Market Activity

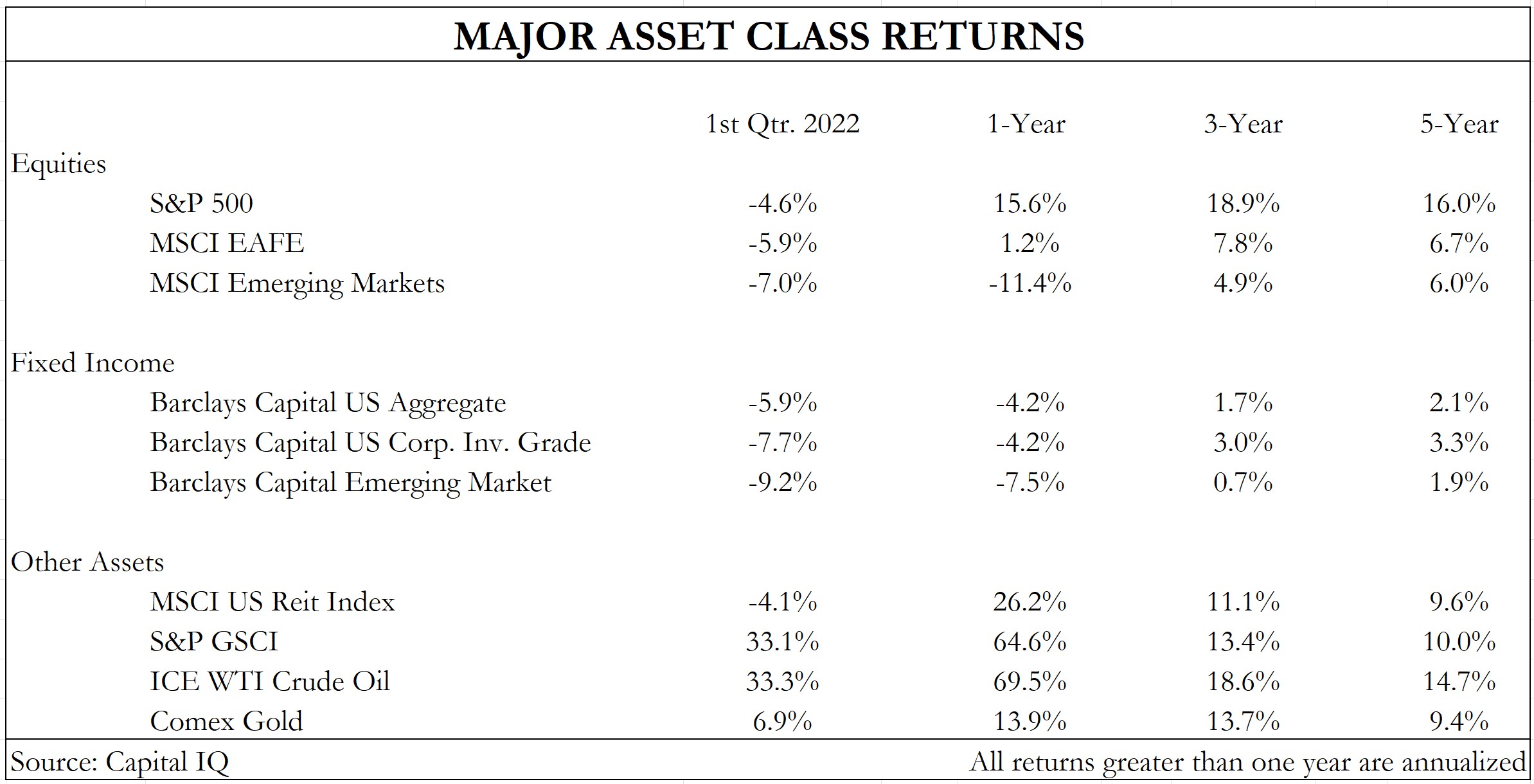

Equities and fixed income had a difficult first quarter; in fact, the Barclays U.S. Aggregate index had its worst quarter since 1980. The 10-year U.S. Treasury yield started the year around 1.52% and finished the quarter at 2.32%. As written in the past, bond prices decline as yields rise (see subsequent section on bond prices and rising interest rates for more detail). Also working against fixed income this quarter was wider spreads, which is the amount of added return required for bearing more credit risk than U.S. Treasuries. Wider credit spreads impact bonds similarly to rising rates. For the remainder of the year, we expect fixed income returns to improve as long-term rate increases moderate.

The S&P 500 had its worst quarter since Q1 2020. What started as a market adjusting to a tightening Federal Reserve policy became one concerned about geopolitical conflict and the supply chain ramifications of disconnecting the world’s 11th largest economy.

Economic Activity

We are in a period of heightened uncertainty regarding the U.S. and global economy, though a U.S. recession is not in store during the next 12-months. On the plus side – the labor market is tight, wages are rising, and consumers have built up tremendous savings. BCA estimates that the U.S. consumer has piled up over $2 trillion in excess savings, which amounts to 8.3% of U.S. GDP. Personal income derived from wages and salaries is expanding at a 9% to 10% rate – this is aided not only by wage growth, but sturdy growth in employment as well. Wages, as measured by the employment cost index and the Atlanta Fed Wage Tracker, are running around 5% to 6% in nominal terms. Given these data points, it is likely that personal consumption expenditures –approximately 70% of the U.S. economy – will grow in inflation adjusted terms this year.

