virus. Our sense and concerns are that the spigots may stay open too long. When you consider that the economy was in a solid growth mode Pre-Covid with record low unemployment, if additional stimulus proves excessive then economic imbalances and inflation pressures are likely. This would put the Fed in a box, as too much of a good thing may not be a good thing.

The Stock Market: The primary factor impacting stock prices is the Fed’s low interest rate policies and actions. Interest rates are the bloodline for economies and the Fed has consistently conveyed the message that the spigots will remain open for another two or so years. At a higher level, global economies have huge sums of capital seeking rates of return and shares of companies that grow and reward stakeholders during these ever-changing times are attractive. Stated differently, stocks continue to compare favorably to securities and funds with low single digit returns and, in some countries, negative interest rates.

While we are true believers that owning shares of leading companies provides the best way of growing capital and protecting purchasing power, bonds have a definite place in portfolio management. Fixed income securities provide safety of assets, known rates of return, and ballast to client portfolios. While stock returns generally exceed fixed income investments over longer periods of time, stocks are only appropriate for risk capital that can withstand inevitable periods of market weakness.

Periodically, we remind ourselves of the math on investment returns – if the price of an asset declines by 20% then it requires a return of 25% to get back to even; if the decline is 50% then a return of 100% only gets one back to even. The main reasons against allocating more than normal amounts to stocks are that valuations are elevated and there are many developments that can cause a rapid repricing of assets lower. Putting it all together, we continue to manage accounts with a neutral asset allocation.

DISCLOSURES – This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third party sources and is believed to be dependable; however, its accuracy is not guaranteed and should not be relied upon in any way, whatsoever. This presentation may not be construed as investment advice and does not give investment recommendations. Any opinion included in this report constitutes the judgment of Lincoln Capital Corporation as of the date of this report and are subject to change without notice. Additional information, including management fees and expenses, is provided on Lincoln Capital Corporation’s Form ADV Part 2. As with any investment strategy, there is potential for profit as well as the possibility of loss. Lincoln Capital Corporation does not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk (the amount of which may vary significantly) and investment recommendations will not always be profitable. The investment return and principal value of an investment will fluctuate so that an investor’s portfolio may be worth more or less than its original cost at any given time. The underlying holdings of any presented portfolio are not federally or FDIC-insured and are not deposits or obligations of, or guaranteed by, any financial institution. Past performance is not a guarantee of future results. Lincoln Capital Corporation prepared presentation, 401.454.3040, www.lincolncapitalcorp.com Copyright © 2023, by Lincoln Capital Corporation.