November Changes

Tax Deferred

(scroll left to right on mobile)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| GDDY | 2.6% | |||

| MDT | 1.8% | |||

| IBM | 1.6% | |||

| ZBRA | 2.3% | |||

| CFG | 1.1% | |||

| NMIH | 0.9% |

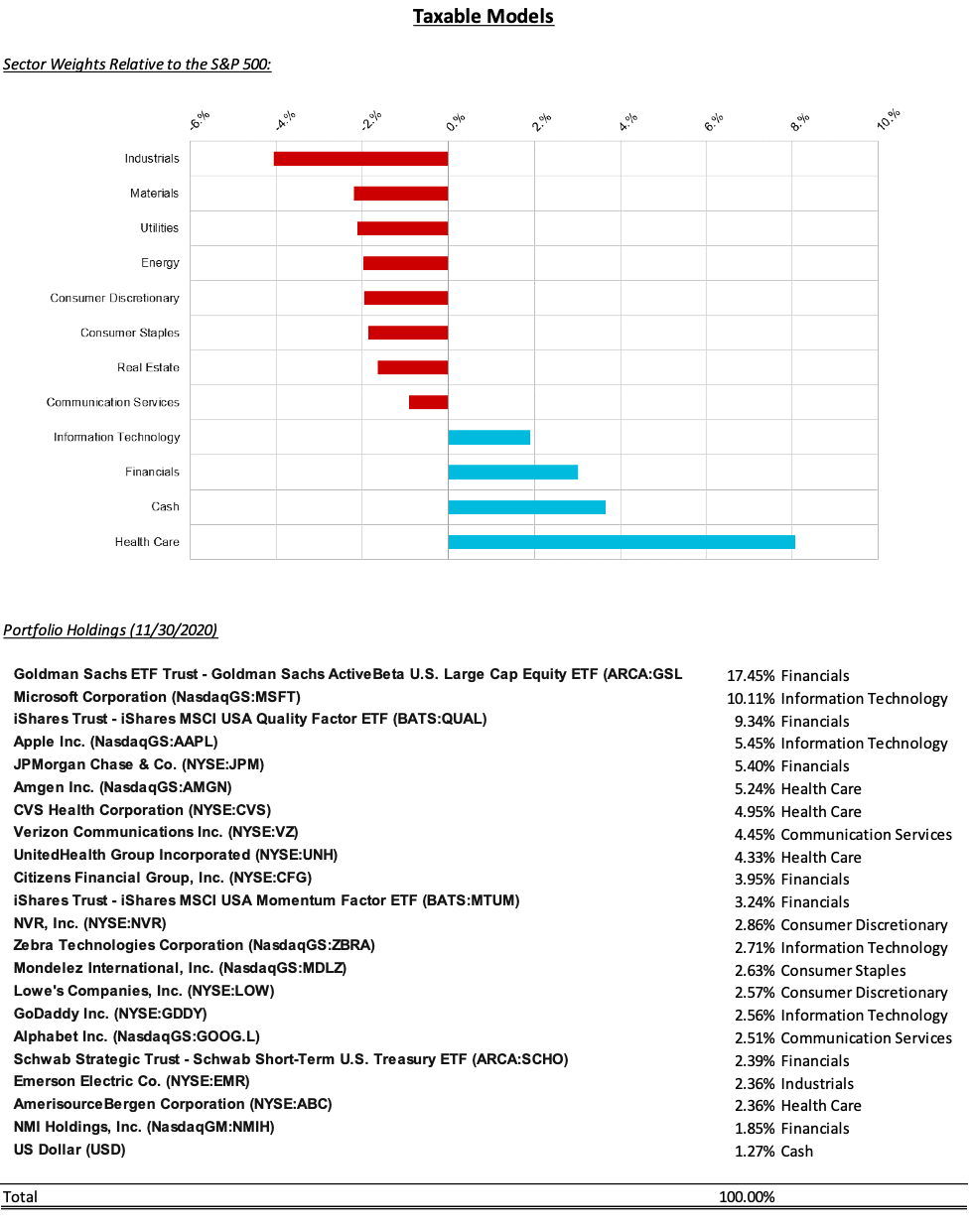

Taxable

(scroll left to right on mobile)

| New Additions | Complete Sales | Partial Sales | Additional Buys | % of Account Traded |

|---|---|---|---|---|

| GDDY | 2.6% | |||

| MDT | 1.6% | |||

| IBM | 1.5% | |||

| CFG | 0.7% | |||

| NMIH | 0.9% |

Summary of Month’s Action:

