December Changes

Tax Deferred

(scroll left to right on mobile)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| LOW | 2.6% |

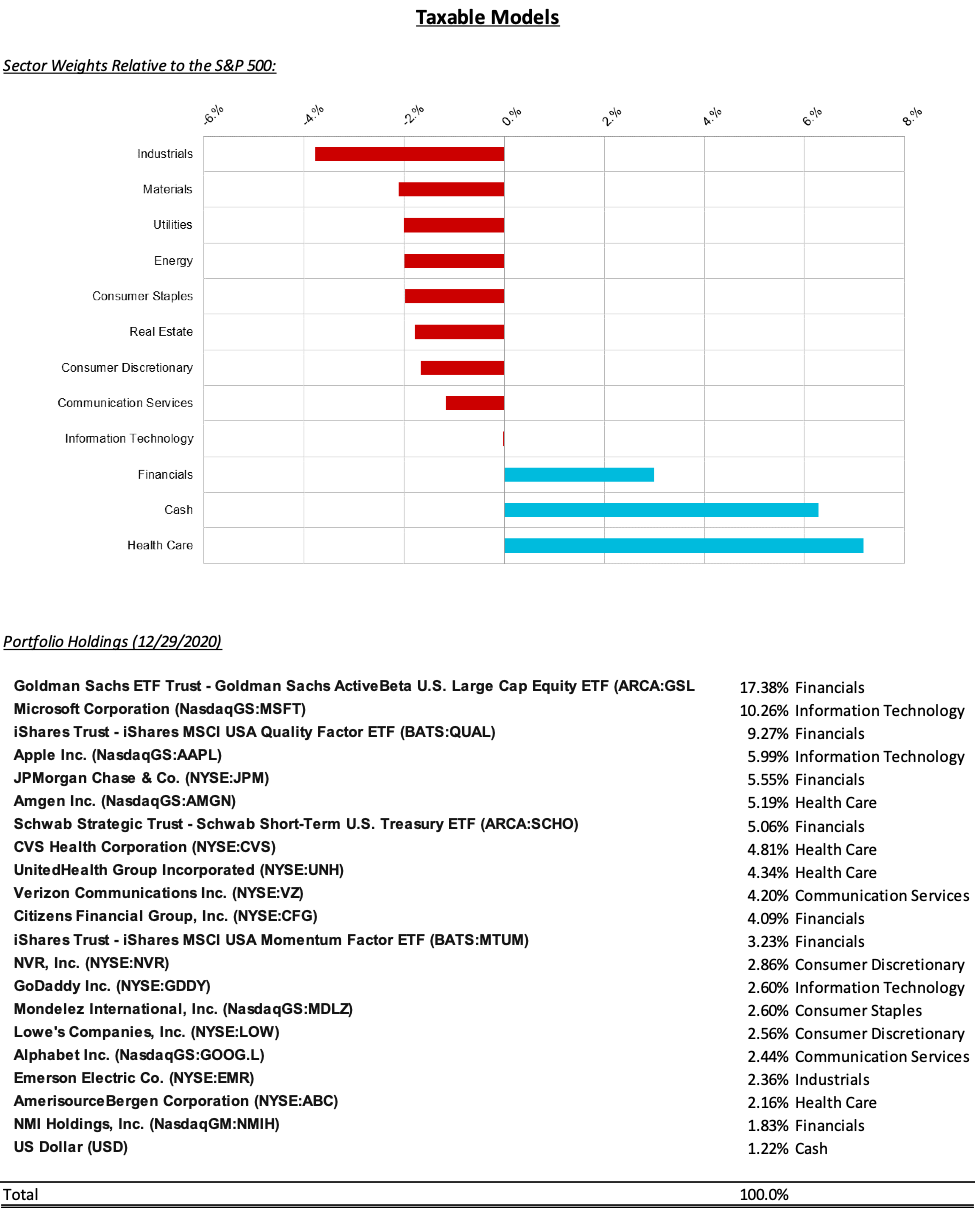

Taxable

(scroll left to right on mobile)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| ZBRA | 2.7% |

Summary of Month’s Action:

Due to the timing of month-end, all performance and position figures are as of 12/29/2020.

The S&P 500 gained 3.0% in December (through 12/29/2020). International developed and emerging market stocks did better, +5.2% and +5.3%, respectively. Taking home top prize was the Russell 2000, a widely followed small cap index, which rose 7.8%. Growth beat value in December, while minimum volatility lagged.