Employment is quickly moving back to pre-pandemic levels. Looking at the employment to population ratio of 25- to 54-year-olds, we should be back to pre-pandemic levels in the next month or so. Older workers are where there may be slack as early retirements drove a sizable portion of this cohort out of the workforce. How permanent these retirements are will determine whether we reach pre-pandemic tightness in one month or closer to the end of the year. Inflation and the opportunity cost of retirement may lure retirees back into the workforce.

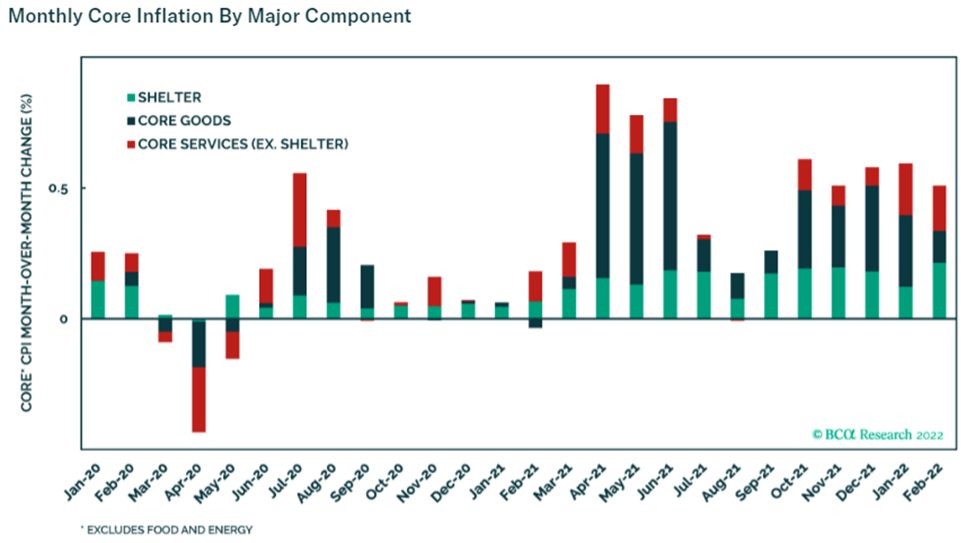

Wages play a key role in inflation, and wage growth is running at multi-decade highs at present. Prior to this past winter, inflation was driven by goods—supply chain disruptions, commodities, and elevated demand. While goods inflation is still running hot, bolstered by the Ukrainian crisis, service and shelter inflation are now expanding as well (as seen below).

We expect goods inflation to revert to normal lower levels, while shelter and service inflationary pressures prove more difficult to correct with supply side adjustments.

On the global stage, we are closely watching developments in Western Europe and China. Western Europe could experience negative growth in coming quarters given larger ties to Russia. China, currently battling a wave of COVID, coupled with a severely depressed property market, is at risk of missing its 5.5% GDP growth target.

Monetary Policy

The Federal Reserve hiked interest rates for the first time since 2018 in Q1. After their March meeting, committee members forecasted a year-end Federal Funds rate of 1.90%, while the market is pricing in the level by year end to be 2.50% to 2.75%. It is probable that at the next FOMC meeting (May) the committee raises the Fed Funds rate by 0.50%, a move not seen since 2000, with a further increase of 0.25% or 0.50% at the June meeting.

Global central banks, aside from Japan, are all moving in the same direction, albeit on slightly different timelines. We continue to expect elevated volatility as the market sorts out this historic level of tightening.

Investment Outlook

The main concerns of investors are the economy (inflation, interest rates, the Fed), the impact from a lingering pandemic, and geo-political issues led by the brutal Russian power grab with Ukraine. Related comments follow.

When COVID shocked world economies two years ago, the support provided by the Fed was engineered to steer global economies away from the abyss. With the recovery now well into its second year, and with inflation rates rising beyond acceptable levels, continued Fed support may cause more harm (inflation) than good, hence Fed moves to be less accommodative and change in the direction of becoming restrictive.

Recent years of zero or negative interest rates were, in our view, indicative of an economy and financial system that is abnormally maligned which no longer applies. To date, the Fed has only increased short-term interest rates by a quarter of one percent, yet investors have sharply raised market interest rates to much higher levels. Our point is that Fed comments have resulted in the market pricing in higher interest rates while Fed actions have been minimal. Economists and investors tend to extrapolate rate increases, and yet, could it be that the Fed will not need to raise rates as much as expected if the market does its bidding for them?

Though COVID and its variations continue to impact people around the globe, we sense the pandemic has evolved into an endemic which, from an economic and investment perspective, will be less of a factor in portfolio management.