Equities posted strong returns in November, with the S&P 500 gaining 10.9% during the month. Stocks tentatively rose into election night, gained the next two days, then moved sharply higher with the initial release of data from Pfizer’s COVID vaccine. U.S. stocks ended the month essentially in line with the highs hit on November 9th. Developed market international stocks were higher by 15.5%, while emerging markets lagged, +9.2%.

Leadership shifted multiple times during the month, rotating from value outperforming growth, to vice versa, then back again. In the end, value equities, as measured by VLUE were up 16.4%. This shift was initiated by the Pfizer news, as investors became more certain the economy would continue to recover and shed their stay at home winners for more cyclical companies.

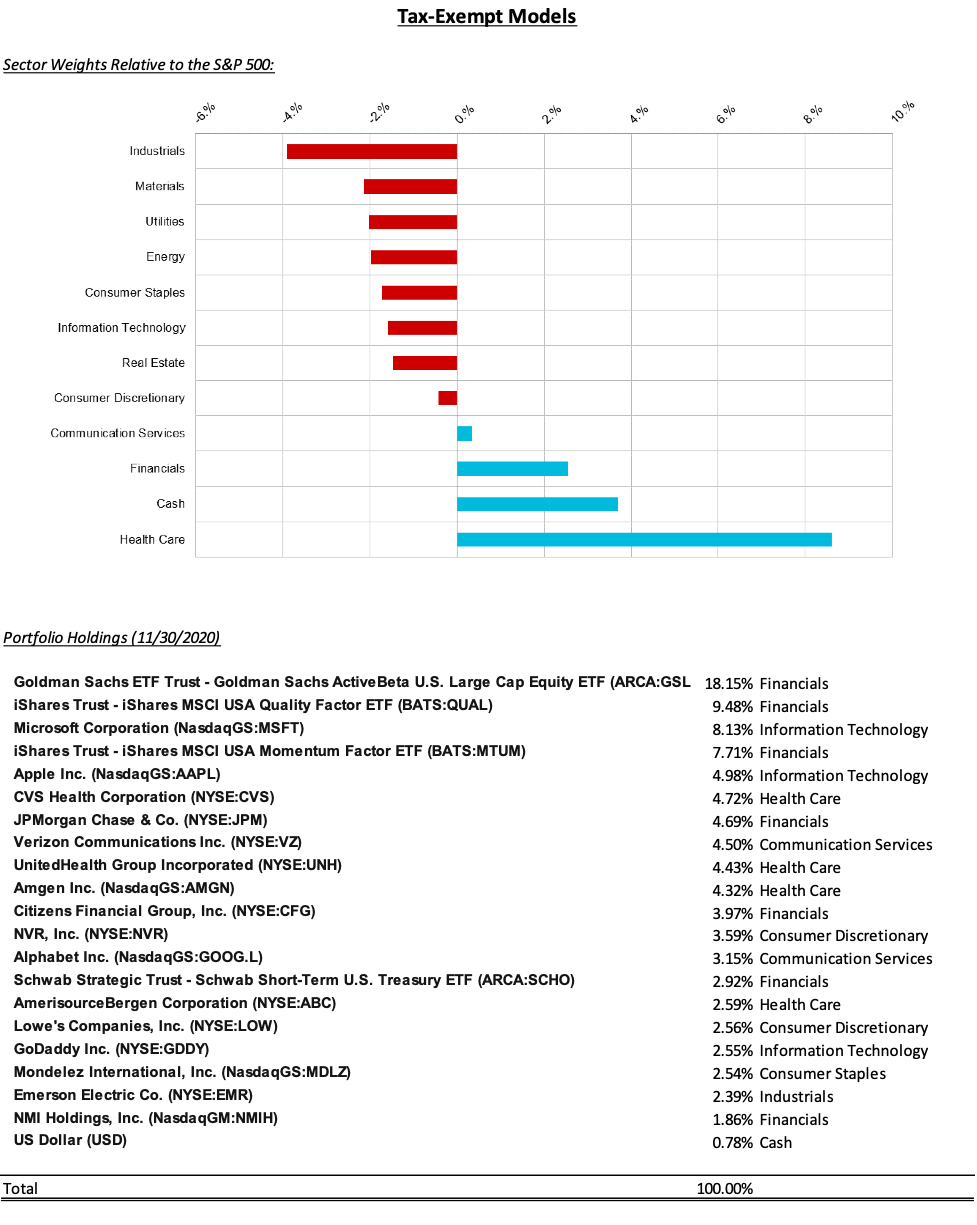

Lincoln Capital’s tax-exempt stock model underperformed during November. The top contributors to performance were Citizens (CFG), CVS Health (CVS), and Zebra Technologies (ZBRA). Laggards for November were NVR, Inc. (NVR), Amgen (AMGN), and Lowe’s (LOW). Most of these companies reported strong earnings results in November, even NVR and LOW, which lagged the market by gaining 1.1% and losing 1.4%, respectively.

Security Specific Comments:

Medtronic Public Limited Company (MDT) / International Business Machines Corporation (IBM) – We sold both IBM and MDT to make room for new additions. We will continue to keep a close eye on IBM and may reenter the position in the future. New management, the spinoff of a major division and the acquisition of Red Hat provide a lot of potential for future gains, but we expect this to be a long transition.

Citizens Financial Group (CFG) – Citizens was sold for risk management purposes. A higher growth period post COVID would likely create higher loan growth and higher long-term interest rates, both would benefit CFG’s bottom line. While we still believe CFG will be in the mid $40’s soon, it is also a volatile stock that could be hurt severely if the high growth anticipated never materializes. It remains a top position for us.