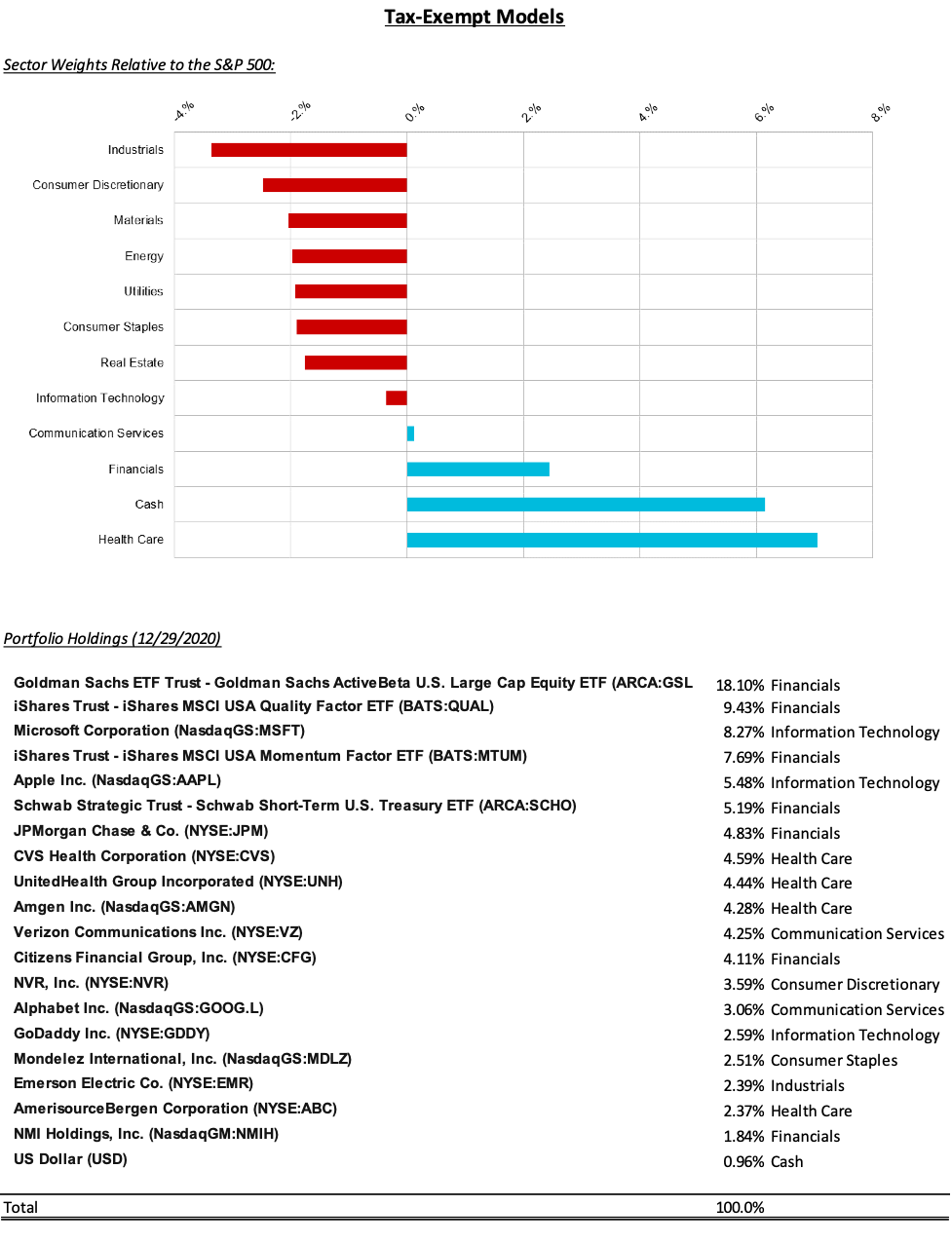

From a sector perspective technology, energy and financials are poised to be the leaders this month, with utilities, real estate, and industrials lagging.

Lincoln Capital’s tax exempt model performed in line with the S&P 500 this month. There were no notable movements in Lincoln Capital’s portfolio this month. Top contributors were Citizens, JP Morgan, and Microsoft, which gained 6.8%, 6.1%, and 4.7%, respectively. Detractors included AmerisourceBergen and Verizon, which declined 5.8% and 2.7%, respectively.

We will discuss our outlook in more detail in our upcoming Tally, but in short, we continue to believe that the market will do fine over the next twelve months. The government is providing strong support to the population and businesses most in need and the Federal Reserve will remain accommodative for the foreseeable future – leaving few appealing alternatives to equities. The economy will continue to mend, particularly once the public is inoculated. However, we expect bouts of volatility over the ensuing 12 months. Robinhood, special purpose acquisition companies (SPAC), and valuations are signs of froth and make the market susceptible to a pullback if an unforeseen risk emerges. The largest long-term risk is the Fed becoming more restrictive, but, as mentioned earlier, this is likely a 2022/2023 phenomenon outside of unforeseen inflation pressures. Higher interest rates from a restrictive Fed would once again provide an alternative to equities and cause a rocky adjustment period. We raised cash this month to prepare for volatility.

Security Specific Comments:

Zebra Technologies (ZBRA) – After selling Zebra in tax-exempt accounts last month, we sold ZBRA in taxable accounts to raise cash. The share price of Zebra continues to move higher, now up just under 40% since the end of October, handily beating the market. At this point we believe the share price has moved too far ahead given the fundamentals of the company. We continue to like the company and the industry and will continue to monitor for an attractive entry point in the future.

Lowe’s Companies (LOW) – We sold LOW in tax-exempt accounts and may make a similar trade in taxable accounts in 2021. LOW is another company where we have a long-term favorable view but believe the intermediate-term risk/reward is challenged. Under the direction of the new CEO, Marvin Ellison, the company has been making great progress closing its productivity gap with Home Depot. Once finally closed, LOW earnings should be greatly improved.

However, we are concerned about the near-term set up as home improvement has been a key beneficiary of the coronavirus lockdown. With customers effectively stuck at home and unable to spend money in traditional channels, LOW saw sales spike over 30% above last year’s levels this summer. Next year should see strong home sales (both new and existing), which historically bodes well for home improvement. However, customers will have less time and more options to spend their money next year, which we believe will result in significant sales declines. Wall Street is mixed on their outlook, the average consensus is for a 4% sales pullback in 2021. We expect the sales pullback to be worse than expected.