Of all the alternatives for resolving the Russian-Ukraine ongoing tragedy, there are no good outcomes—just less bad options. We would not be surprised that a negotiated resolution is crafted which allows Ukraine to remain independent and become a member of the European Union while Russia takes control of certain targeted areas. A face-saving agreement may be required by Putin at a cost of leaving Russia and Putin as isolated pariahs.

Investment Strategy

Only time will tell whether we are at the start of a bear market, a pause in a continuing bull market, or something in between. Our guesstimate is the last option: the long upward trending bull market will continue with periodic dips and corrections. This is based on the view that bear markets normally go together with recessions, which we find unlikely in the next year or so, and we look for corporate profits that exceed expectations. That said, the overall market may struggle as stock multiples adjust to higher interest rates.

As this repricing of assets runs its course, selective stock picking and bond portfolio management will prove beneficial. We have this background in mind as we monitor all existing positions and others with a favorable risk/reward relationship.

In fixed income, we have been managing portfolios to minimize the impact from rising interest rates, and to opportunistically buy bonds as interest rates normalize to higher levels, thereby increasing portfolio income. In equity portfolios we will maintain positions in well-managed companies that are well positioned to navigate developments in an evolving landscape. This includes stocks of attractive companies with stock prices that have declined and present better entry prices and value.

Bull markets are known to climb Walls of Worry and there certainly is no shortage of worries at present. To benefit from the long-term growth and returns that stock investments provide, investors need to endure periodic declines and stay the course through its gyrations. As always, please contact us if we may be of assistance.

Rising Rates and Bonds

Interest rates represent the cost to borrow money whether as assessed on a credit card, a mortgage, or an auto loan. For investors, changes in interest rates directly impact the price of bonds and other fixed income investments. This past March the Federal Reserve raised their benchmark rate for the first time since 2018 to a range between 0.25% and 0.50%. Prior to this, interest rates had been at historic lows near 0% since the COVID-19 pandemic began in 2020. Who is the Fed, why are they raising rates, and is this is a long-term positive for bond investors?

The Federal Reserve was created in 1913 when then President Woodrow Wilson signed the Federal Reserve Act into law. A primary Fed responsibility is to conduct monetary policy by influencing credit conditions in pursuit of stable prices and full employment. One way they influence monetary policy is by raising and lowering the benchmark (Fed funds) rate. In 2020 when the COVID-19 pandemic hit, the Fed lowered the fed funds rate to a range of 0.0% to 0.25%, and then began buying trillions of bonds (QE – Quantitative Easing) to support the economy and to spur growth. By pressuring interest rates lower, the cost to borrow money decreased allowing companies and individuals to spend more on products and services. This monetary boost combined with increased government spending and other related factors have now raised inflation to the highest level since 1982 at 7.9% year-over-year.

While rising rates increase the cost of mortgages and other types of loans, they are to the benefit of savers and bond investors, even though the day-to-day pricing of existing bonds may decrease. For example, let us assume an investor owns a 10-year, $10,000 par bond that pays a 4% coupon (the bond price is 100% of its maturity value). If rates rise and the costs to borrow money increase, bond issuers such as corporations, municipalities, banks, and the U.S. Government increase the rate they pay to borrow money. All things being equal, a new 10-year bond pays 5% from the same issuer. The bond the investor owns still pays 4%, and the investor will receive $10,000 par value at maturity, but the day-to-day price may drop close to $9,200. Did the holder of the 4% bond lose money? No, if the holder retains the bond to maturity, then the return will remain the same (4% per year) as when purchased. The reasons the market price drops is because the 4% coupon is less attractive than the current going rate of 5%. Market value is the price where willing parties will transact, and to compensate a buyer who can buy other bonds at a 5% return, a buyer would only be interested if the investor’s bond could be bought closer to $9,200, where they would earn a 5% return.

In summary, although bond market values decline with rising rates, barring default by the issuer or selling of the bonds prior to maturity, investors lock in a positive rate of return and, importantly, cash flows from interest and maturities will be reinvested at higher interest rates. With a longer time frame, rising rates are a positive for investors looking for a safer alternative to stocks.

As always, if you have any questions, please know that we are available at your convenience.

DISCLOSURES – This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third party sources and is believed to be dependable; however, its accuracy is not guaranteed and should not be relied upon in any way, whatsoever. This presentation may not be construed as investment advice and does not give investment recommendations. Any opinion included in this report constitutes the judgment of Lincoln Capital Corporation as of the date of this report and are subject to change without notice. Additional information, including management fees and expenses, is provided on Lincoln Capital Corporation’s Form ADV Part 2. As with any investment strategy, there is potential for profit as well as the possibility of loss. Lincoln Capital Corporation does not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy. All investments involve risk (the amount of which may vary significantly) and investment recommendations will not always be profitable. The investment return and principal value of an investment will fluctuate so that an investor’s portfolio may be worth more or less than its original cost at any given time. The underlying holdings of any presented portfolio are not federally or FDIC-insured and are not deposits or obligations of, or guaranteed by, any financial institution. Past performance is not a guarantee of future results. Lincoln Capital Corporation prepared presentation, 401.454.3040, www.lincolncapitalcorp.com Copyright © 2023, by Lincoln Capital Corporation.