Zebra Technologies Corporation (ZBRA) – Zebra posted a great quarter easily surpassing expectations and guiding above expectations for the fourth quarter. We hold Zebra in high regard, and expect its product offerings (mobile computers, scanners, printers, sensors) to continue to be in high demand for its warehouse, logistics, retail, and healthcare customers for the foreseeable future. However, the valuation has become stretched, trading at 26.0x 2021 EPS. We sold the position in tax-exempt accounts with the expectation of re-acquiring the shares in the future. For taxable accounts, the tax bill would be too high a hurdle to overcome to make the trade attractive in our opinion.

NMI Holdings, Inc. (NMIH) – We purchased the other ½ of the NMIH position we started last month. NMIH had an investor day in November and the main takeaways reinforced our opinion of the opportunity. We expect continued positive progress in housing defaults, aided by steady to moderately increasing housing prices. The trends should drive strong future earnings and stock price appreciation.

GoDaddy Inc. (GDDY) – GoDaddy is a leading web site registrar and host but also offers its customers extensive tools for building their site and running their business. GDDY’s domain business has 79 million domains under management out of 360 million registered domains globally. GDDY’s domain market share is even higher when considering just .com domains. To give further context to GDDY’s scale in domains, for .com names, GDDY is larger than the next 10 registrars combined. This level of scale should enable GDDY to spend significantly more on marketing than peers, yet still have a lower per unit acquisition cost. Higher marketing dollars should maintain its market share lead.

Looking to the future, the most promising area of GDDY’s business is its content management system (CMS) called Websites + Marketing. This tool allows users to build and launch a quality website quickly. Growing this business will provide significant value to GDDY, as CMS customers generate 4-10x the sales of domain only customers, with much lower levels of churn.

Given this competitive position, it is likely GDDY will hit their long-term goals of double-digit sales growth and mid-teens free cash flow growth. With a free cash flow yield of 5.5% today, GDDY represents an attractive value. As an upside possibility, if GDDY is successful in growing its Websites + Marketing business, it may move closer to Wix’s (its closest CMS competitor) multiple of 10.7x sales, which compares favorably to GDDY’s 4.5x.